3. Competing with China in the digital age

This is chapter 3 of the MERICS Paper on China "Towards Principled Competition in Europe's China Policy: Drawing lessons from the Covid-19 crisis."

Key Findings

- China sees the Covid-19 pandemic as an opportunitiy to rebuild its economy by putting digitalization first, in line with existing goals and plans.

- The crisis has not altered China’s state-driven industrial and technology policymaking. The pandemic and decoupling from the US have added urgency to Beijing's indigenous innovation drive.

- For Europe, economic competition with China is increasingly playing out in the digital domain and new technologies. policymakers will be forced to integrate previously marginal policy issues into their China strategies.

- When it comes to collaboration with China in research and innovation, a risk-based approach is needed to prevent unwanted tech transfers.

- China’s need for European technology and know-how, for instance in intelligent manufacturing and the industrial internet, could be leveraged to advance EU interests by making access and partnerships conditional.

- The EU will need to join forces with partners around the world if it wants to attain digital and technological sovereignty.

1. Crisis lessons: Covid-19 has given China’s digital transformation top-level attention

Chinese leaders’ response to Covid-19 has underscored their longstanding ambition to turn China into a high-tech superpower, with digital technologies spurring innovation and transforming the economy.1 As the crisis unfolded, the government worked closely with technology companies to tackle the emergency.2 However, the pandemic also accelerated a broader trend: Much like the EU, China has identified the coronavirus as an opportunitiy to rebuild its economy by putting digitalization first.3

There is work to be done – while the lockdown boosted China´s consumer-facing digital economy, digitalization in traditional industries like manufacturing is still lagging.4 Xi Jinping’s leadership wants this to change, and therefore gave digital transformation top-level attention during the outbreak.5 As the country was hit by the virus, 5G network construction was ramped up. The technology, which is set to power the industrial Internet of Things (IIoT) along with intelligent vehicles, smart health systems and other disruptive applications, is a strategic priority of the Chinese Communist Party (CCP). The Ministry of Industry and Information Technology (MIIT) instructed telecom carriers and local governments to “forcefully advance 5G network construction”.6 By the end of this year, Beijing wants to have over 600,000 base stations.7

For Europe, economic competition with China is increasingly playing out in the digital domain and new technologies. The EU has begun to address China’s state-driven technology ambitions in the context of two major policy challenges – strategic acquisitions of European technologies and the presence of high-risk vendors Huawei and ZTE in the continent’s digital infrastructure. This year has seen the implementation of the defensive strategy Brussels crafted in response, with EU investment screening rules and cybersecurity measures for 5G now in the adoption phase.8 However, this is merely the beginning of work on a necessarily more strategic EU response to China’s technology and digital policies – and member states are far from united on the matter.

Post-pandemic China will remain the formidable “economic competitor in the pursuit of technological leadership” the previous European Commission (EC) described in its March 2019 Strategic Outlook.9 Despite government calls for marketization and encouraging openings to foreign investors, Beijing will not abandon state capitalism and techno-nationalist policies any time soon.10 With economic recovery plans forcing both Europe and China to look inward, and negotiations for a bilateral investment agreement moving slowly, it looks increasingly unlikely that there will be progress on rebalancing economic relations within the year.11

Against this backdrop, policymakers will be forced to recalibrate their strategies in ways that reflect China’s policy direction and will have to integrate previously marginal policy issues. This chapter focuses on three specific dimensions:

- If member states want to prevent unwanted tech transfers to China, they need to look beyond Chinese Foreign Direct Investment (FDI) and come to terms with the way Beijing utilizes foreign research collaboration as an industrial policy tool.

- A realistic assessment of China’s standardization strategy for ICT and emerging technologies would help European actors better understand where their competitor is headed.

- Distortions in the digital economy caused by state interference should feature more prominently in ongoing debates on reciprocity and fair competition.

2. China's trajectory: Covid-19 and decoupling from the US add urgency to indigenous innovation drive

The coronavirus crisis has not altered China’s state-driven industrial and technology policymaking. The latest business confidence survey conducted by the European Chamber of Commerce in China shows that Covid-19 has, rather, exacerbated existing trends: European businesses are experiencing an increasingly politicized environment and persistent market barriers in critical sectors, like ICT, and they expect state-owned enterprises to gain more opportunities at the expense of the private sector.12 The rollout of 5G illustrates the contradictions of China’s economic strategy, with selective opening in some sectors and protectionist industrial policy elsewhere. As of April, domestic vendors had secured 90 percent of the multibillion 5G contracts already awarded by state-owned telecoms operators.13

But the issues around 5G are not only about market access: 5G is where the Chinese government´s technology policies and national security priorities converge. The CCP’s top priority is to reduce reliance on foreign technology, which it sees as an existential threat. Mounting tensions with Washington have only accelerated China’s quest for indigenous innovation, as decoupling in hardware, software, and even science and talent exchanges becomes a reality.14 The upcoming five-year plan (2021-2026) is expected to place a heavy focus on homegrown technological innovation to further ease China´s dependence on the United States.15

Towards this end, China’s innovation policy relies heavily on central planning. Recent calls to liberalize the allocation of production factors, including technology and data, are therefore not likely to lead to structural shifts.16 It is reasonable to expect continued reliance on interventionist industrial policies designed to nurture indigenous innovation, especially for the development of ’strategic emerging industries’ (SEI) – sectors that Beijing has decided to bet on in order to transform the economy and climb up value chains.17 In February, the MIIT identified nine SEI as policy priorities in restarting the pandemic-battered economy.18 The fact that the national memory chip champion YMTC and US EV company Tesla were given preferential treatment, so that they could operate amid the lockdown, is evidence of Beijing´s determination.19

The Covid-19 crisis has catalyzed the push for digital transformation and hi-tech development.20 The term ‘new infrastructure’ (新基建) – from 5G and industrial internet platforms to data centers and artificial intelligence (AI) – emerged as a major policy focus in post-pandemic stimulus measures.22 The goal is to speed up the adoption of digital and emerging technologies and their integration with traditional industries, in order to stimulate new growth drivers and boost China’s future competitiveness.23 Although the bulk of Beijing’s infrastructure stimulus will go to traditional projects, a think tank under the MIIT expects total investment in new to reach 10 trillion yuan (1.3 trillion euros) by 2025.23

3. Key issues: Filling gaps in Europe´s toolbox to address China´s strategy for tech self-reliance

With Beijing accelerating its bid for self-reliance and global leadership in key technologies, Europe must brace for challenges. Europeans may not be used to seeing technology and the digital realm as terrains of great power competition, but shifting global trends force a rethink. The pandemic and an ever-fiercer contest for technology dominance between Washington and Beijing provide opportunities for Europe – even though it was a net loser in the first waves of the digital revolution – to revise policies around a number of critical issues set to influence technological and industrial competitiveness in the years to come.

Issue 1 – Research and innovation (R&I) cooperation

China already matches the EU-28 in R&D intensity, while Chinese companies have been increasing their investments in research much faster than their European competitors.24 Despite pandemic-induced budget constraints R&D remains a priority, especially in basic research and core technologies.25 China’s vibrant innovation system offers tremendous opportunities for European firms, and Covid-19 has brought the importance of cross-border innovation into the spotlight. Europe could also benefit from attracting more talent flows as Chinese STEM researchers face growing barriers in the US.26

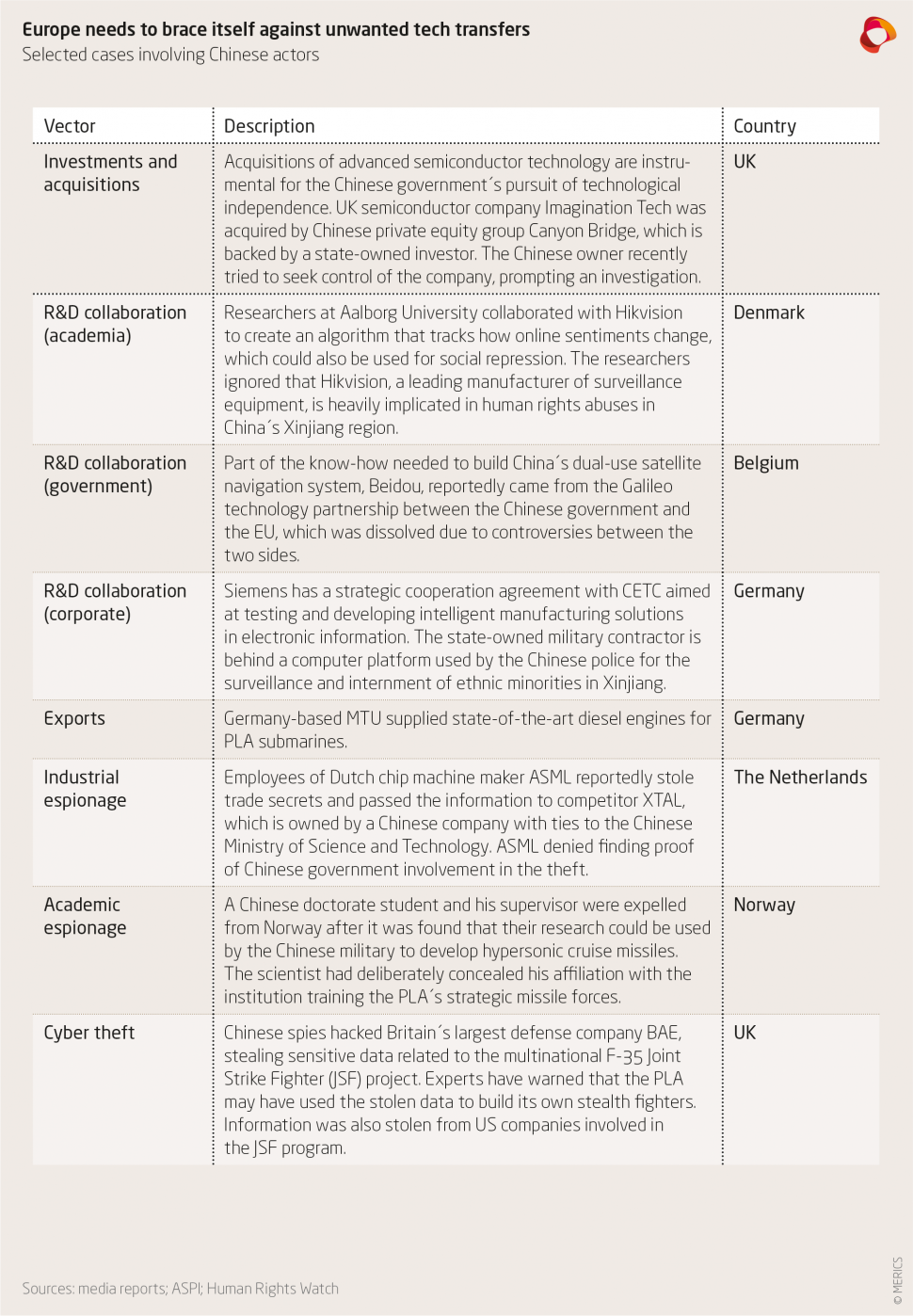

Despite these opportunities, the lack of reciprocity in bilateral R&I ties is still a problem, particularly in terms of funding, data-sharing, and IP protection.27 Even more importantly, collaboration with China requires substantial investment in risk assessment and due diligence. China's foreign research collaboration strategy poses long-term risks for Europe´s competitiveness, security, and values. China´s government seeks to leverage collaboration for industrial policy goals.

Transferring foreign talent and technology is a strategic priority, accomplished through a sophisticated web of legal, extra-legal and illicit channels.28 These range from setting up science parks and tech transfer centers and attracting European R&D to China, to sending military scientists to universities and engaging in industrial espionage.29 In some cases, Sino-European partnerships have contributed to China´s military technology R&D, or efforts to perfect mass surveillance.30Against this backdrop, a shift to a more clear-eyed approach to R&I collaborations with Chinese actors is overdue.

Issue 2 – Standardization: Technology specifications meet connectivity along the Digital Silk Road

Europe must also come to terms with China’s strategic approach to technology standardization, starting with a realistic assessment.31 Chinese companies’ growing participation in standard-setting bodies and the standardization of emerging technologies (AI, 5G and IoT in particular) is entirely normal and critical for ensuring safety and interoperability; their market shares will depend on the quality of their technology and their success at commercializing it.32 At the same time, Beijing sees standardization as a tool for strengthening indigenous innovation.33 To that end, it actively promotes and sponsors Chinese companies’ participation in international standard-setting bodies.34 Cases of firms forming coalitions to support domestic industrial policy goals have already emerged.35

Beijing also pushes the internationalization of Chinese technical standards in a range of industries through the BRI, with a strong focus on ICT, emerging technologies and the integration of these with industrial production.36 By building fiber-optic cables, smart cities, data centers and digital service platforms, while encouraging developing and emerging economies to adopt Chinese standards as part of the Digital Silk Road (数字丝绸之路, DSR), China is attempting to blend digital connectivity and standardization and to leverage the lower cost of Chinese standards compared to Western alternatives.37 While the content of most DSR memoranda of understanding (MoUs) is undisclosed, evidence points to an increased emphasis on standardization cooperation.38 By 2019, China had signed 85 standards cooperation agreements with 49 countries and regions along the BRI.39

This year, China will release a national standardization strategy incorporating the results of the ´China Standards 2035´ project (中国标准2035项目), a major research effort aimed at streamlining the national standardization system and promoting Chinese standards globally.40 Next-generation technologies like IoT, cloud computing, big data, 5G and AI are a focal point of this strategy.41

European businesses have long been concerned about the closed nature of Chinese standardization committees.42 If they were excluded from the 'China Standards 2035' process, while Beijing succeeded at exporting its preferred standards through the DSR, the playing field in the digital economy could be tilted in favor of Chinese competitors. Meanwhile, Chinese firms´ first-mover advantage in the standardization of applications like facial recognition means China could acquire a greater say in emerging technology governance, thereby promoting interests that are not necessarily aligned with European ones.43

Issue 3 – Digital economy: Expanding the remits of unfair competition

As EU Commissioner Thierry Breton put it, we are witnessing a “global battle for industrial data”.44 Like Brussels, the Chinese government is also upping its game to unleash the untapped potential of data in upgrading industry and transforming the economy through platform business models and technologies like IoT, AI and cloud computing. Unlike internet users’ data, data from production plants and machines in China is not yet shared and used to create value. The government wants this to change. While these efforts date back to the 2015 ´Internet Plus´ action plan, there is now a stronger focus on the industrial internet and the creation of an industrial big data system by 2025.45

Data security is a top priority for Chinese regulators and a matter of national and regime security. This encourages them to place sweeping restrictions on the collection, processing, and cross-border transfer of personal and ‘important’ data. On July 1, the draft ´Data Security Law´ was released for public comment.46 By introducing a system for grading and regulating data, including industrial data, based on its importance for national security, the law could heavily impact foreign business. The law also codifies China´s ability to retaliate against any country imposing trade and investment restrictions towards the PRC related to data and technology. These developments could further politicize the treatment of foreign technology in China and exacerbate competition distortions in the digital economy.

Lastly, the EU and members states should also pay more attention to the DSR since Beijing is leveraging it to promote and finance the global expansion of domestic technology companies.47 Despite the growing backlash against Huawei in developed countries, the unmet needs for digital connectivity in developing and emerging economies will continue to provide fertile ground for Chinese ICT and digital projects. These often consist of integrated hardware and software packages provided by state-backed companies, with the potential outcome of creating China-centered digital ecosystems in which European companies cannot participate.48 Already dominant in China´s closed digital market, Chinese tech giants could control increasing amounts of data and create entrenched monopolies in third markets.

4. EU-China relations: Leveraging China’s tech dependence becomes a priority for the EU

Europe plays a central role in Beijing’s hi-tech ambitions. Despite increased scrutiny, most Chinese transactions in the then EU-28 in 2019 were in the ICT sector.49 This is consistent with the trend of Europe being both target (through acquisitions) and willing partner (through R&D collaborations) of Beijing’s MIC2025 strategy.50 Additionally, European firms have experienced an increase in forced tech transfers in recent years.51 As China finds its access to US technology increasingly curtailed, it is likely that it will turn to Europe for alternatives. This is already happening in the semiconductor value chain, for example.52

It was the appreciation that Europe’s competitiveness and economic security were at risk that already led to a significant change in EU China policy. Following Brussels’ call, more member states are adopting or upgrading investment screening tools and reconsidering the role of Chinese vendors in their digital infrastructure. Moreover, as part of an ambitious work program launched by the previous EC to fill gaps in the EU’s defensive toolbox, reform proposals have been advanced in competition, trade and public procurement policy.53

Despite these achievements, the EU and member states cannot effectively compete in the Fourth Industrial Revolution by only playing defense. To preserve the continent´s digital and technological ‘sovereignty’, in February the EC therefore unveiled new industrial, digital and data strategies aimed at strengthening EU competitiveness, making sure that the bloc masters critical technologies, especially AI.54 Although the European concept of digital sovereignty is sometimes conflated with China´s approach to the governance of cyberspace, its rationales differ fundamentally from China´s, where state control over data and the digital economy is first and foremost a tool of information control.

Having rightly identified the nexus between industrial, competition and digital policymaking, the EU now needs to implement its offensive agenda. Momentum is building across the bloc and in the UK, a key partner in the technology and innovation contest with China. In a major shift, London decided to fully exclude Huawei from its 5G networks, and major EU economies like Italy are also placing restrictions on the company´s involvement in network rollouts.55 Meanwhile, Paris and Berlin are elevating the importance of digital and industrial policies as pillars of the post-pandemic recovery.56

The EU has many cards to play, starting from a world-leading science and innovation base, talent, and lots of cutting-edge technology; the challenge is to overcome longstanding weaknesses in terms of digital market fragmentation, regulatory hurdles, and underinvestment in scalable tech businesses.57 China, by contrast, is very good at funding and commercial adoption of digital and emerging technologies. It has large digital businesses that adopt technology quickly and foster dynamic ecosystems – both domestically and increasingly also overseas – taking advantage of a favorable regulatory regime at home.

That said, the EU has some relative strength vis-à-vis China. For one, investing in internal capabilities and enforcing EU rules in the Single Market is unlikely to provoke substantial backlash on the Chinese side. Meanwhile, China’s need for European technology and know-how, for instance in intelligent manufacturing and the industrial internet, could be leveraged to advance EU interests by making access and partnerships conditional. The bloc’s relative power is high when it comes to R&I and standardization, both areas where Beijing is eager to partner with European institutions and industry. However, the EU is quickly losing ground as an innovation and standards power while China is doubling down on investment in these fields.

5. Policy Priorities: Europe needs to translate industrial and digital strategies into action

The new EC’s offensive agenda, which considers technology and the digital sphere to be critical elements in today´s geopolitical competition, is Europe’s best chance to respond to China’s bold plans for high-tech leadership. Planned investments in 5G, AI, cloud, cybersecurity, and green technologies as part of the EUR 750 billion post-pandemic recovery package are steps in the right direction.58

A challenge for Europe will be to position itself strategically as the US-China tech conflict heats up. Fully applying defensive tools to protect technology and critical infrastructure will be key, as restricted access to American technology forces Chinese firms to look elsewhere. Additionally, companies will need to adjust their scenario planning constantly to navigate the partial decoupling of American and Chinese tech ecosystems. Policymakers will face increased pressure to think even more strategically across policy domains and competences, which requires setting up new structures to tackle risks associated with emerging technology ties with China.59

When it comes to R&I, a risk-based approach is needed to prevent unwanted tech transfers. This means shifting to a logic of coercing and containing with regard to those aspects of China´s cooperation strategy that threaten Europe´s competitiveness, security and values. It will be necessary to raise awareness among member states, universities and businesses and draft guidelines for R&I partnerships with Chinese entities, including red lines for partners and technologies that are off-limits. Aside from curbing unwanted tech transfers, increasing the Horizon Europe Program budget to EUR 120 billion, as recommended by the European Parliament, would boost the EU´s ability to compete on the global stage.60

On standardization, EU actors need to coordinate their lobbying efforts in China, especially in the context of China Standards 2035, as it is in the EU interest to engage and shape and promote emerging market-oriented forces.61 More resources should also be invested to help companies understand the standardization dimension of the DSR, while member states´ standards cooperation format with China – such as the Sino-German Industry 4.0 Cooperation – should be leveraged whenever possible to achieve European regulatory objectives in the Chinese market.62

In international standard-setting bodies, Europe does not need to copy China´s state-led strategy to invest more resources and ensure continued relevance of its businesses. Beijing and Washington see standardization as terrain for geo-economic competition. If it wants to retain its industrial competitiveness in the digital age, the EU should shift from an overly technical to a more strategic approach.63 Breton´s recent call for greater EU engagement in the standardization of lithium for EV batteries in response to China´s proposal to set up a new committee was timely.64 The EU should also be prepared, in consultation with industry and like-minded countries, to coerce and contain China when it manipulates standard-setting processes

As China seeks access to Europe´s technology and digital market, Brussels and member states should insist on digital reciprocity as a new principle in bilateral relations. China´s protected digital market, discriminatory standards and data regulations hurt the competitiveness of European businesses, and they are now being exported through the DSR. As it works on creating a unified data market, the EU should explore ways for making Chinese companies’ access conditional.

Navigating China´s emerging data regulations will be challenging, as the government will not change its approach to data security. Europe can only resist and limit. As it sets out to measure cross-border data flows and address unjustified obstacles as part of its European Strategy for Data, the EU should monitor competition distortions arising from unequal access to data in the Chinese market. The monitoring should include third markets where Chinese ICT and Internet players are creating new digital ecosystems, as data-driven market power or anticompetitive practices may arise.

Lastly, the EU will need to join forces with partners around the world if it wants to attain digital and technological sovereignty.65 Many aspects of the China challenge, from forced technology transfers to digital protectionism, cannot be confronted alone. The UK´s recent proposal to set up a group of like-minded democracies to fund secure 5G solutions is worth exploring.66 For example, such grouping could invest in secure, sustainable and affordable digital connectivity in the developing world, thereby providing alternatives to China´s DSR. At stake is not just Europe’s competitiveness, but also its strategic autonomy and the very democratic values and fundamental rights it wishes to promote in the digital transformation.

- Endnotes

-

1 | Hooi, Alexis (2020). “Digital Economy Growth Gives Push to Virus Fight.” China Daily. April 13. https://www.chinadaily.com.cn/a/202004/13/WS5e93b86aa3105d50a3d15a10.html. Accessed: August 25, 2020.

2 | Von Carnap, Kai et al. (2020). “Tracing. Testing. Tweaking.: Approaches to Data-driven Covid-19

Management in China.” MERICS. June 24. https://merics.org/en/report/tracing-testing-tweaking.

Accessed: August 25, 2020.

3 | On Europe’s digital ambitions after Covid-19: Stolton, Samuel (2020). “Ministers to Chart Europe’s

Digital Future with post-COVID19 Commitments.” EURACTIV. June 8. https://www.euractiv.com/section/digital/news/ministers-to-chart-europes-digital-future-with-post-covid19-commitments/. Accessed: August 25, 2020.

4 | Online sales, gaming and e-learning all surged during the pandemic. See Xinhua (2020). “China Focus: Digital Economy Helps Offset Coronavirus Impact.” February 7. http://www.xinhuanet.com/english/2020-02/07/c_138764342.htm. Accessed: August 25, 2020. Xu, Tony (2020). “China’s Gaming Market Records Strong Growth During Coronavirus Lockdown” Pandaily. April 17. https://pandaily.com/chinas-gaming-market-records-strong-growth-during-coronavirus-lockdown/. Accessed: August 25, 2020; Wang, Yue (2020). “China’s E-learning Leaders Add $3.2 Billion As Coronavirus Fears Drive Students Online.” Forbes. February 27. https://www.forbes.com/sites/ywang/2020/02/27/chinas-e-learning-leaders-add-32-billion-as-coronavirus-fears-drive-students-online/#54b682804fb6. Accessed: August 25, 2020.; data on China’s industrial digitalization can be found in Arcesati, Rebecca et al. (2020). “China’s Digital Platform Economy: Assessing Developments Toward Industry 4.0: Challenges and Opportunities for German Actors.” MERICS. May 29. https://merics.org/en/report/chinas-digital-platform-economy-assessing-developments-towards-industry-40. Accessed: August 25, 2020.

5 | Ran, Xiaoning 冉晓宁(2020). “我国数字经济全面提速 (China’s Digital Economy is Undergoing All-Round

Acceleration). Xinhua. July 8. http://www.xinhuanet.com/tech/2020-06/08/c_1126085568.htm.

Accessed: August 25, 2020.

6 | Ministry of Industry and Information Technology of the People’s Republic of China 工业和信息化 (2020). “工业和信息化部关于推动5G加快发展的通知 (Ministry of Industry and Information Technology Notice on Promoting the Accelerated Development of 5G). March 24. http://www.miit.gov.cn/n1146290/n1146402/n1146440/c7832353/content.html. Accessed: August 25, 2020.

7 | CGTN (2020). “China to Build 600,000 5G Bases in 2020 Despite COVID-19 Impact.” June 6. https://news.cgtn.com/news/2020-06-06/China-to-build-600-000-5G-base-stations-in-2020-R65gk7tJcs/index.html. Accessed: August 25, 2020.

8 | Implementation of EU investment screening rules: European Commission (2020). “Coronavirus: Commission Issues Guidelines to Protect Critical European Assets and Technology in Current Crisis.” Press Release. March 25. https://ec.europa.eu/commission/presscorner/detail/en/IP_20_528. Accessed: August 25, 2020.; 5G security toolbox: European Commission (2020). “Secure 5G Deployment in the EU: Implementing the EU toolbox – Communication from the Commission.” January 29. https://ec.europa.eu/digital-single-market/en/news/secure-5g-deployment-eu-implementing-eu-toolbox-communication-commission. Accessed: August 25, 2020.

9 | European Commission and High Representative of the Union for Foreign Affairs and Security Policy

(HR/VP) (2019). “EU-China: A Strategic Outlook” March 12. https://ec.europa.eu/commission/sites/beta-political/files/communication-eu-china-a-strategic-outlook.pdf. Accessed: August 25, 2020.

10 | Kennedy, Scott (2020). “China Won’t Be Scared into Choosing Marketization.” CSIS. April 23. https://www.csis.org/analysis/china-wont-be-scared-choosing-marketization. Accessed: August 25, 2020; Foreign investment catalogue shortened: Zhou, Cissy (2020). “China Eases Restrictions on Foreign Investors, but is it Too Late?” SCMP. June 25. https://www.scmp.com/economy/china-economy/article/3090620/china-eases-restrictions-foreign-investors-it-too-little-too. Accessed: August 25, 2020.

11 | Brundsen, Jim and Fleming, Sam (2020). “EU Warns China that Investment Talks are Entering ‘Critical Stage’.” Financial Times. June 28. https://www.ft.com/content/a5197502-6106-48e9-bb81-e4d87925d619. Accessed: August 25, 2020.

12 | European Union Chamber of Commerce in China (2020). “Facing Uncertainty, European Companies in China Find Themselves Navigating in the Dark.” July 10. https://www.europeanchamber.com.cn/en/press-releases/3230. Accessed: August 25, 2020.

13 | Morris, Iain (2020). “As Ericsson Advances, Nokia’s 5G Business May Be Finished in China.” LightReading. April 27. https://www.lightreading.com/asia/as-ericsson-advances-nokias-5g-business-may-be-finished-in-china/a/d-id/759209?. Accessed: August 25, 2020.

14 | Mai, Jun and Lee, Amanda (2019). “Xi Jinping Calls for Self-Reliance as China Grapples with Long-term US Challenge of Trade War and Ban on Huawei and other Technology Manufacturers.” SCMP. May 22. https://www.scmp.com/news/china/politics/article/3011388/xi-jinping-calls-self-reliance-china-grapples-long-term-us. Accessed: August 25, 2020.

15 | Tang, Frank (2020). “China’s Five-Year Plan to Focus on Independence as US Decoupling Threat Grows.” SCMP. May 24. https://www.scmp.com/economy/china-economy/article/3085683/coronavirus-china-five-year-plan-focus-independence-us. Accessed: August 25, 2020.

16 | CCP Central Committee and State Council (2020). 中共中央 国务院关于构建更加完善的要素市场化配置体制机制的意见 (CCP Central Committee and State Council Opinions on Establishing an Improved System and Mechanism for the Market-Based Allocation of Production Factors). Xinhua. April 9. http://www.xinhuanet.com/politics/zywj/2020-04/09/c_1125834458.htm. Accessed: August 25, 2020.

17 | Recent Xinhua article highlighting the importance of SEI development in the context of post-pandemic economic recovery, which is described as a “window of opportunity” (窗口期, literally “window period”) by several industry experts: Yang, Ting杨婷 (2002). 多方抢占战略性新兴产业新“窗口期” (Multiple Players Seize New “Window Period” for Strategic Emerging Industries). Xinhua. July 9. http://www.xinhuanet.com/2020-06/09/c_1126089728.htm. Accessed: August 25, 2020.

18 | Asia Society Policy Institute and Rhodium Group (2020). “Innovation Policy Reform.” In “The China Dashboard: Spring 2020.” https://chinadashboard.asiasociety.org/spring-2020/page/innovation.

Accessed: August 25, 2020.

19 | Cheng, Ting-Fang and Li, Lauly (2020). “How China’s Chip Industry Defied the Coronavirus Lockdown” Nikkei Asian Review. March 18. https://asia.nikkei.com/Spotlight/The-Big-Story/How-China-s-chip-industry-defied-the-coronavirus-lockdown. Accessed: August 25, 2020.; Fortune (2020). “How China Bent Over Backward to Help Tesla When the Coronavirus Hit.” March 18. https://fortune.com/2020/03/18/china-help-tesla-coronavirus/. Accessed: August 25, 2020.

20 | In April, Xi Jinping stressed the importance of the digital economy in his inspection tour to Zhejiang province. In May, the National Development and Reform Commission (NDRC) launched the Digital Transformation Partnership Initiative, a public-private platform aimed at supporting SMEs hit by the pandemic: National Development and Reform Commission (2020). 数字化转型伙伴行动倡议 (Digital Transformation Partnership Initiative). May 13. https://www.ndrc.gov.cn/xwdt/ztzl/szhzxhbxd/xdcy/202005/t20200513_1227930.html. Accessed: August 25, 2020.

21 | State Council of the People’s Republic of China (2020). 国务院常务会议明确新基建投资模式:市场投入为主,民资有更大空间 (State Council Executive Meeting Clarifies New Infrastructure Investment Model: Priority to Market Investment, Private Capital to Have Even Larger Space). April 29. http://www.gov.cn/zhengce/2020-04/29/content_5507395.htm. Accessed: August 25, 2020.

22 | Xinhua (2020). “Economic Watch: China Embraces New Infrastructure to Catalyze New Growth Drivers.” May 22. http://www.xinhuanet.com/english/2020-05/22/c_139080081.htm. Accessed: August 25, 2020.

23 | Cross, Gavin and Zhang, Qizhi (2020). “Caixin Insight: New Infrastructure and Old Street Stalls.” Caixin Global. June 4. https://www.caixinglobal.com/2020-06-04/caixin-insight-new-infrastructure-and-old-street-stalls-101563017.html. Accessed: August 25, 2020; CCID report on ʻnew infrastructure’: CCID 中国电子信息产业发展研究院 (2020). „新基建”发展白皮书 (“New Infrastructure” Development White Paper). March. http://www.miitthinktank.org.cn/aatta/20200324225821366/1-2003231F017.pdf. Accessed:

August 25, 2020.

24 | European Commission (2020). “Science, Research and Innovation Performance of the EU 2020: A Fair, Green and Digital Europe.” May. https://ec.europa.eu/info/sites/info/files/srip/2020/ec_rtd_srip-2020-report.pdf. Accessed: August 25, 2020.

25 | Chen, Stephen (2020). “Two Sessions 2020: China Cuts Science Budget by 9 Per Cent but National R&D Still Tipped to Grow.” SCMP. May 22. https://www.scmp.com/news/china/science/article/3085672/two-sessions-2020-china-cuts-science-budget-9-cent-national-rd. Accessed: August 25, 2020; China Daily (2020). “Enhancing R&D Input Key to Growth.” May 21. http://epaper.chinadaily.com.cn/a/202005/21/WS5ec5b358a3102640f4a63586.html. Accessed: August 25, 2020.

26 | Zwetsloot, Remco (2020). “The U.S. Needs Multilateral Initiatives to Counter Chinese Tech Transfer.” Brookings Institution. June 11. https://www.brookings.edu/techstream/the-u-s-needs-multilateral-initiatives-to-counter-chinese-tech-transfer/. Accessed: August 25, 2020.

27 | Moran, James (2020). “Viewpoint: China is a Challenging, but Essential EU Research Partner.” ScienceBusiness. April 6. https://sciencebusiness.net/international-news/viewpoint-china-challenging-essential-eu-research-partner. Accessed: August 25, 2020; Wallace, Nicholas (2020). “Access to Information an Obstacle in EU-China Joint Research.” ScienceBusiness. April 6. https://sciencebusiness.net/international-news/access-information-obstacle-eu-china-joint-research. Accessed: August 25, 2020.

28 | Office of the United States Trade Representative – Executive Office of the President (2018). “Findings of the Investigation into China’s Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property and Innovation under Section 301 of the Trade Act of 1974.” March 22. https://ustr.gov/sites/default/files/Section%20301%20FINAL.PDF. Accessed: August 25, 2020; Hannas, Wm. C. and Chang, Huey-meei (2019). “China’s Access to Foreign AI Technology: An Assessment.” Center for Security and Emerging Technology. September. https://cset.georgetown.edu/wp-content/uploads/CSET_China_Access_To_Foreign_AI_Technology.pdf. Accessed: August 25, 2020.

29 | Huotari, Mikko, Weidenfeld, Jan and Arcesati, Rebecca (2020). “Managing Economic Cooperation and Competition with China: Towards a More Integrated European Trade Policy Approach.” MERICS. March 12. https://merics.org/en/report/managing-economic-cooperation-and-competition-china. Accessed: August 25, 2020; Zhuo, Wenting (2017). “Shanghai Unveils Step to Attract Foreign R&D Centers.” China Daily. October 17. https://www.chinadaily.com.cn/business/2017-10/17/content_33352161.htm. Accessed: August 25, 2020; Upton, Ben (2019). “EU Companies R&D Spending Growing Four Times Faster in China.” Research Professional News. April 3. https://www.researchprofessionalnews.com/rr-news-europe-innovation-2019-4-eu-companies-r-d-spending-growing-four-times-faster-in-china/. Accessed: August 25, 2020; Joske, Alex (2018). “Picking Flowers, Making Honey: The Chinese Military’s Collaboration with Foreign Universities.” ASPI. October 30. https://www.aspi.org.au/report/picking-flowers-making-honey. Accessed: August 25, 2020; Cerulus, Laurens (2018). “Europe Raises Flags on China’s Cyber Espionage.” Politico Europe. April 10. https://www.politico.eu/article/europe-raises-red-flags-on-chinas-cyber-espionage/. Accessed: August 25, 2020.

30 | C4ADS (2019). “Open Arms: Evaluating Global Exposure to China’s Defense-Industrial Base.” October 17. https://www.c4reports.org/open-arms. Accessed: August 25, 2020; Stryhn Kjeldtoft, Sebastian (2020). “Aalborg Universitet har hjulpet omstridt kinesisk firma, der bidrager til forfølgelse og overvågning af millioner (Aalborg University has helped controversial Chinese company that contributes to the persecution and surveillance of millions).” Politiken. June 23. https://politiken.dk/udland/int_kina/art7835507/Aalborg-Universitet-har-hjulpet-omstridt-kinesisk-firma-der-bidrager-til-forf%C3%B8lgelse-og-overv%C3%A5gning-af-millioner. Accessed: August 25, 2020.

31 | Wilson, Naomi (2020). “China Standards 2035 and the Plan for World Domination – Don’t Believe China’s Hype.” Council on Foreign Relations. June 3. https://www.cfr.org/blog/china-standards-2035-and-plan-world-domination-dont-believe-chinas-hype. Accessed: August 25, 2020.

32 | On Chinese companies’ growing influence in standardization organizations, see Fägersten, Björn and Rühlig, Tim (2019). “China’s Standard Power and Its Geopolitical Implications for Europe.” Swedish Institute of International Affairs. https://www.ui.se/globalassets/ui.se-eng/publications/ui-publications/2019/ui-brief-no.-2-2019.pdf. Accessed: August 25, 2020.

33 | Ernst, Dieter (2011). “Indigenous Innovation and Globalization: The Challenge for China’s Standardization Strategy.” UC Institute on Global Cooperation and the East West Center. June. https://www.eastwestcenter.org/system/tdf/private/ernstindigenousinnovation.pdf?file=1&type=node&id=32939. Accessed: August 25, 2020.

34 | Central Government of China 中华人民共和国中央人民政府 (2015). 国务院办公厅关于印发国家标准化体系建设发展规划(2016-2020年)的通知 (State Council General Office Notice Concerning Issuing the National Standardization System Construction Development Plan 2016-2020). http://www.gov.cn/zhengce/zhengceku/2020-03/24/content_5494968.htm. Accessed: August 25, 2020. Kamensky, Jack (2020). “China’s Participation in International Standards Setting: Benefits and Concerns for US Industry.” China Business Review, February 7. https://www.chinabusinessreview.com/chinas-participation-in-international-standards-setting-benefits-and-concerns-for-us-industry/. Accessed: August 25, 2020.

35 | Lenovo 联想中国 (2018). 行动起来,誓死打赢联想荣誉保卫战! (Take Action and Fight to Win the Battle to Defend Lenovo’s Honor). https://mp.weixin.qq.com/s/JDlmQbGFkxu-_D2jsqNz3w. Accessed: August 25, 2020.

36 | State Council Information Office 国务院新闻办公室 (2018). 标准联通共建“一带一路”行动计划 (2018-2020年) (Standard China Unicom Joint Construction of One Belt One Road Action Plan (2018-2020). http://www.scio.gov.cn/xwfbh/xwbfbh/wqfbh/37601/39274/xgzc39280/Document/1641459/1641459.htm. Accessed: August 25, 2020; Ministry of Industry and Information Technology 工业和信息化部 (2018). 工业和信息化部关于工业通信业标准化工作服务于“一带一路”建设的实施意见 (MIIT Implementation Opinions Concerning the Standardization Work in the Industrial Communications Industry in Serving the Construction of One Belt One Road). http://www.miit.gov.cn/n1146295/n1652858/n1652930/n3757016/c6480388/content.html. Accessed: August 25, 2020.

37 | Segal, Adam (2020). “China’s Alternative Cyber Governance Regime.” Statement before the U.S.-China Economic Security Review Commission, March 13. https://www.uscc.gov/sites/default/files/testimonies/March%2013%20Hearing_Panel%203_Adam%20Segal%20CFR.pdf. Accessed: August 25, 2020; for an up-to-date analysis of the Digital Silk Road, see Triolo, Paul et al. (2020). “The Digital Silk Road: Expanding China’s Digital Footprint.” Eurasia Group, April 29. https://www.eurasiagroup.net/live-post/digital-silk-road-expanding-china-digital-footprint. Accessed: August 26, 2020.

38 | According to Chinese government sources, as of April 2019 China had signed DSR-related MoU with

16 countries, while 12 countries were drawing up action plans. People’s Daily 人民日报 (2019). 人民日报:数字丝绸之路建设成为新亮点 (People’s Daily: Digital Silk Road Construction Becomes New Highlight). April 22. http://www.xinhuanet.com/zgjx/2019-04/22/c_137997345.htm. Accessed: August 26, 2020; one of the objectives of the Belt and Road Digital Economy Cooperation Initiative, for example, is to promote international cooperation on standards: Xinhua 新华网 (2017). 7国共同发起倡开启 “数字丝绸之路” 合作新篇章 (Seven Countries Launch Initiative to Open a New Chapter in Digital Silk Road Cooperation. December 3. http://www.xinhuanet.com/world/2017-12/03/c_1122050732.htm. Accessed: August 26, 2020.

39 | Office of The Leading Small Group for Promoting the Belt and Road Initiative (2019). The Belt and Road Initiative: Progress, Contributions and Prospects. Foreign Languages Press (ed.) http://files.chinagoabroad.com/Public/uploads/content/files/201904/201904220254037.pdf

40 | SESEC (2019). “China Started to Think About Its Standardization Strategy of 2035.” February 12. https://www.sesec.eu/china-started-to-think-about-its-standardization-strategy-of-2035/. Accessed: August 25, 2020. the document “Main Points of National Standardization Work in 2020,” issued by the Standardization Administration of China (SAC), states that a strategic plan for national standardization will be released: SAC 国家标准化管理委员会 (2020). 国家标准化管理委员会关于印发 《 2020年全国标准化工作要点》的通知 (SAC Notice on Issuing the “Main Points of National Standardization Work in 2020”). http://www.gov.cn/zhengce/zhengceku/2020-03/24/5494968/files/cb56eedbcacf41bd98aa286511214ff0.pdf.

Accessed: August 25, 2020.

41 | Xinhua 新华网 (2018). 国家标准委:正制定《中国标准2035》(Standardization Administration of China: Formulating „China Standards 2035“). January 10. http://www.xinhuanet.com/fortune/2018-01/10/c_129787658.htm. Accessed: August 25, 2020.

42 | Business Europe (2020). “The EU and China: Addressing the Systemic Challenge.” January. https://www.businesseurope.eu/sites/buseur/files/media/reports_and_studies/the_eu_and_china_full_february_2020_version_for_screen.pdf. Accessed: August 25, 2020.

43 | Gross, Anna et al. (2019). “Chinese Tech Group Shaping UN Facial Recognition Standards.” Financial Times, December 1. https://www.ft.com/content/c3555a3c-0d3e-11ea-b2d6-9bf4d1957a67. Accessed: August 25, 2020.

44 | Rose Michael (2020). “Europe Can Win Global Battle for Industrial Data, Says EU Industry Chief.”

Reuters, February 15. https://de.reuters.com/article/uk-eu-data/europe-can-win-global-battle-for-industrial-data-says-eu-industry-chief-idUKKBN2090N3. Accessed August 25, 2020.

45 | For a summary of the 2015 Internet Plus action plan, please see China State Council (2015). “China Unveils Internet Plus Action Plan to Fuel Growth.” July 4. http://english.www.gov.cn/policies/latest_releases/2015/07/04/content_281475140165588.htm. Accessed August 25, 2020; for a summary of MIIT measures for accelerating the development of industrial internet, issued in March: People’s Daily Online (2020). “China Unveils New Measures to Boost Industrial Internet Development.” March 26. http://en.people.cn/n3/2020/0326/c90000-9672931.html. Accessed August 25, 2020; Central Government of China 中国人民共和国中央人民政府 (2020).《关于工业大数据发展的指导意见》发布——着力打造工业大数据生态体系 (“Guiding Opinions Concerning the Development of Industrial Big Data” Published – Focus on Creating an Industrial Big Data Ecosystem). May 16. http://www.gov.cn/zhengce/2020-05/16/content_5512110.htm. Accessed: August 25, 2020.

46 | National People’s Congress 中国人民代表大会 (2020). 中国人民共和国数据安全法 草案 (Draft Data Security Law of the People’s Republic of China). Republished by NPC Observer. https://npcobserver.files.wordpress.com/2020/07/data-security-law-draft.pdf. Accessed: August 25, 2020.

47 | Eder, Thomas S. et al. (2019). “Networking the Belt and Road: The Future Is Digital.” MERICS, August 28. https://merics.org/en/analysis/networking-belt-and-road-future-digital. Accessed: August 25, 2020.

48 | European Union Chamber of Commerce in China (2020). “The Road Less Travelled: European Involvement in China’s Belt and Road Initiative.” https://static.europeanchamber.com.cn/upload/documents/documents/The_Road_Less_Travelled%5b762%5d.pdf. Accessed: August 25, 2020.

49 | Kratz, Agatha et al. (2020). “Chinese FDI in Europe: 2019 Update.” MERICS Paper on China, April 8. https://merics.org/en/report/chinese-fdi-europe-2019-update. Accessed: August 25, 2020.

50 | On FDI, see: Hanemann, Thilo et al. (2019). “Chinese FDI in Europe: 2018 Trends and Impact of New Screening Policies.” Rhodium Group, March 6. https://rhg.com/research/chinese-fdi-in-europe-2018-trends-and-impact-of-new-screening-policies/. Accessed: August 25, 2020; on the participation of European (specifically German) research institutions in research collaborations with Chinese actors and the risks involved, see: Zenglein, Max J. and Holzmann, Anna (2019). “Evolving Made in China 2025.” MERICS Paper on China, July 2. https://merics.org/en/report/evolving-made-china-2025. Accessed: August 25, 2020.

51 | Michael, Martina (2020). “China’s Tech Transfer Problem Is Growing, EU Business Group Says.” Reuters, May 20. https://www.reuters.com/article/us-china-eu/chinas-tech-transfer-problem-is-growing-eu-business-group-says-idUSKCN1SQ0I7#:~:text=China’s%20tech%20transfer%20problem%20is%20growing%2C%20EU%20business%20group%20says,-Michael%20Martina&text=The%20European%20Union%20Chamber%20of,from%2010%25%20two%20years%20ago. Accessed: August 25, 2020.

52 | Nikkei Asian Review (2020). “Huawei Strikes European Chip Tie-Up As Fears Rise over US Curbs.” April 28. https://asia.nikkei.com/Spotlight/Huawei-crackdown/Huawei-strikes-European-chip-tie-up-as-fears-rise-over-US-curbs. Accessed: August 25, 2020.

53 | European Commission (2020). “Commission Adopts White Paper on Foreign Subsidies in the Single Market.” Press Release, June 17. https://ec.europa.eu/commission/presscorner/detail/en/ip_20_1070. Accessed: August 25, 2020.

54 | For more information on the industrial strategy, please see European Commission (2020). “Commission Communication: A New Industrial Strategy for Europe.” March 10. https://ec.europa.eu/info/strategy/priorities-2019-2024/europe-fit-digital-age/european-industrial-strategy_en#:~:text=Search-,European%20industrial%20strategy,while%20coping%20with%20global%20competition. Accessed: August 25, 2020; digital strategy: European Commission (2020). “Shaping Europe’s Digital Future.” https://ec.europa.eu/digital-single-market/en/content/european-digital-strategy. Accessed: August 25, 2020; data strategy: European Commission (2020). “Communication: A European Strategy for Data.” February 19. https://ec.europa.eu/info/strategy/priorities-2019-2024/europe-fit-digital-age/european-data-strategy. Accessed: August 25, 2020. White paper on AI: European Commission (2020). “White Paper on Artificial Intelligence: A European Approach to Excellence and Trust.” February 2020. https://ec.europa.eu/info/sites/info/files/commission-white-paper-artificial-intelligence-feb2020_en.pdf. Accessed: August 25, 2020.

55 | Nakashima, Ellen and Booth, William (2020). Britain to Bar Huawei from Its 5G Wireless Networks, Part of a Growing Shift Away from the Chinese Tech Giant.” The Washington Post, July 13. https://www.washingtonpost.com/national-security/britain-to-bar-huawei-from-its-5g-wireless-networks-part-of-a-growing-shift-away-from-the-chinese-tech-giant/2020/07/13/44f6afee-c448-11ea-b037-f9711f89ee46_story.html. Accessed: August 25, 2020; Bechis, Francesco and Lanzavecchia, Otto (2020). “Italy: New 5G Security Measures Impair Huawei, ZTE.” Formiche, July. https://formiche.net/2020/07/italy-5g-security-measures-impair-huawei-zte/. Accessed: August 25, 2020.

56 | France Diplomacy (2020). “European Union – French-German Initiative for the European Recovery from the Coronavirus Crisis.” May 18. https://www.diplomatie.gouv.fr/en/coming-to-france/coronavirus-advice-for-foreign-nationals-in-france/coronavirus-statements/article/european-union-french-german-initiative-for-the-european-recovery-from-the. Accessed August 25, 2020; Delcker, Janosch and Heikkila, Melissa (2020). “Germany, France Launch Gaia-X Platform in Bid for Tech Sovereignty.” Politico, June 5. https://www.politico.eu/article/germany-france-gaia-x-cloud-platform-eu-tech-sovereignty/. Accessed: August 25, 2020.

57 | Chivot, Eline (2020). “The EU’s Post-Coronavirus Marshall Plan Must Have a Focus on Improving Its Digital Economy.” Euronews, May 14. https://www.euronews.com/2020/05/14/the-eu-post-coronavirus-marshall-plan-must-focus-on-improving-its-digital-economy-view. Accessed: August 25, 2020.

58 | DW (2020). “European Commission Unveils 750 Billion Recovery Plan.” https://www.dw.com/en/european-commission-unveils-750-billion-recovery-plan/a-53584998. Accessed: August 25, 2020.

59 | Barkin, Noah (2020). “Export Controls and the US-China Tech War.” MERICS, March 18. https://merics.org/en/report/export-controls-and-us-china-tech-war. Accessed: August 25, 2020.

60 | European Parliament (2019). “Horizon Europe: Framework Program for Research and Innovation 2021-2027.” May. https://www.europarl.europa.eu/RegData/etudes/BRIE/2018/628254/EPRS_BRI(2018)628254_EN.pdf. Accessed: August 25, 2020.

61 | Rühlig, Tim N. (2020). „Technical Standardization, China and the Future International Order.” Heinrich-Böll-Stiftung, February. https://eu.boell.org/sites/default/files/2020-03/HBS-Techn%20Stand-A4%20web-030320-1.pdf. Accessed: August 25, 2020.

62 | Platform Industrie 4.0 (2019). “Second Sino-German Annual Meeting of the State Secretaries and Vice Ministers on Intelligent Manufacturing.” February 13. https://www.plattform-i40.de/PI40/Redaktion/EN/News/Actual/2019/2018-11-german-chinese-meeting.html. Accessed: August 25, 2020.

63 | ETSI (2020). “Calling the Short: Standardization for EU Competitiveness in the Digital Era.” Report from expert panel. https://www.etsi.org/images/files/Calling-The-Shots-Standardization-For-The-Digital-Era.pdf. Accessed: August 25, 2020.

64 | Foo, Yun Chee (2020). “Exclusive: EU Must Engage in Lithium Standards or Lose to China, EU’s Breton Says.” Reuters, June 18. https://www.reuters.com/article/us-eu-lithium-standards-exclusive/exclusive-eu-must-engage-in-lithium-standards-or-lose-to-china-eus-breton-says-idUSKBN23P2I5. Accessed: August 25, 2020.

65 | Arcesati, Rebecca and Rasser, Martijn (2020). “Europe Needs Democratic Alliances to Compete with China on Technology.” MERICS, May 29. https://merics.org/en/analysis/europe-needs-democratic-alliances-compete-china-technology. Accessed: August 25, 2020.

66 | Sherman, Justin (2020). “The UK Is Forging a 5G Club of Democracies to Avoid Reliance on Huawei.” Atlantic Council, June 2. https://www.atlanticcouncil.org/blogs/new-atlanticist/the-uk-is-forging-a-5g-club-of-democracies-to-avoid-reliance-on-huawei/. Accessed: August 25, 2020.

This is chapter 3 of the MERICS Paper on China "Towards Principled Competition in Europe's China Policy: Drawing lessons from the Covid-19 crisis." Continue with Chapter 4 "Advancing liberal multilateralism" or go back to the table of contents.