China's economy in Q4: Strong exports offset domestic weaknesses

MERICS Economic Indicators Q4/2025

This analysis is part of the Q4/2025 MERICS Economic Indicators, our quarterly analysis of China’s economic data. You can find the most recent data here.

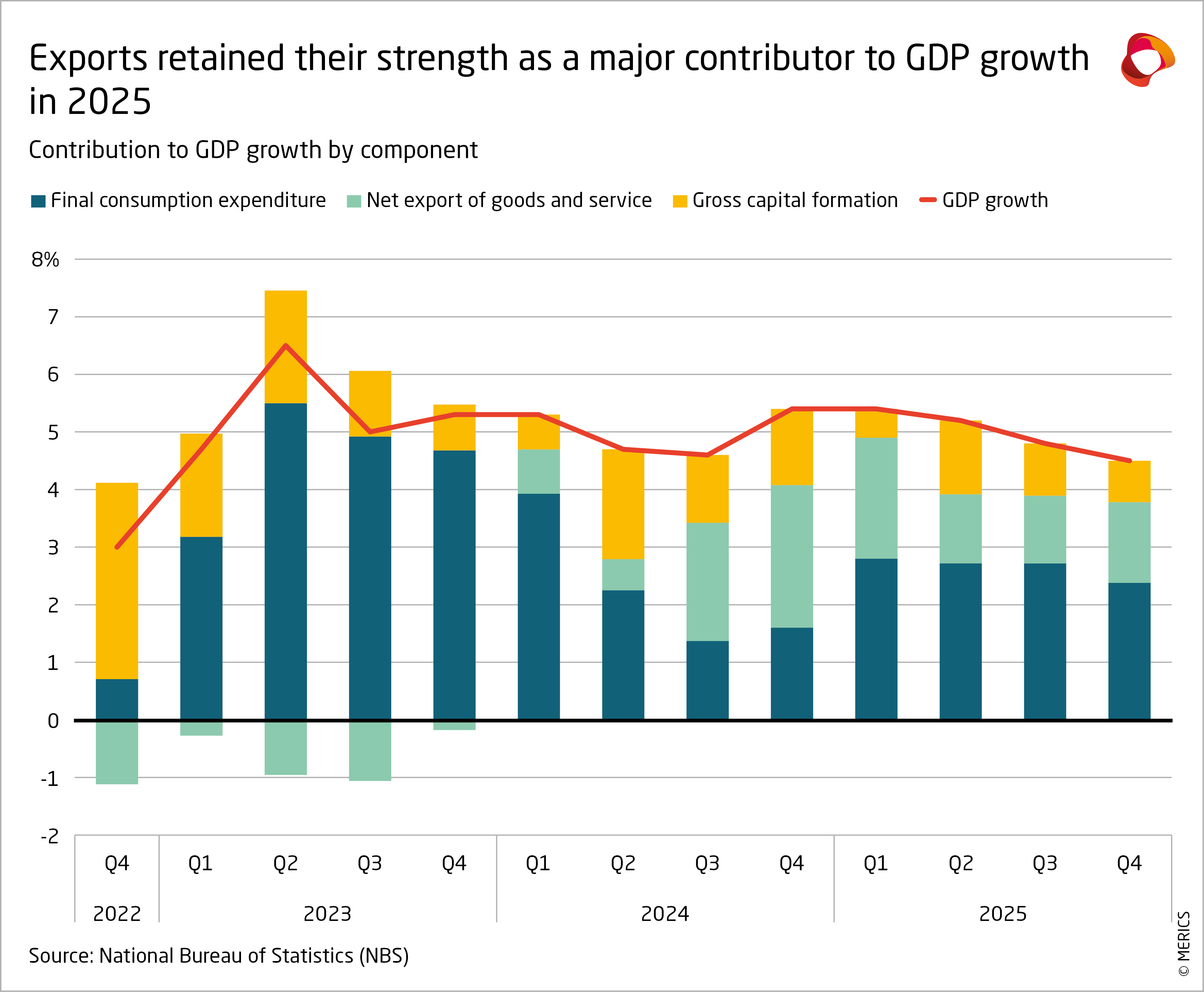

Beijing’s policymakers will be pleased with the end-of-year report card for China’s economy. Exports delivered a record trade surplus of USD 1.2 trillion, despite renewed trade frictions with the United States. The 5 percent GDP growth target was met. Major priorities progressed, for instance managing debt levels and growing China’s strategic industries. However, growth slowed toward the end of the year, highlighting underlying domestic weaknesses.

In Q4, China’s GDP grew at 4.5 percent – a three-year low – reflecting falls in fixed-asset investment (FAI) and sluggish consumer spending, though the weak year-on-year performance was partly due to comparison with an unusually strong growth surge from exports in Q4 2024 amid fears of a trade war. Fixed-asset investment shrunk by 3.8 percent over 2025, the first annual contraction since 1996 when data was first published. Cash-strapped local governments, cautious corporate investors and continued price falls in real estate all contributed to the negative FAI. The investment slowdown hit most sectors, with strong growth now limited to a few high-end manufacturing fields, such as automotive and aerospace.

Consumer demand remains weak

Weak consumer demand also dampened momentum in Q4. Retail sales growth continued trending downwards in Q4, finishing at only 0.9 percent in December. The government’s trade-in scheme for consumer goods helped boost retail sales at the start of 2025. However, it suppressed consumer spending in the second half of the year as households had already purchased their big-ticket items. Youth unemployment (which is improving at a slower rate than a year ago) and falling house prices are also hurting consumer sentiment.

Policymakers remained remarkably restrained in rolling out support measures through Q4. This was probably because of strong exports, the one remaining reliable engine of growth. China has chalked up a record trade surplus through seamless diversification. Exports in USD terms grew by 6.6 percent in December and by 5.5 percent in 2025 overall. They did so even as annual exports to the US declined by 19.8 percent, thanks to growth of 13.4 percent in sales to ASEAN markets and 8.5 percent to the EU.

China’s policymakers seem little worried about slowdown

The absence of any major announcements about stimulus in Q4 was notable in itself. Clearly, policymakers viewed the slowdown in some areas as acceptable and saw no reason for panic. In 2026, the GDP growth target is likely to be about 5 percent again. As China’s leadership will want to avoid a bad start to the year, fresh stimulus announcements are more likely in the coming months.

There have already been some signals that support is coming. The Central Economic Work Conference in December declared reversing the decline in investment will be a priority in 2026. Promoting investment in strategic sectors will be a major part of the central government’s approach. In December, it launched a national venture capital guidance fund aiming to mobilize CNY 1 trillion to support companies in strategic and emerging industries. At its press conference to preview the year ahead, the National Development and Reform Commission (NDRC) emphasized the role of new materials, aerospace, quantum technology and biomanufacturing industries as economic growth drivers.

Perhaps most crucial will be the government’s ability to stimulate more consumption, though whether it is willing to take significant steps in this direction remains unclear. In January, the NDRC said it was working on increasing the income of urban and rural residents in 2026 but offered no details. The central bank announced it would maintain a moderately loose monetary policy. Slightly lower interest rates could deliver some relief to households paying off debt, but they are unlikely to respond by taking out substantial new loans for consumption purchases. The government will continue its consumer goods trade-in program in 2026, albeit with more limited subsidies and funding levels.

External pressure could be a trigger for change

So long as foreign markets continue to absorb the output of China’s factories, the goal of boosting consumption will remain a secondary objective behind the tried and tested approach of supporting local industry. Substantial pushback from other countries to China’s growing trade imbalance could be a trigger for change. Thus far, the tariffs and trade barriers erected by other countries have been too targeted in scope or ineffective to impose significant constraints on Chinese industries. If larger economies like the EU were to expand these measures in 2026, then Beijing might finally start to feel the need to make changes.

Without external pressure, it will likely require some sort of domestic shock to change the calculus in Beijing and direct more resources to households in meaningful ways, perhaps as a pressure valve against public discontent. A continued plunge in investment, persistently falling house prices and rising unemployment levels could be a toxic mix. Clearly the leadership does not feel tangible public dissatisfaction is on the horizon, or it would be taking more decisive action. But if this scenario becomes more plausible, their hand may be forced.