MOFCOM five-year plan + Circular economy + Support for SMEs

1. MOFCOM five-year plan calls for greater diversification in trade

At a glance: The Ministry of Commerce (MOFCOM) released a policy outline that seeks to solidify China’s position in international trade, boost investment links and augment its ability to reshape global supply chains. By 2025 the policy aims to:

- Shorten the negative list on foreign investment and further open up the telecommunications, internet, education, culture and health care sectors

- Ratify the EU-China Comprehensive Agreement on Investment (CAI), increase links between Chinese provinces and US states and reinforce Russia-China ties

- Diversify imports of agricultural products and energy resources, and build stable regional supply chains between China and neighboring countries in Asia

- Improve the assessment of foreign investment deals for risks which may be of national security concern

MERICS comment: China will likely achieve its aim to diversify food and energy imports through stronger ties with developing countries and Russia. The extension of the friendship treaty between Russia and China in June shows that the two countries are increasingly leaning on each other amid tensions with the West. Conversely, China will have a tough time strengthening economic ties with the US and ratifying the CAI as human rights concerns continue to block the advancement of such agreements.

While the planned expansion of the national security review mechanism for foreign investment will increase uncertainty for foreign firms looking to invest in China, it is unlikely to seriously disrupt investment flows. Despite the tit-for-tat sanctions exchanged between China and the EU in March of 2021, EU companies are nevertheless increasing investment in China as the country remains an important source of revenue in the pandemic depressed global economy and a key market for future growth.

The shortening of the negative list will, for the most part, be of little benefit to foreign firms. Often industries are strategically selected where Chinese companies are already dominant, for example in telecoms. Health care appears to be the only new area where foreign companies could acquire significant market share. China’s rapidly ageing population makes absorbing high-quality medical services a top priority, offering an important opportunity for EU companies. All the same, foreign firms will need to be wary of the government’s changing agenda. As the clamp down on the education sector following recent measures to incentivize foreign investment indicates, the central government can quickly change course.

Policy name: 14th Five-Year Plan for the Development of Commerce

(商务部关于印发《“十四五”商务发展规划》的通知) (Link)

Issuing body: MOFCOM

Date: July 8, 2021

2. Circular economy plan promotes resource use efficiency

At a glance: The National Development and Reform Commission (NDRC) issued the 14th FYP Development Plan for the Circular Economy. The blueprint promotes clean, recycling-based production methods and green design to maximize resource use and the lifecycle of products. Several targets for 2025 are listed with 2020 as the baseline year, including:

- Increase resource productivity by 20 percent, measured by the weight of key fossil fuel, metal, mineral and biomass resources consumed per unit GDP

- Reduce energy and water consumption per unit GDP by 13.5 and 16 percent respectively

- Raise the utilization rate of bulk solid waste from 56 to 60 percent

- Grow the output value of the resource recycling industry to CNY 5 trillion

MERICS comment: Despite passing its Circular Economy Promotion Law as early as 2008, China’s energy and water consumption per unit GDP are still significantly higher than the world average. Managing the increased waste derived from new technologies such as batteries and solar modules looms as a pressing challenge. The rollout of circular economy measures will enjoy significant support as it fulfills two of Beijing’s top priorities: cleaning up the environment and the self-reliance campaign. This will present both opportunities and challenges to European companies and policy makers.

Foreign companies experienced in green manufacturing techniques and product life cycle systems could be welcome partners for local governments and businesses seeking to build up recycling capabilities and resource use efficiency. European officials can also build on the momentum of the new plan to establish deeper cooperation. The European Commission adopted a new circular economy action plan in 2020, which includes a commitment to lead global efforts on the circular economy. Building on the Memorandum of Understanding on Circular Economy Cooperation signed by the EU and China in 2018, closer exchanges could help to align standards and provide more clarity for companies operating internationally.

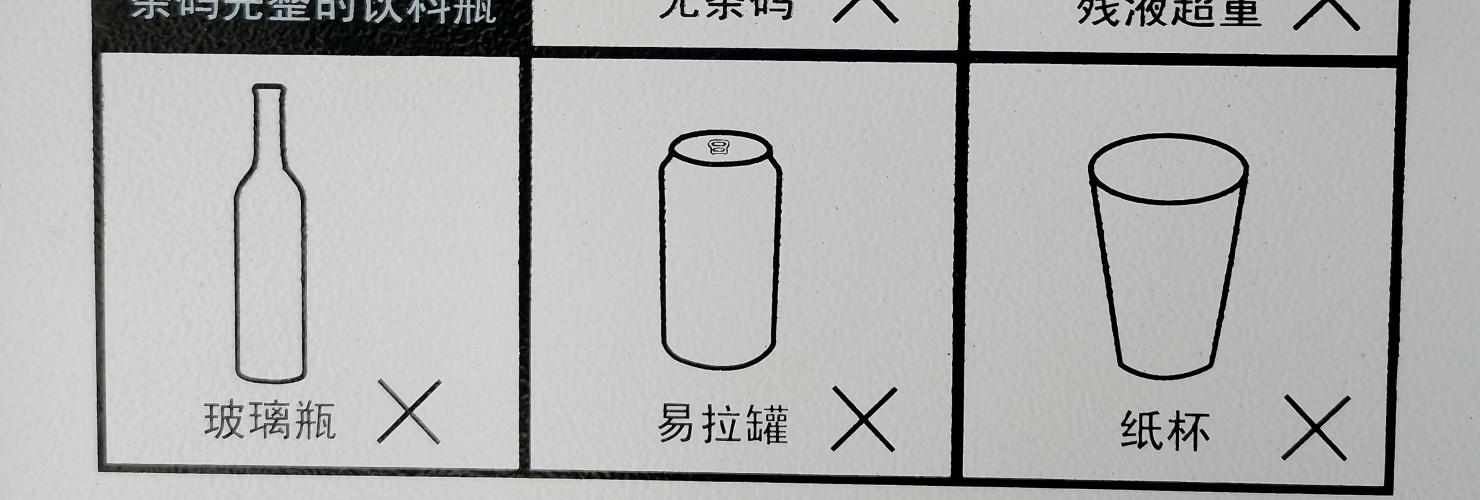

But challenges for European companies are also present. The new development plan lists boosting indigenous innovation in recycling technologies as a key priority and officials will likely offer targeted support to domestic firms to spur on the shift towards more sustainable forms of production. In the long run, European firms should expect increased competition from domestic players in technology and core designs related to green manufacturing. Furthermore, companies will need to prepare for compliance with new guidelines, such as the draft on administrative measures regarding the use of and reporting on disposable plastic products.

Policy name: 14th Five-Year Plan Development Plan for the Circular Economy

(国家发展改革委关于印发“十四五”循环经济发展规划的通知) (Link)

Issuing body: NDRC

Date: July 7, 2021

3. More support for little giants to fill supply chain gaps

At a glance: Six ministries and government agencies jointly issued guiding opinions aimed at accelerating the development of small and medium-sized enterprises (SMEs). Eligible SMEs are ideally active in technologies listed in the Industrial Four Bases Development Catalogue (工业“四基”发展目录), a supplement to the Made in China 2025 Strategy (中国制造2025). The policy aims to cultivate SMEs into “little giant” companies that excel in niche sectors. The key targets are as follows:

- By 2025, develop 10,000 “little giant”, 1,000 “single industry” and a large number of “leading” companies specialized in niche sectors

- Promote little giant companies to develop and apply autonomous and controllable industrial software

- Enhance the technological autonomy of industrial and supply chains through the promotion of little giant companies

- Build an ecosystem that integrates large and medium-sized companies and little giant companies to build advanced manufacturing clusters

MERICS comment: Chinese policymakers have for a long time sought to emulate Germany’s ‘hidden champions’: highly specialized, globally active companies with high market shares in niche sectors. The explicit mentions of technological autonomy and autonomous and controllable software demonstrate the important role of little giants in China’s push for technological self-reliance. The policy also serves to direct additional capital towards SMEs, as they struggle to attract funding from China’s state-run banks which prefer to lend to SOEs.

Policymakers are keen to see little giants thrive internationally. In 2019, they selected Siasun, a collaborative robot maker. In 2016, shortly after China liberalized its outward FDI regime, Siasun acquired German technical training institute Teutloff. Currently the firm is building an R&D center in Magdeburg. Little giants like Siasun play a key role in China’s attempts to boost automation to enhance productivity.

If successful, the rise of the little giants could impact European companies both negatively and positively. European players that enjoy significant market shares in China in related niche sectors could see reduced demand as customers are steered towards these new local suppliers. On the other hand, European firms seeking to onshore supply chains and integrate into the local technology ecosystem, to avoid disruptions caused by political frictions, could find little giants useful.

Policy name: Guiding Opinions on Accelerating the Cultivation and Development

of High-Quality Manufacturing Enterprises

(关于加快培育发展制造业优质企业的指导意见) (Link)

Issuing bodies: MIIT, MOST, MOF, MOFCOM, SASAC, CSRC

Date: July 3, 2021

Worth noting

Policy news

- July 6: NDRC releases a policy document supporting the construction of renewable energy power transmission projects, to facilitate the expansion of wind and photovoltaic power generation capacity (NDRC notice (CN))

- July 9: The State Council issues guidelines on the digitalization of foreign trade and development of cross-border e-commerce (State Council notice (CN); State Council article (EN))

- July 10: The Cyberspace Administration of China (CAC) issues a draft notice requiring companies which hold data on more than one million users to apply for a cybersecurity approval before listing their companies overseas (CAC notice (CN); Reuters article (EN))

- July 12: The Ministry of Industry and Information Technology (MIIT) releases a draft for the Three-Year Action Plan for the High-Quality Development of the Cybersecurity Industry (2021-2023), characterizing cybersecurity as an emerging industry that can create business opportunities (MIIT plan (CN); SCMP article (EN))

- July 13: MOFCOM and seven other government agencies release a list of 10 demonstration cities and 94 demonstration enterprises to promote supply chain innovation, safety and stability (MOFCOM notice (CN); MOFCOM press conference (EN))

- July 13: MIIT, CAC and the Ministry of Public Security issue new regulations which require anyone in China who discovers network product security vulnerabilities to inform the government and forbid such information from being given to “overseas organizations or individuals” other than the product’s manufacturer (MIIT notice (CN); ABC News article (EN))

- July 14: The Shanghai Municipal Government releases the 14th Five-Year Plan for the Development of Advanced Manufacturing Industry in Shanghai, highlighting three leading and six key industries (Shanghai Municipal Government notice (CN); Global Times article (EN))

- July 15: The Central Committee of the CCP and the State Council designate the Pudong New Area in Shanghai as a ‘Leading Area for Socialist Modernization’ and promise more support to strengthen local innovation in fields such as AI, semiconductors and life sciences (State Council opinions (CN); Global Times article (EN))

- July 16: Following extensive delays, China’s national ETS starts trading in the power sector with more than 2,200 companies and about half of the country’s energy-related emissions covered (People’s Daily article (CN); Global Times article (EN))

- July 17: The Shanghai Municipal Government issues draft regulations to protect data generated and collected during the testing of autonomous vehicles (Shanghai Municipal Government notice (CN); Reuters article (EN))

- July 20: MOFCOM, MIIT and the CAC jointly issue a guideline that increases policy support for China’s digital economy to expand internationally, for instance by setting up international R&D centers (MOFCOM guidelines (CN))

- July 23: CAC issues a notice on the deployment of IPv6 (the latest version of the Internet Protocol), with targets to increase the number of active IPv6 users and IoT devices connected to the protocol to 800 million and 400 million respectively by 2025 (CAC notice (CN); The Register article (EN))

- July 24: The Central Committee of the CCP and the State Council issue opinions banning private tutoring institutions from making profits, raising capital or going public (State Council opinions (CN); Bloomberg article (EN))

- July 26: MOFCOM issues the first negative list for cross-border trade in services in the Hainan Free Trade Port, outlining 70 management measures in 11 categories for overseas services providers (MOFCOM notice (CN); Global Times article (EN))

Corporate news

- July 1: Baidu and the University of Maryland jointly develop an autonomous excavator system which can continuously operate for over 24 hours, allowing for enhanced safety and productivity (Baidu press release (CN); Baidu press release (EN))

- July 6: US conglomerate Honeywell signs a deal with China Baowu Steel Group to provide hydrogen purification technology in order to reduce the steelmaker’s pollution and energy consumption (Honeywell Wechat notice (CN); Caixin article (EN))

- July 7: EV-maker NIO receives certificates from TÜV Rheinland allowing the company to operate and sell its battery swapping stations and charging equipment in all EU countries (NIO Wechat notice (CN); Caixin article (EN)).

- July 7: Nexperia, a Dutch semiconductor firm owned by Chinese Wingtech Technology, acquires Britain’s largest and financially troubled chipmaker Newport Wafer Fab for an estimated USD 87 million (Nexperia press release (EN); Caixin article (EN))

- July 7: Huawei signs its largest patent licensing deal in the automotive sector with an unnamed Volkswagen supplier, including a license for Huawei’s 4G standard essential patents (Huawei press release (CN); Huawei press release (EN))

- July 8: Toyota-backed Pony.ai opens its robotaxi service to the public in Shanghai and unveils its long-range LIDAR sensor Iris, which will form the basis of its first level-four autopilot system scheduled for mass production by 2023 (Sohu article (CN); Yicai article (EN))

- July 10: The State Administration for Market Regulation blocks the USD 5.3 billion merger of Huya and Douyu, two of China’s biggest video live-streaming platform and both backed by tech giant Tencent Holdings (SAMR notice (CN); SCMP article (EN))

- July 16: Xiaomi overtakes Apple in Q2 2021 to rank second worldwide in smartphone sales for the first time, according to technology market analysis firm Canalys (Reuters (CN); Bloomberg article (EN))

- July 16: Seven central government departments, including CAC and the Ministry of State Security, begin an on-site cybersecurity inspection of ride hailing giant Didi Chuxing after the company completed an IPO in New York without full consent from Beijing (CAC notice (CN); SCMP article (EN))

- July 20: CRRC begins production of an indigenously developed maglev train featuring a top speed of 600 km/h, in Qingdao (Xinhua article (CN); Global Times article (EN))

- July 21: Volvo Cars signs an agreement with parent company Geely Holding, to acquire Geely’s stake in the companies’ JVs in China; this is likely in preparation for Volvo’s planned IPO (Sina article (CN); Volvo Cars press release (EN))

- July 27: Tencent temporarily suspends new user registrations for its extremely popular WeChat app, raising fears of new regulatory pressures (The New York Times (CN); The New York Times (EN))