Light at the end of the tunnel after a weak Q4

MERICS Economic Indicators Q4/2022

Q4 analysis: Mounting economic pressure forces government to make policy adjustments

China’s economy had a turbulent year in 2022. Consumers and businesses suffered gloomy prospects in an erratic regulatory environment, amid disruptive zero-Covid constraints. The anti-lockdown protests that erupted in November partly reflected frustration at the economic impact of Covid controls on people’s daily lives. As Xi Jinping’s third term in power began, key policies crumbled under shockingly direct criticism from protestors. However, the sudden reversal of China’s stringent Covid policies is a long-awaited game changer for the economic outlook, though it came too late to improve 2022’s growth.

China’s economy expanded by 3 percent in 2022, the weakest growth since 1976. Following another slowdown to 2.9 percent growth in Q4, there is hope that the growth trough has finally bottomed out. Naturally, there are high hopes for a quick recovery as the economy begins to reopen fully and economic growth returns to the top of the leadership’s list of priorities.

Before China’s economy moves on to the post-pandemic phase there will be several waves of Covid infections. China’s health care system will likely be put to the test and companies will need to deal with spikes in sick days. But there is finally light on the end of the tunnel. As the economy begins to normalize, the services sector and consumption can start to recover. The process will need effective policy support.

The Central Economic Work Conference confirmed that there will be more stimulus measures this year, in the form of monetary easing and increased fiscal spending. Boosting consumption and private sector investment are key priorities. It has been reported that authorities are considering special local government bonds of up to CNY 3.8 trillion in 2023 – a new record. Increased spending will push the budget deficit to around 3 percent, up from 2.8 percent in 2022. In China, this is a stronger signal than the numbers might suggest, as a lot a public spending is conducted off-the-book. However, the overall stimulus will be constrained by debt control and the need to manage financial risks for local governments that are already highly leveraged.

Aside from stimulus measures and scrapping zero-Covid, China’s economic policies underwent other remarkable reversals in Q4. Crackdowns on the tech and real estate sector were eased, marking a course correction from the seemingly uncoordinated policy blitz over the past two years that damaged economic sentiment and cut growth. The greater centralization of economic policies under Xi looks to have failed its first real test, though economic leaders may be learning from mistakes and making adjustments.

Amid a looming global recession, China’s policymakers enter 2023 adjusting their economic policies to domestic pressures and growing external challenges, a theme that is likely to continue. Despite growing optimism, China’s recovery remains vulnerable, especially as it has become more difficult for policymakers to engineer growth. How the government responds to the new challenges will be a good indication of whether and how Xi’s economic policy priorities will shift – if at all. The last quarter has clearly given an indication that his policies seem to be contested.

![]() Hover over/tap the charts to see more details.

Hover over/tap the charts to see more details.

Exhibit 1

The MCCI was first developed in Q1 2017.

Macroeconomics: Zero-Covid leaves its mark on GDP growth one last time

Exhibit 2

![]() Hover over/tap the charts to see more details.

Hover over/tap the charts to see more details.

Exhibit 3

- China’s economy had a volatile year as multiple, localized Covid lockdowns undermined growth, alongside regulatory crackdowns on tech firms and the crucial real estate sector. In Q4, GDP growth slowed to 2.9 percent, the third lowest quarterly growth on record. Annual growth fell to 3 precent, the second lowest rate since 1976. The painful economic costs of the zero-Covid policy were a major reason why it was abandoned in early December.

- The service sector remained hard hit by the government’s economic policies, making a sustainable recovery impossible. The stagnant services sector dragged down overall GDP growth. Growth in services fell to 2.3 percent in Q4, down from 3.2 percent in Q3. The slowdown was driven by the sharp contraction in real estate, and the impact of zero-Covid policies on transportation and hospitality (see exhibit 2).

- Manufacturing was impacted by harsh lockdowns in October and November, as well as slowing demand for exports. Strong manufacturing activity has been a vital growth driver for China’s economy throughout the pandemic, but growth fell to 2.3 percent in Q4, below overall GDP growth.

- Construction was a bright spot once again, growing by 7 percent in Q4. But this was a weaker performance than in Q3 when construction grew by 7.8 percent. However, the sector’s strong data was largely due to base effects when set against contraction in final quarter of 2021.

- Strong global demand was a reliable growth driver for China’s economy throughout the pandemic. Net exports contributed to GDP growth for 11 consecutive quarters, but in Q4 2022 softening global demand meant net exports dragged down GDP growth by 1.2 points (see exhibit 3). As the trend is likely to persist, new growth drivers will be essential.

What to watch: If service sector growth starts to outpace GDP growth, it will be a healthy sign of recovery.

Business: Industrial output loses momentum in the final months of 2022

Exhibit 4

![]() Hover over/tap the charts to see more details.

Hover over/tap the charts to see more details.

Exhibit 5

- Manufacturing was an important growth driver in 2022 but fizzled out towards the end of the year. Output slowed gradually in Q4 from September’s peak of 6.4 percent year on year growth to 0.2 percent in December. Supply chain disruptions caused by a jump in Covid infections, combined with weak global demand, weighed heavily on output during the last two months of the year.

- The NBS Manufacturing Purchasing Manager’s Index (PMI) remained below 50.0 through Q4, indicating contraction. The PMI, which has been falling for four months, dropped to 47 in December – its lowest level since the early days of the pandemic in February 2020. Confidence in the service sector also failed to recover; the sector’s PMI fell to 41.6 percent in December.

- Disruptions to workforce availability and supply chains hit high-tech industries such as smartphone production particularly hard, as the well-publicized worker protests at Apple supplier Foxconn showed. In electronics industries value-added output fell sharply in November and December (see exhibit 5). However, in chemical raw materials and chemical products sectors, output grew steadily at about 11 percent across Q4, reflecting ongoing demand for basic industrial materials across the manufacturing sector.

- The automotive sector ended a highly volatile, but still positive year with 6.3 percent full year output growth. Less happily, December output fell by 5.9 percent against December 2021. Automakers’ success in obtaining overall growth in 2022 was due to a mix of government stimulus measures and new energy vehicles (NEVs), which are the sector’s bright spot. Production of NEVs hit record levels in December. However, subsidies for NEVs have come to an end and overall auto production remains far away from its 2017 peak.

- The weak real estate market continued to have a depressing effect on industrial outputs like steel and cement. Construction materials output kept on falling in Q4. Cement and plate glass output - already weak - worsened, to rack up their biggest quarterly slowdown in 2022. In December, cement output plunged 12.3 percent, while plate glass dropped 6.3 percent, compared to the same month last year.

What to watch: A rebound in the service sector will be a vital sign for the recovery setting in.

International trade and investment: Export boost to China’s economy fizzles out amid Q4 slowdown

Exhibit 6

![]() Hover over/tap the charts to see more details.

Hover over/tap the charts to see more details.

Exhibit 7

- After nearly three years, the extraordinary expansion of China’s exports ended in Q4. Exports dropped throughout the quarter, contracting by 9.9 percent in December year-on-year on a USD basis. They recorded their lowest value since the early days of the pandemic in February 2020. However, much of the decline was due to base effects as Q4 data was set against high growth in the reference period last year.

- Despite dropping in Q4, exports remained at high levels and played a vital role in preventing a sharper overall economic slowdown. Exports expanded by 7 percent in 2022, another record. Total exports were worth USD 3.6 trillion, which was 50 percent higher than the pre-pandemic average between 2017 and 2019.

- Export volumes will continue a process of normalization from these elevated levels. Demand for Chinese exports will be dampened by inflation in key markets and slower global economic growth. China’s 2023 economic growth will be shaped by how fast export levels decline from their peaks, so it will be a key trend to watch.

- Weaker import demand for semiconductors indicates slowing demand in China’s massive electronics sector. In 2022, the quantity of integrated chips imported slumped by 15.3 percent. There was also a drop in China’s imports from Taiwan and South Korea, key suppliers of semiconductor and electronic components. In 2022, imports from Taiwan shrank by 18.6 percent and those from South Korea by 9.4 percent.

- China’s trade surplus broke yet another record as weak domestic demand suppressed imports. The trade surplus surged by 30.1 percent in 2022, compared to 2021, to reach USD 877 billion. China’s trade surplus has more than doubled from 2019 levels.

What to watch: Improving import growth and a shrinking trade surplus would be crucial signs of economic recovery.

Financial markets: Monetary easing remains cautious despite muted credit demand

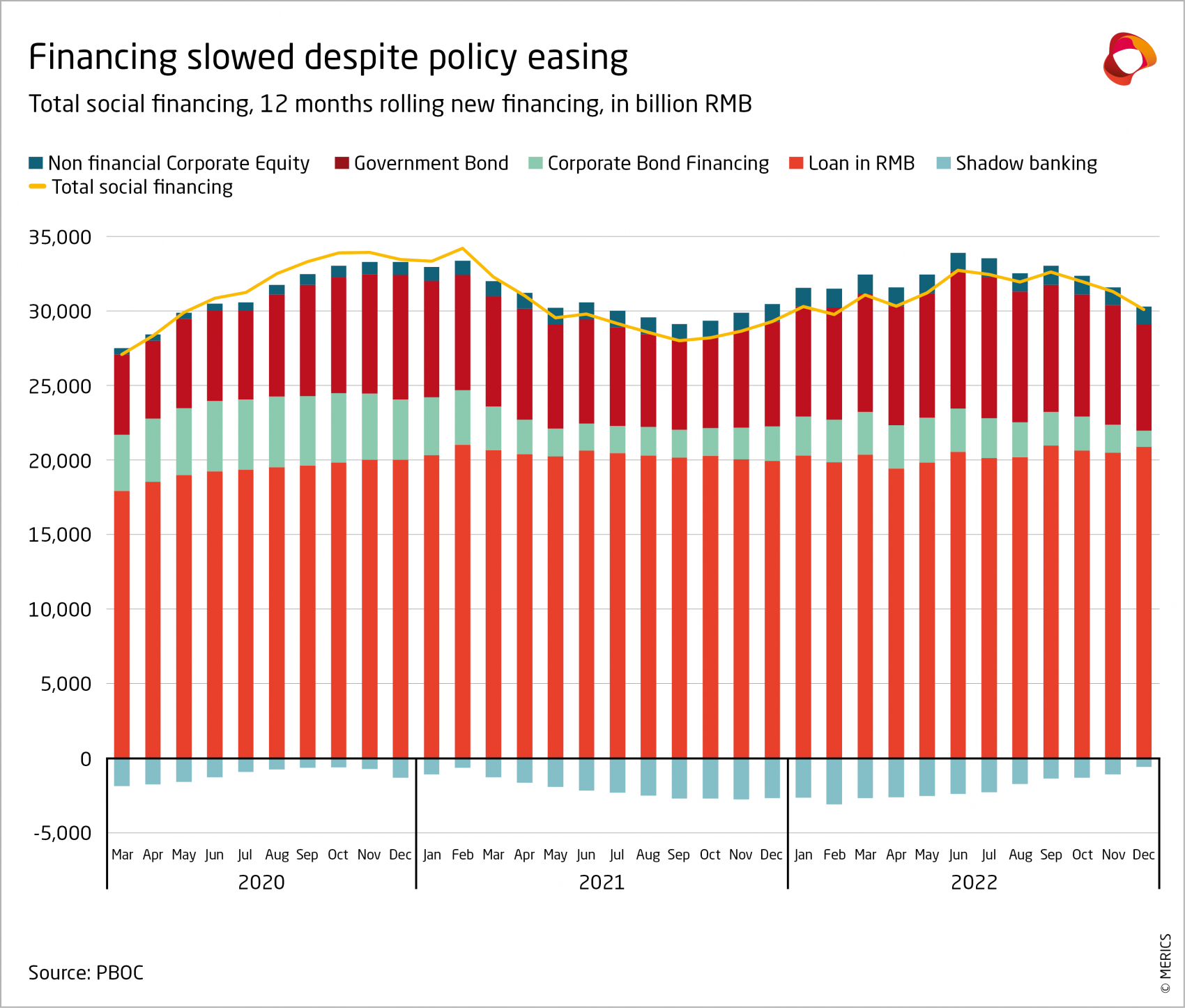

- The People’s Bank of China (PBOC) continued monetary easing in Q4 to fuel and support economic growth. In November, the banking system gained extra liquidity for loans that was worth a total of CNY 500 billion due to a 0.25 percentage points cut in the required reserve ratio. The ratio was last cut in April. However, the PBOC has avoided unleashing any flood-like stimulus, mindful of risks to China’s highly leveraged economy, and says it will not do so in 2023.

- The overall financing flow to the real economy slowed in December (see exhibit 8). The continuous dynamism in bank loans, especially long-term loans to corporates, was outweighed by drops in corporate bond and equity issuance. With household loans also in the red, a vital part in the recovery of the Chinese economy is refraining from taking on debt.

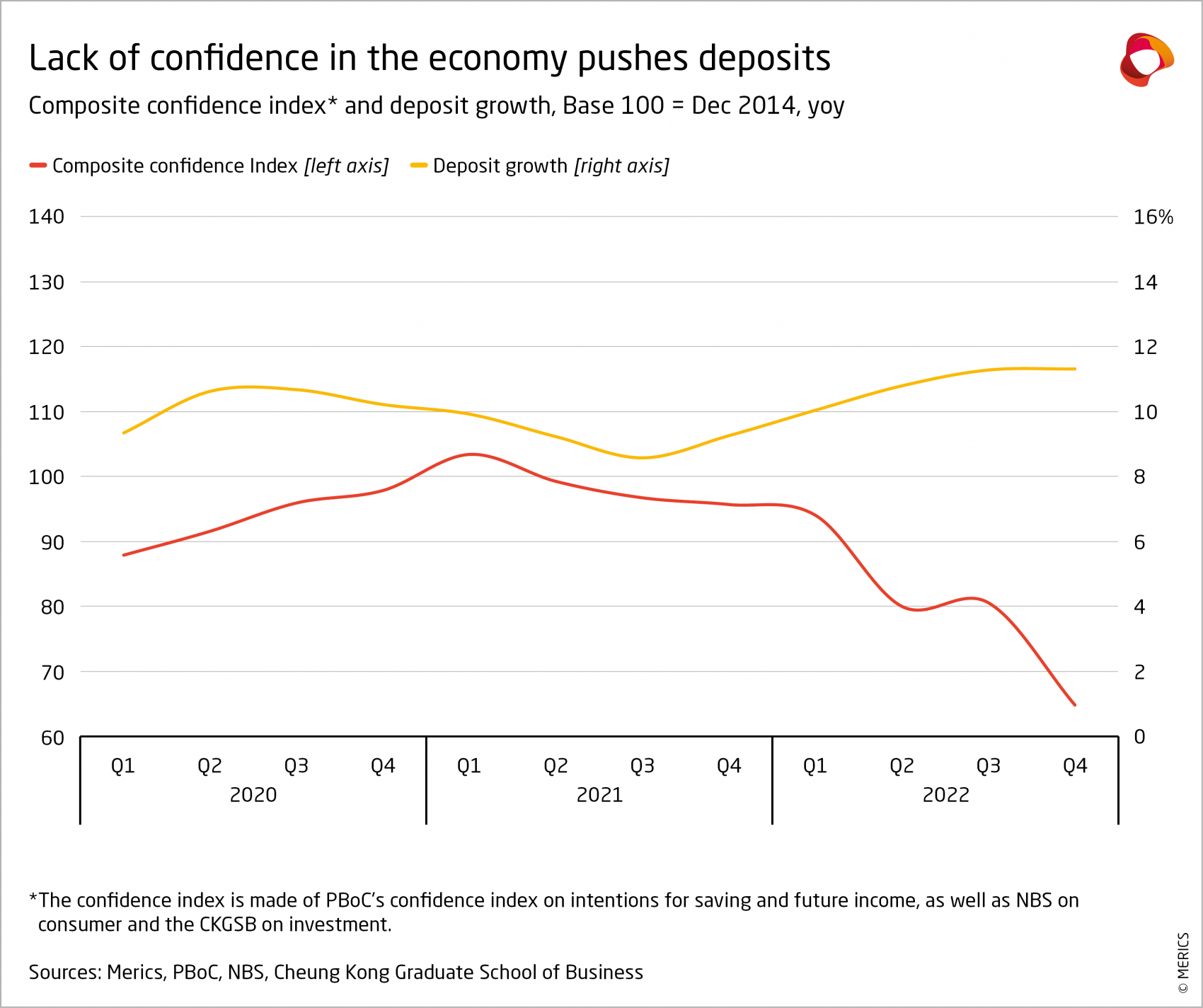

- Business activity was dented in Q4; first, by rolling local lockdowns under the ‘dynamic zero Covid’ policy, then by a wave of Covid infection after the policy was scrapped with no preparation. Households and private companies, especially SMEs, have remain reluctant to invest, preferring to save, despite the PBOC’s stimulus efforts (see exhibit 9).

- State and state-affiliated entities have come to the rescue, issuing numerous bonds, thereby shouldering investment risks to maintain momentum. Special local government bond quotas are expected to reach CNY 3.8 trillion in 2023, a new record. It is a sign of more government investment, particularly in infrastructure, to counter the overall investment slump.

- The PBOC fended off yuan depreciation trends over the quarter without dipping into foreign exchange reserves, though stealth interventions through state-owned commercial banks are suspected. By the end of Q4 there were even early signs of foreign investors regaining their appetite for China, with inflows reaching CNY 139 billion in December, the highest monthly inflow in 2022.

What to watch: If the demand for loans were to come more from private households and companies, rather than state-entities, this would indicate both greater economic confidence and healthier credit composition.

Investment: Real estate and private sector investment drag down overall growth

Exhibit 10

![]() Hover over/tap the charts to see more details.

Hover over/tap the charts to see more details.

Exhibit 11

- Investment activity slowed further, largely due to zero-Covid restrictions and the crackdown on real estate. Overall fixed asset investment growth slowed throughout Q4, falling from 5.9 percent in September to 5.1 percent in December year on year. State-owned enterprises’ investments were a key growth driver, given that investments by private and foreign companies slowed in response to the persistent poor investment outlook (see exhibit 10).

- As part of the stimulus infrastructure investment gradually picked up, expanding for eight continuous months. By December, growth reached 9.4 percent. But the overall gain was fairly modest as figures were inflated by the distorting impact of the low base period: growth in Q4 2021 was only 0.9 percent. More stimulus measures are likely in the months ahead, and local government finances will also be less constrained by the cost of applying zero-Covid rules.

- Strong, ongoing manufacturing investment prevented a sharper slowdown in overall investment growth. By December, growth in manufacturing investment had slowed to a still-healthy 9.1 percent, down from 10.1 percent in September. Electrical machinery powered its way to a rise of 42.6 percent by the end of Q4. Persistent high investment in the automotive sector was also key, fueled by demand for new EV capacity. Overall automotive investment rose by 12.6 percent in 2022.

- By contrast, investment in the tertiary sector was weak overall and continued to slow over Q4. Service sector investment was severely affected by the strict Covid measures, and slowed to 3 percent in December.

- Stalling real estate investment was the biggest drag on overall investment. It contracted 8.3 percent by the end of 2022, hitting its lowest level since March 2020. With land sales and new construction starts also sharply down, no quick recovery should be expected, despite government efforts to ease pressure on the sector.

What to watch: Upticks in real estate and private sector investment would be key indicators of an improvement in the investment climate.

Prices: China continues to buck the global trend of high inflation

Exhibit 12

![]() Hover over/tap the charts to see more details.

Hover over/tap the charts to see more details.

Exhibit 13

- Consumer price rises eased off during the final three months of 2022, after peaking in September at 2.8 percent higher year on year. In November, consumer price growth fell to 1.6 percent, then picked up slightly to 1.8 percent in December once Covid restrictions ended. Full year 2022 CPI rose by 2 percent. This was well below the annual target of 3 percent, giving scope for more stimulus measures.

- Prices are expected to rise in the coming months as consumption recovers, though overall increases are likely to remain modest. China’s authorities will be particularly vigilant towards food prices as these have been major drivers of inflation. Food prices hit a 2-year peak in September, rising by 8.8 percent, but price rises cooled during Q4, and were 4.8 percent in December. The National Development and Reform Commission (NDRC) has signaled that price stability should be prioritized and stepped-up market supervision ahead of the Chinese New Year holiday season.

- Greater demand for domestic and international travel is likely to affect prices until transportation capacity normalizes again. Travel related prices inched up in Q4, expanding by 3.9 percent in December year on year, compared to 1.9 percent at the end of September. Travel related price increases over the coming holiday weeks will be temporary, with little effect on overall price development.

- Following a 13-month drop in prices, the producer price index (PPI) fell below zero amid weak demand and Covid related disruptions. Base effects from high growth rates in the same period of last year also impacted price data in Q4. Prices contracted by 2.3 percent in October and November year on year, but dropped by only 0.7 percent in December, suggesting slightly stronger demand.

- Real estate prices continue to be affected by weak demand after a year of economic uncertainty in 2022. Of the 70 cities tracked by the National Bureau of Statistics (NBS), 53 reported falling real estate prices in December, considerably higher than the 10-year average of 21. This is despite falling supply triggered by the government-led crackdown on the real estate sector.

What to watch: An uptick in the CPI, particularly in services, would signal that the economy is coming back to life.

Labor market: Job creation stumbles in Q4

Exhibit 14

![]() Hover over/tap the charts to see more details.

Hover over/tap the charts to see more details.

Exhibit 15

- Job creation exceeded the government’s target in 2022. Altogether 12.1 million new urban jobs were created last year, outstripping the annual target of 11 million. But employment remains a key pressure point, both economically and socially. The protests that erupted against strict Covid controls in November were also motivated by the zero-Covid policy’s economic damage, seen in weak job prospects and sluggish income growth. If economic recovery is to gain traction in 2023, employment and wage growth are both essential.

- Employment and income prospects both sank to historic lows in late 2022. The People’s Bank of China (PBOC) index of future income sentiment fell to 44.4 in Q4, compared to 50 in Q1. The previous weakest point was 45.9, recorded at the outbreak of the pandemic in Q1 2020. Future employment sentiment also fell off a cliff, down to 43 by the end of the quarter.

- Weak income growth will limit household spending on consumer goods and services. This is a double challenge as retail and services are crucial for new job creation, particularly for low skilled workers. Furthermore, service sector jobs will become more vital as China’s export boom slackens and labor demand normalizes in manufacturing.

- Urban unemployment edged up to 5.6 percent in November before dropping back to 5.5 percent in December, the same level at the end of Q3. The true figure is thought to be higher as migrant workers are not captured in official figures; many migrants work in the hard-hit construction sector. However, government measures helped to reduce unemployment among 16-24 year old to 16.7 percent in December, down from a record peak of 19.9 percent in July.

- The government remains under pressure to create graduate jobs, as 2023 will bring another record cohort of 11.8 million new university graduates, up from 10.8 million in 2022. Additional government support is likely to include more hiring by public sector and state-owned enterprises.

What to watch: The annual round of official minimum wage increases, after Chinese New Year, will give an indication of how much wages are likely to grow in 2023.

Retail: No quick rebound for consumption as lockdowns end

Exhibit 16

![]() Hover over/tap the charts to see more details.

Hover over/tap the charts to see more details.

Exhibit 17

- China’s zero-Covid lockdown policies were scrapped at the start of December but there was no rebound in sales after the U-turn. Retail spending contracted by 1.8 percent in December, year on year. At best, it was a milder fall than the 5.9 percent recorded in November. Covid promptly swept through the population and waves of infection may well continue to hinder the normalization of consumer spending. Demand for medi-cines surged in December (see exhibit 16).

- Over the past three years, Chinese households are estimated to have accumulated CNY 5.6 trillion in excess savings. There is much hope that these savings will soon be unleashed in a shopping boom, though this is far from certain. Much depends on how consumers view their overall economic prospects and whether spending patterns have changed.

- Online sales of goods and services remained sluggish, expanding by 4 percent in 2022, far down on double digit growth over much of the past five years. Online sales now account for 30 percent of total retail, up from 26.5 percent prior to the pandemic. The coming months will show if online sales prevail after the re-opening of the country.

- Recovery in the restaurant sector will be an important indicator for the battered service sector. The pan-demic has left considerable damage. In 2022, restaurant spending stayed nearly 8 percent below 2019 lev-els. The contraction worsened in December, down 14.1 percent year on year - the worst figures since mas-sive lockdowns in Shanghai and other cities in February 2022.

- A swift recovery in travel activity would be another important sign of life for China’s economy. There are signs of improvement, but any return to normal is still far away (see exhibit 17). A sudden boost in interna-tional travel, could surpass domestic spending on travel, especially in the luxury segment: the government relaxed many international travel restrictions from January 8, after the end of Q4.

What to watch: Spending during Chinese New Year holiday fortnight will offer early indications of consumers’ willingness to spend, as it is first major holiday since the end of zero-Covid.