China-Russia alignment: a threat to Europe's security

A report by MERICS, Chatham House and GMF

Key findings

- The war in Ukraine has altered the balance of interests between China and Russia. They have drawn closer together and further away from the West without reconciling their different world views.

- The new China-Russia alignment is characterized by a strong, flexible political bond but lacks a shared ideology or legal framework. It reflects mutual instrumentalization and is highly contingent on external factors.

- This alignment has evolved from a mere challenge into a complex security threat to Europe and its transatlantic partners.

- Although the United States and Europe see threats from Russia and China as separate and carrying different degrees of urgency, it is imperative to understand the nature and the extent of the threat they pose together.

- Russia’s war on Ukraine is a direct threat to European security. Beijing’s assistance to Russia turns China into a security threat to be contained rather than only a “partner, competitor and systemic rival”.

- China is providing Russia with an economic lifeline, helping Moscow to circumvent Western sanctions and expand its military-industrial complex with unrestricted exports of critical dual-use goods.

- China is supporting Russia also with hybrid operations and increased military cooperation, reducing Russia’s diplomatic isolation and promoting Russia’s narrative in the Global South.

- Attempts to drive a wedge between the two “limitless partners” are likely to be counterproductive. Instead, the key is to change Beijing’s calculus for supporting Moscow.

- The policy recommendations for transatlantic partners provided here revolve around three pillars: 1. Revising Europe’s view of China to acknowledge the security threat it represents. 2. Recognising China’s potential role to play in ending the war in Ukraine, yet without weakening European security. 3. Clarifying red lines and imposing costs on China for its support for Russia’s war effort.

1. Introduction: The China-Russia alignment poses a security threat to Europe

In May, Russia’s President Vladimir Putin chose Beijing for the first foreign visit after his re-inauguration. The meeting was Putin’s forty-third with China’s President Xi Jinping, who told his “best friend” that China would continue to provide an economic lifeline, political support and equipment needed for Russia to win in Ukraine. Russia and China continue to deepen their partnership, mounting a common challenge to the West1. They can advance their strategic objectives better together, undermining perceived Western domination of the global order and impacting Europe’s future security.

Russia’s war of aggression against Ukraine has de facto upended the post-Cold War security architecture in Europe and is a direct, existential threat to European security. Beijing plays an important role for Russia’s war efforts, regardless of China’s status as Europe’s largest trading partner or its desire to hedge on Europe to win its geostrategic competition with the United States.

Beijing has been propping up Russia’s war efforts by proliferating its war narrative, increasing bilateral trade, providing significant non-lethal support and reducing Moscow’s international isolation. China’s support has encouraged much of the Global South to refuse to condemn or sanction Russia. Beijing’s effective support for Moscow has undermined the impact of the West’s sanctions policy. So far, China has done this at virtually no cost but there are indications that this may be changing.

US Secretary of State Antony Blinken delivered a clear warning in Beijing on 24 April that the United States and its European allies were no longer willing to tolerate China’s sales of critical components and dual-use goods that “Moscow is using to ramp up its defence industrial base”.2 Similarly, European Commission President Ursula von der Leyen stated on 6 May, after meeting President Xi in Paris alongside France’s President Emmanuel Macron: “More effort is needed to curtail delivery of dual-use goods to Russia that find their way to the battlefield. And given the existential nature of the threats stemming from this war for both Ukraine and Europe, this does affect EU-China relations”.3 Europe and the United States have begun taking a stronger stance, though so far it does not seem enough to deter Beijing from supporting Russia.

Russia’s war in Ukraine has elevated the Russo-Chinese alignment from a mere challenge to be managed into a security threat that must be contained by the transatlantic partners together. The full-scale invasion of Ukraine has solidified consensus in the EU that Russia is Europe’s major and most urgent security threat, whereas views differ in Washington as illustrated by the delay in the approval of the security assistance package for Ukraine in the US Congress. There, China is seen as the most important long-term threat while Russia’s challenge to its security is less direct.

However, the EU still officially regards China as “a partner for cooperation, an economic competitor, and a systemic rival”, a description adopted in the Commission’s 2019 strategic outlook4 and confirmed again by the European Council in June 2023.5 This categorization needs to be completed with a fourth category, one that labels China also as a security threat to Europe.

Europe needs to present Beijing with a starker choice: either it continues helping Russia and faces consequences, or it begins curbing support for Russia’s war efforts and continues to enjoy close trade links with its key economic partners.

The transatlantic partners need to better understand the nature of Russo-Chinese alignment to find a common approach to this security challenge.

2. The balance of interests in China-Russia relations

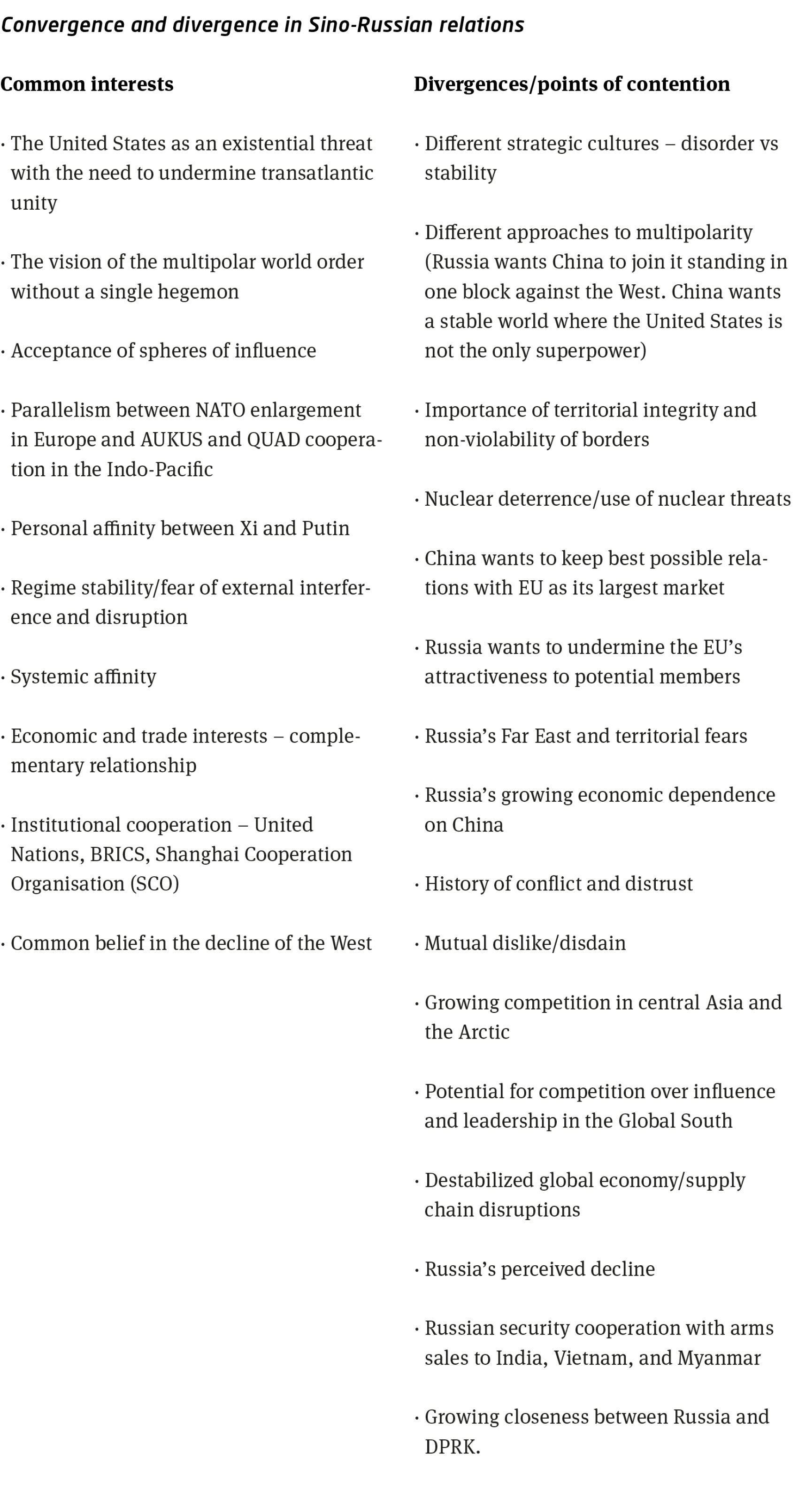

Opinions vary on the strength and potential impact of the evolving Russo-Chinese alignment. Our assessment of potential areas of convergence and divergence between them found more areas of divergence. Logically, this creates an expectation that the alignment is fragile and likely to rupture. Policymakers may feel encouraged to think about driving a wedge between China and Russia to lessen the risks their alignment poses, but this may be counterproductive. Indeed, the reality is different. Not all common interests and risks in China-Russia relations carry the same weight; they vary with political circumstances. The war in Ukraine has switched the balance in favour of an ever-closer alignment; its strategic basis is the evolving geopolitical context that presents Moscow and Beijing with opportunities as well as risks.

Both are illiberal regimes in the rules-based global order, which they regard as serving Western interests. Both wish this order to change and accommodate different models of governance. The pair have global ambitions and are united in their desire to push back against perceived Western dominance, as openly expressed in the February 2022 China-Russia joint statement of “limitless partnership”.6 Their converging external threat perception has boosted the value of cooperation over risk management or competition.

Moscow’s rift with the West caused by the Russian aggression in Ukraine and the growing US-China confrontation have ramped up perceptions in Moscow and Beijing that the United States and its likeminded partners pose a threat to their national security defined, inter alia, as regime stability.

Equally, Beijing and Moscow are keen to exploit a window of opportunity, based on their common perception of the West’s decline, the erosion of its moral and political hegemony, cracks in transatlantic unity, and the success of China’s development model.

Their lack of a shared positive agenda, and their different visions of what a multipolar world should look like, are often cited as reasons why the alignment may be short-lived7. China has benefitted from being a systemic player, while Russia seeks to destroy the system and the rules that underpin it. But mounting a campaign of disruption does not require a positive agenda or a coherent plan for the international order. It would therefore be unwise to dismiss the Russo-Chinese alignment as a temporary ‘marriage of convenience’. They are united in presenting a common challenge to the West to create a new global order and strong drivers underpin this process.

2.1 Russia has no alternative but to turn to China

President Putin needs allies in order to achieve his ambitious goals and deal with their global consequences. Russia cannot do so alone. For Moscow, there is therefore no alternative to partnership with China, making the alignment a top foreign policy priority8.

The 2022 full-scale invasion of Ukraine led to the near-total disruption of Russia’s relations with the West, forcing its “pivot to the East”. Moscow argues the West has indirectly become a party to the conflict by backing Ukraine militarily and poses an existential threat. It has therefore globalized its war narrative, expanding its war aims from the “de-Nazification” and “de-militarization” of Ukraine to the de-Westernization of the global order.

Russia’s strategic objectives go beyond subjugating Ukraine and establishing an uncontested sphere of influence. They also include diminishing the West, curtailing US hegemony, and fragmenting the international system into “civilizational” centres of power. President Putin claims this new multipolar world will be more just and democratic, more accommodating of cultural and ideological differences, and more respectful of sovereignty defined as freedom from intervention in internal affairs.9

More fundamentally and urgently, Russia’s war effort requires an uninterrupted input of critical components, so it is paramount that China continues to supply dual-use goods, such as semiconductors and machine tools, that are on the high-priority export control list. Russia also needs the cash flow from selling its hydrocarbon resources. Despite the complicating lack of infrastructure, China has become one of the largest importers of Russian crude oil. Russia’s March 2024 exports to China, including supplies via pipelines and sea-borne shipments, had reportedly jumped by 12.5 percent on year-earlier due to Russia’s sanctioned vessels offloading cargo in Chinese ports.10

Russia has also stepped up its challenge to the West in the Global South and multilateral diplomacy. It has been purposefully undermining legacy multilateral institutions such as the Organization for Security and Cooperation in Europe (OSCE), the Organization for the Prohibition of Chemical Weapons (OPCW), and others, branding them as serving Western interests. In tandem with China, Moscow is redoubling efforts to promote multilateral institutions that exclude Western countries, namely BRICS and the Shanghai Cooperation Organization (SCO) of central and southern Asian countries.

Expanding these organizations to include more countries in the Global South has also helped Russia intensify its global engagement. Moscow has deployed the Ukraine war to turn the Global South into both an instrument and a theatre of geopolitical competition, capitalizing on long-held grievances about colonialism and power imbalances. China compensates for Russia’s lack of an offer to the Global South. For now, the two countries complement each other, rather than compete, in their mutually reinforcing efforts to fragment the global order.

2.2 For Beijing, the war in Ukraine is an opportunity

Beijing perceives Russia’s war serving as a proxy in the struggle against the Western-dominated world order, a goal that fits its own global ambitions. The war keeps the West’s attention and resources focused on Ukraine, rather than the Indo-Pacific. It illuminates divisions between the transatlantic partners and proffers lessons that could help China’s leaders to prepare for a variety of scenarios in the Indo-Pacific. Beijing’s coordination with Russia is driven by its quest to weaken US-Western hegemony and replace it with a new type of great power relations11.

Debates on whether or not China is interested in peace in Ukraine center mainly on issues of timing and the endgame, along with what potential spillovers from the conflict China might face. While European nations want the war to be as short as possible, Beijing’s assessment differs: “The war in Ukraine is a long-term war” and Russia is ready for a protracted war that it should win.12 Ukraine’s ability to survive is viewed by the Chinese policy community as entirely dependent on Western aid, yet the transatlantic partners are divided and worry about how long the West can support Ukraine. Hence, Beijing calculates that a long-term war is a win for Russia, and that Moscow is unlikely to lose.

A Russian defeat also risks regime instability in Russia and might limit China’s global ambitions and its leaders’ credibility. Of course, the question of regime stability echoes very strongly in the Chinese leadership.

For Beijing, any Chinese role as a peace broker would rest on what Russia and Ukraine want, which is a different tack from Western analysis that tends to be focused on identifying Chinese leverage over Russia. Beijing believes the war’s end will be determined by the United States, Russia and Ukraine – leaving little agency to Europe and/or China. Hence, China’s 12-point position paper on the Ukraine “crisis”13 is a dead end, merely a collection of China’s favored positions and principles. China would likely seize any genuine opportunity to expand its role, as suggested by the performative diplomacy of Special Envoy Li Hui since 2022. While China declined to attend the International Peace Conference in Switzerland in June 2024, the recent China-Brazil proposal to mediate and organise a peace conference signals that if all parties are ready and conditions are right, Beijing could play a role in ending the war. The recent Iran/Saudi deal illustrates China’s pragmatism and its convening power to offer the right enabling framework once a deal is within reach.

Although Beijing likely prefers a long war and eventual Russian victory, the Chinese leadership is equally aware of the attendant risks. In reality, many in the Chinese foreign policy community would agree that there is no result or end of the war that would satisfy China. First, they are conscious of a political cost for China’s relationship with Europe, and to a lesser extent the United States.14 Second, their active de-escalation efforts around the risk of a nuclear conflict express the assessment that Russia’s escalating nuclear threats represent a real risk, and that the safety and security of critical infrastructure such as nuclear plants is not guaranteed15. China’s leadership took seriously Moscow’s announcements that “all necessary means” would be used to defend Russia, the suspension of the New START agreement with the United States,16 and deployment of nuclear weapons in Belarus. Third, the heightened risk of a direct Russia-NATO confrontation is a major concern that Beijing takes seriously as it threatens unintended consequences for Chinese assets and interests in Europe. And finally, there is a degree of dissatisfaction with the war’s economic fallout and the disruption of supply chains.

3. The Russo-Chinese alignment is an externally determined strategic necessity

The different perspectives on their partnership from Beijing and Moscow show the two elites using each other out of Russia’s strategic necessity and China’s choice. This is driven by external geopolitical factors in ways made possible by the solid ties between the two leaders. The China-Russia alignment will remain flexible, non-binding and features several significant weaknesses and vulnerabilities.

First, the Russo-Chinese relationship is one of mutual instrumentalization based on strategic necessity. Russia and China are a mutually important resource to each other to achieve their respective strategic objectives, diminish the West, and expand significant partnerships in the Global South. Russia cannot achieve its ambitions without China, whereas China has options. China’s starting point is its long-standing perception that the West is pursuing a containment strategy in the Indo-Pacific and beyond to halt China’s rise pushing Beijing to reinvest the Eurasian dimension of its policy17. Supporting Russia serves President Xi’s objective of expanding China’s “circle of friends”, both in the Global South and elsewhere.

Second, the relationship is largely an externally determined one that is underpinned by personal ties between the two presidents. For Russia, the deepening rift with the West has driven it towards China. Equally for China, its rivalry with the United States has pushed it to back Russia. Both states share a common enemy, which they believe stands in the way of achieving strategic objectives, exemplified, inter alia, by NATO expansion and the creation of AUKUS and QUAD respectively. Both China and Russia perceive the United States as a hegemonic power and a homogenizing political force imposing its system of governance and Western liberal norms by promoting them as international.

Third, China and Russia recognize each other’s security interests. In addition, presidents Putin and Xi have a clear personal rapport and reportedly share a common worldview (authoritarian solidarity, and a strong sense of anti-Westernism). There were no signs of strain at their May 2024 meeting, only mutual friendship on full display. Beijing frequently echoes the Russian narrative on European security architecture. In a phone call with Secretary of State Blinken shortly before the war, China's foreign minister Wang Yi urged the West to “form a balanced, effective and sustainable European security mechanism through negotiations, with Russia’s legitimate security concerns being taken seriously and addressed”18, a view also reflected in China’s 12-points position paper on the “Ukraine crisis”.19 The need to “address the legitimate security concerns of all sides” has since been reiterated at all occasions, including in President Xi’s article in Le Figaro on the eve of his visit to France in May 2024.20

Fourth, the alignment is flexible and non-committal, with both sides refraining from any binding obligations. This is a deliberate policy choice: the non-formalized and non-hierarchical nature of the alignment between these two autocratic states is important for Russia, which is trying to retain strategic autonomy vis-à-vis China. It wants to be able to develop close ties with other states in the Asia-Pacific, notably India (but also Vietnam, Myanmar, the DPRK), irrespective of Chinese concerns. Doing so enables Moscow to strengthen its position vis-à-vis China and engage in so-called ‘friendly balancing’.

While China’s partnerships with third countries are always non-committal and flexible to be able to respond to changes in the geopolitical environment, Russia has a unique role in the hierarchy of partnerships China has built21 It belongs to President Xi’s close “circle of friends”, a policy framework that creates a hierarchy in China’s relations with its partners. To date, the only full alliance China has is with the DPRK, and this commitment is today criticized in China.

In their joint statement of 4 February 2022, China and Russia upgraded their trust and deepened the level of cooperation, yet did so without creating obligations. In it, they “re-affirm that the new inter-state relations between Russia and China are superior to political and military alliances of the Cold War era. Friendship between the two states has no limits, there are no ‘forbidden’ areas of cooperation […]”.22 This was solemnly re-affirmed in Moscow in March 2023 when the two presidents signed the “Joint Statement on Deepening the Comprehensive Strategic Partnership of Coordination for the New Era” and again in May 2024 in Beijing with another detailed Joint Statement, celebrating 75 years of diplomatic relations (between the now-defunct Soviet Union and the People’s Republic of China).

Finally, despite its apparent strength the alignment contains several vulnerabilities. Its foundations are fragile; social and cultural ties between the two peoples remain limited and are being compensated for by close personal relations between the two presidents. If the exogenous factors underpinning the alignment change, then the strategic necessity for the alignment is likely to diminish. Russia fears that China’s calculations may change (depending on the West’s policies) and could result in it abandoning Russia. Moreover, a deep-seated mistrust of each other’s motives has not fully disappeared. For example, Moscow’s “pivot to the East” is accompanied by domestic prioritization of Russia’s Far East. The social and economic development of these areas is being treated as of urgent, betraying a degree of anxiety. The underdeveloped, depopulated Far East could be potential prey for the fast-rising superpower across the border. Recently leaked documents revealed Russia’s war gaming scenarios for a nuclear war with China, exposing long-standing fears.23

Another often-cited vulnerability is the relationship’s growing asymmetry, with Russia becoming a junior partner or China’s vassal. However, Beijing’s support for Russia indicates its interest in strengthening rather than diminishing Moscow. As Stephen Kotkin noted, only China decides whether a country becomes a vassal and by doing so assumes the burden of responsibility.24

For Moscow, failure to confront the West including by not losing the war is an existential threat whereas accommodation with China is not. Moreover, Russia is trying to instrumentalize China vis-à-vis China itself. Using China to win the war in Ukraine is essential to push back at the West but also to boost its own position vis-à-vis China and ultimately rebalance their relationship. For this to work, Russia has to increase its value to China so we can expect it will step up military-security cooperation, helping China develop naval and strategic nuclear capabilities. Russia would also like the US-China relationship to deteriorate further. Ideally for Russia, US-China tensions should evolve into open confrontation, strengthening their alignment, binding US resources and potentially dividing the West.

4. The China-Russia alignment poses a threat to European security and stability

Together, China and Russia aspire to thwart Western unity and develop the capabilities to pose a formidable threat to transatlantic security. China has become a critical enabler of Moscow’s war effort, with an immediate impact on the battlefield.

By extension, it is impacting European security in four main dimensions:

- China-Russia trade and financial flows

- the provision of critical dual-use goods from China to Russia

- coordinated non-conventional security threats

- military and security cooperation

The United States and its European partners need to develop mechanisms to better coordinate their approaches. Disunity is a vulnerability that both China and Russia are keen to exploit. Here, we examine the nature and the extent of the threat from the Russo-Chinese alignment to the EU and the United States.

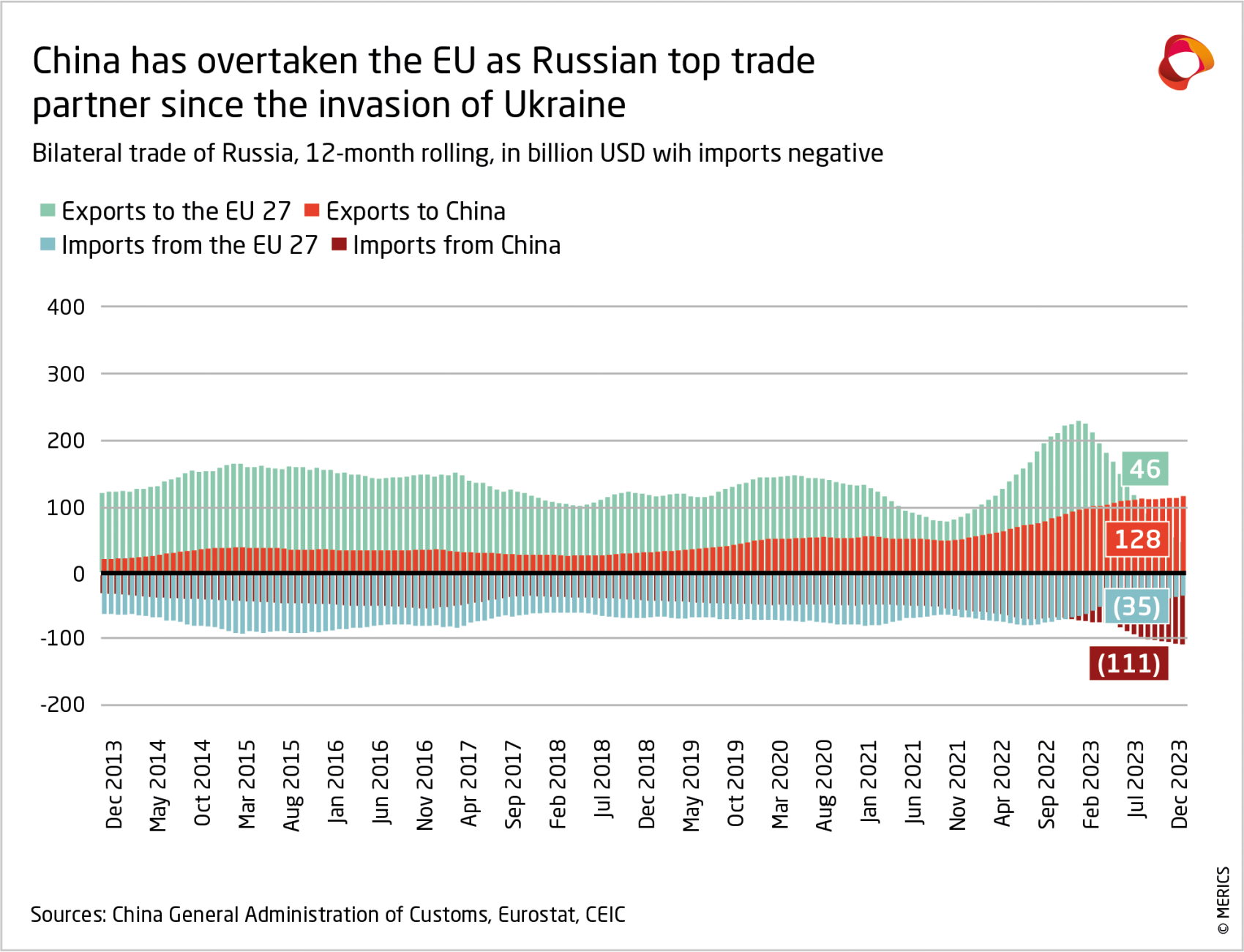

4.1 The growth and dynamism of China-Russia trade and financial flows gives Russia major support at a critical juncture in its war on Ukraine

In 2023, bilateral trade between China and Russia hit a record high of USD 240 billion, up 26.3 percent on the previous year.25 Moscow is moving towards a strong dependence on China’s economy. China is Russia’s fastest growing export destination, and China’s exports to Russia have surged to substitute for goods from Europe and other sanctions partners.26

The value of Chinese exports to Russia in 2023 was USD 111 billion, which was comparable to Chinese exports to the Netherlands and to Vietnam. China is the only large, industrialized country which continues to trade in unlimited ways with Russia. Sanctions and shrinking trade with the EU and the US makes trade with China vital for Russia’s economy to survive the impact of the war.27 But there are important areas which do not show any dynamic development28: Chinese investments in Russia were minor and have diminished. Beijing is happy to displace Western premium goods, but it is not interested in developing Russia as a competitor in high tech areas.29

Fossil fuel trade remains the backbone of the economic relationship, but without the necessary infrastructure to increase volumes fast. There is currently only one oil pipeline (the Siberia-Pacific Ocean Oil pipeline, 2012), which exports some 35 million tons annually to China. The only gas pipeline (Power of Siberia pipeline of 2019) is projected to export up to 38 billion cubic meters of gas per year to China by 2025 (well more than double 15.5 billion cubic meters in 2022)30. Negotiations continue on the construction of a Siberia Power 2 pipeline from the Arctic Yamal peninsula to China via Mongolia, but it is not certain that China wishes to invest in such a huge fossil fuel infrastructure project. Russian arms exports to China were strong but have been steadily shrinking since 2018.31 IT cooperation has also shrunk significantly because Chinese IT companies fear US secondary sanctions. China’s currency and part of its financial infrastructure have replaced Western financial institutions. Russia’s trade with China is conducted mostly in yuan, but Russia continues to rely on US dollars in trade with other states. Russian foreign minister Sergei Lavrov announced on 22 April 202432 that Russia and China had almost completely replaced the dollar using their national currencies. However, larger Chinese banks tend to avoid getting involved, for fear of US secondary sanctions.

4.2 China has become a key provider of critical dual-use goods to Russia

An important distinction needs to be made between lethal and non-lethal equipment. The Chinese leadership has been consistent since the start of the war in not providing lethal weapons to Russia, as the US and Europe have drawn a strong red line here. Arms exports would risk a significant escalation of tensions. China is likely to continue respecting this red line, given the high stakes in maintaining access to its largest export markets in the EU and the US.

However, China has ramped up exports of critical high technology products to Russia,33 which could potentially be used militarily. It is therefore important to assess to what degree China’s exports of listed dual-use goods to Russia constitute a circumvention of Western sanctions and a crucial support for the Russian war effort. The high proportion of exports of machine tools from or via China are of key importance as they help Russia manufacture military equipment.

Publicly available Chinese customs data suggest that China is exporting more than USD 300 million worth of dual-use products each month that are identified by the EU, US, UK and Japan as “high priority” items for weapons’ production, including in rockets and drones. These sales reached a peak of USD 600 million in December 2023.34 Overall, trade experts estimate on the basis of IMF data with Russian trade figures that out of the total Chinese exports since the invasion, over a third were products on the EU’s restricted lists (dual-use and advanced technology products as well as economically critical goods, in addition to the high priority items). Chinese exports of EU-restricted goods to Belarus, Armenia, Central Asian states and Turkey have also significantly increased. These are Russia’s other fastest growing import sources,35 used to circumvent sanctions.

Russian customs data for 2022 show that the bulk of these exports were not products made in China: they were produced in third countries for US and EU companies and transferred via Chinese trading companies. China has thus become the most important platform for Russian imports of Western dual-use goods.36

Russia is undertaking its most ambitious defense industry expansion since the Soviet era, at a much faster pace than expected. According to US estimates,37 Russia uses machine tool shipments from China to bolster ballistic missiles production and microelectronics which are used in the production of Russian missiles, tanks and aircraft. In 2023, up to 90 percent of Russia’s microelectronics imports were reported as coming from China, including military optics for tanks and armored vehicles. That year, 70 percent of Russia’s imports of machine tools from China were estimated to be destined for producing ballistic missiles. Chinese drone engines were also used to propel Russian military drones. This assessment largely coincides with the Yermak-McFaul International Group’s findings that China is the source of more than 80 percent of imported microchips (mainly of Western production) used in Russian weapons, including in missiles, and a crucial supplier of critical military drones’ components for Russia.38

China’s significant exports of dual-use goods, materials, components, and machine equipment enable Russia to expand armaments production. This constitutes an indirect threat to European security by making a difference on the battlefield. Dual-use exports give crucial support to the Russian’s military capacity and prolong the war. To end the war in Ukraine, China must be persuaded that it is in its own long-term interest to stop helping Russia to reconstitute its military industrial base.

China remains ambivalent as it neither wishes to lose its most important economic partners, nor for Russia to lose the war. However, China’s room for ambivalence is now being squeezed. EU leaders raised China’s support for Russia circumventing sanctions explicitly at the last EU-China summit in Beijing in December 2023. The matter was also raised by German Chancellor Olaf Scholz and US Secretary of State Blinken during their Beijing meetings with President Xi in April 2024. French President Macron declared on 6 May 2024 that President Xi had made a commitment to abstain from selling any arms to Moscow and to “control strictly the exports of dual-use goods”39 during his visit to Paris.

None of these appeals have led to any change in China’s behavior towards exports of critical dual-use items. Consequently, the United States and the EU decided in February 2024 to list a few Chinese companies (mainland and Hong Kong) and third country firms40 in new sanctions against Russia. More such listings are likely to be decided in the near future. By doing so, EU/US companies are forbidden to trade high risk critical dual-use goods with these companies. Blocking such dual-use product supply channels is challenging and requires targeted law enforcement in the sanctioning jurisdictions against any companies involved, combined with export controls (i.e., end-use certificates). Effective cooperation with countries where companies are circumventing sanctions will be needed, which may also require evidence-sharing.

4.3 Russia and China are pursuing below threshold, grey zone operations

The war in Ukraine has also put the spotlight on Russia-China joint intelligence cooperation, influence operations, cyber-attacks in Europe.

In the information domain, China has given Russia a considerable boost by amplifying its war narrative and adding to its credibility and outreach, particularly in the Global South. By blaming the war on the “expansion of NATO”, “Western imperialism” and “double standards”, both Russia and China have undermined global solidarity towards Ukraine’s independence, sovereignty, and territorial integrity.

China’s security operations have turned more towards Europe, including for military technology purposes and political influencing. Intelligence-gathering coordination between Russia and China is growing. It builds on already existing industrial espionage, and on Russian’s military intelligence gathering and political information influencing. Chinese spying activities intersect with Russian networks that have penetrated the EU’s extreme political parties on the far right and far left. In May 2024, German police arrested a parliamentary assistant of the lead candidate of the far right party AfD on suspicion of spying for China41. The purpose of both countries’ intelligence operations in Europe is the same: spreading doubts about democracy, creating divisions and thereby gaining influence. “China and Russia have common goals that they jointly promote when this services their interests”, warned Finland’s Security and Intelligence Service in 202342.

Such influencing goes together with increased cyber-attacks, allegedly undertaken by the group “Advanced Persistent Threat Group 31” (APT 31), linked to Chinese intelligence, against individual parliamentarians in several parliaments, most of whom are members of the Inter-Parliamentary Alliance on China (IPAC). Cyber-attacks in 2021 targeted at least five Belgian parliamentarians in the national and European parliaments, including former Prime Minister Guy Verhofstadt 43. The Belgian national parliament asked the state for a criminal investigation and named itself a civil party in the legal pursuit of the hackers.

China’s Ministry of Foreign Affairs has denied any involvement44 and the denial was reflected in the absence of official reactions to EU sanctions on Chinese cyber-attack entities imposed in summer 2021.

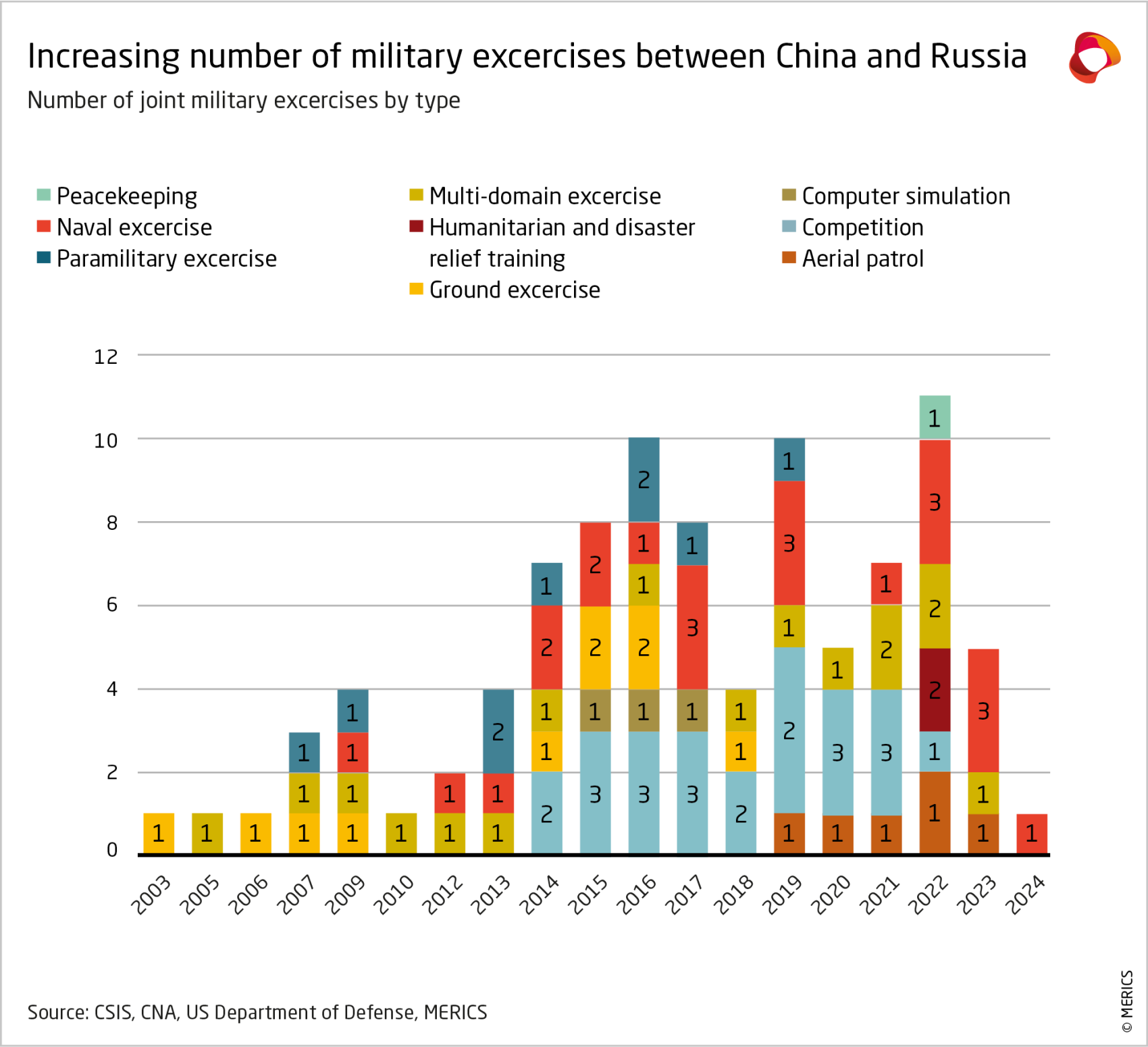

4.4 Growing military cooperation between China and Russia is an evolving threat

While not an imminent threat in Europe, this dynamic must be taken seriously in other regions, in particular the Indo-Pacific. At their May summit, Presidents Putin and Xi agreed to step up military ties, notably by expanding the scale of joint military exercises, more joint maritime and air patrols, and greater cooperation in bilateral and multilateral frameworks. Military cooperation between Russia and China has been steadily increasing, deepening interoperability between the two militaries. There have been joint navy maneuvers (e.g., December 2022 in the East China Sea and in the Gulf of Oman in March 2024 when Iran and Russia joined the “Marine Security Belt 2024” exercise),45 land military exercises (Exercise Vostok in September 2022 in Russia’s Far East, joined by 2000 Chinese troops)46 and cooperation on early missiles warning systems as well as joint patrols in Asia with nuclear-armed bombers47.

Former US Secretary of Defense Robert M Gates warned in 2023 that never before had the country faced four allied antagonists at the same time (Russia, China, North Korea and Iran), whose collective nuclear arsenal could soon be double the size of its own: “Developments in China and Russia matter, and the threats posed by these interconnected countries should be explained”.48

5. Policy recommendations: Responding to the changing nature of the Russia-China alignment

Responding to the multifaceted challenges that the Russia-China alignment poses to transatlantic partners requires a fundamental rethinking of threat perceptions regarding European security, taking into consideration the need for both differentiated and joint (Russian-Chinese) approaches. It also calls for the creation of diplomatic mechanisms for monitoring and addressing evolving threats. Proposed policy recommendations aim at changing China’s calculus regarding the war in Ukraine and more specifically its support for Russia. They take into consideration the complexity of the issue, including economic interdependence, and factor in the risk of inadvertently strengthening the alignment. They are premised, however, on the necessity of ‘doing all it takes’ to restore peace in Europe.

5.1 Redefining the paradigm to reflect threats to European security

The recent trajectory of China-Russia relations, in particular since the war in Ukraine, requires European and US decision-makers to change their understanding of their respective relations to China and develop the capacity to deal with the China-Russia alignment on an informed basis when making decisions. This requires a holistic approach, overcoming specialised and separate thinking on Russia as a security threat and China as an economic competitor.

Europe can no longer afford to ignore the threat that China represents for European security, even though it will remain an important and difficult economic partner, a competitor in many sectors, and a partner in dealing with global challenges. This means considering that China is simultaneously a cooperation partner, an economic competitor, a systemic rival and a threat to European security.

The recognition of China as a security threat will confront EU decision-makers with the difficult choice of how to strike the right balance between the continent’s future prosperity with China as a major economic partner and a crucial one for addressing global challenges, while ensuring increased European security. Europe has gone through several phases in rethinking and defining its engagement with China. China’s continued support for Russia is pushing Europe to enter a new one.

Recognition of China as a security threat along with Russia will create the need to forge an international space for monitoring and responding to the challenges brought by this alignment. The EU will remain an effective forum for European coordination, including with the UK. NATO would need to expand its approach to look thoroughly at these chal-lnges, including in the NATO+4 format (with Japan, Republic of Korea, Australia and New Zealand). The G7+ format will become increasingly important on the economic security and finance-related aspects.

However, any specific decision-making and the conduct of relations with China and Russia will have to be done individually at national level and collectively at EU level. It remains important to maintain the capacity and intent to treat each country differently, taking account of the specificity of each issue, to avoid inadvertently promoting even more “togetherness”.

5.2 Redefining what transatlantic partners can expect on China’s role in ending the war in Ukraine

After two years of calling on China to use its influence to end the war in Ukraine, it must be acknowledged that the transatlantic partners have not been successful and are changing their respective approaches.

Today, China sees the war as long term and has no intention of investing the necessary political capital to play an active role in helping to end it anytime soon unless both parties first make the necessary preliminary steps. The Chinese absence at the Geneva Peace Conference confirmed it. China’s position on the war has not fundamentally changed since it circulated Beijing’s 12-points plan on a resolution to the so-called “crisis”. The gesticulation with the Brazil proposal or Special Envoy Li Hui’s diplomatic tours only aim at signaling that Beijing could play a role if it thought adequate conditions existed. China’s potential role in achieving a ceasefire or participating in Ukraine’s reconstruction could well become relevant someday.

No one should underestimate China’s capacity to change its approach if the time and conditions are right and an opportunity could be seized. No one in Beijing could define what the right conditions might look like today. If such a scenario were to emerge, Europe and its transatlantic partners need to be clear that China should not acquire a stake in any redefinition of Europe’s security architecture. This is for OSCE member states to determine, if and when the moment comes.

At present, Europe and the United States cannot count on China to play a role in ending the war now and have to recognize that China is instead supporting Russia’s war efforts.

The transatlantic partners’ objectives when engaging China today should be two-fold:

- First, to reinforce the message on the avoidance of any nuclear escalation, building on a shared interest with China to ensure Russia’s nuclear threats do not escalate and are stopped. Realistically, Beijing will not do this because Western partners ask, but because of its own national interests.

- Second, invest limited political capital in asking China to play a role in international conferences to bring an end to the war. Beijing will make its own assessment on when to play a role. However, political capital should be invested to raise the costs of China’s support to Russia’s war efforts.

5.3 Considering how to end China’s export of dual-use items

Ending the war includes curtailing China’s growing support for Russia’s war effort. Europe is confronted with a difficult policy choice: either to continue its appeals at the highest levels - thus maintaining the existing red lines and acknowledging that Europe does not intend to use all possible tools to change China’s behavior - or to shift its red lines by increasing the cost to China of exporting dual-use equipment to Russia.

This will not be easy, as it requires measuring the consequences and China’s possible retaliation. Political leadership and courage will be needed as well as working closely with EU companies, key actors in EU-China economic relations, who are often driven by fear of retaliation. They are the first line of defense against sanctions circumvention with their products and hence need to apply due diligence to exports. More action by governments will be needed to ensure this happens.

Expanding restrictive measures to curtail China’s export of dual-use equipment would be a measured and proportionate response and a decision that the EU could take. This would have a direct effect on the companies concerned, including reputational costs.

- Listing all those Chinese/Hong Kong (and other relevant third countries) companies (in the EU: under Annex IV of EU Regulation 833/2014) against which there exists evidence of sanctions’ circumvention by imposing export restrictions towards these companies regarding dual-use goods and technology. These should cover both cases: a) the transhipping of EU origin goods b) the “backfilling” of EU export restrictions with indigenous goods and tech items, thereby contributing to the technological enhancement of Russia’s defence and security sector.

- Combining this with effective law enforcement action inside EU member states’ jurisdictions against firms exporting such goods directly or indirectly towards these third countries’ companies, including through the requirement to provide “end user certificates” under the dual-use export control regulation so as to guarantee no export to Russia, with relevant clauses to be included in commercial contracts.

- Working with G7+ partners to enable the imposition of secondary sanctions against EU companies in third country jurisdictions as well as foreign companies involved in such circumvention, in case prior measures do not lead to curbing circumvention effectively. This is currently only possible under US legislation.

- The EU should also consider creating the possibility of imposing secondary sanctions against financial institutions in third countries that assist Russia in evading EU sanctions. This would mirror the new OFAC49 authority that enables the United States to place a foreign financial institution under sanctions because it is involved in the financing or the payment of trade transactions. This may become the most effective way of stopping such transactions, as the effect of the recent US threat to use this authority on the Chinese financial services sector has shown.50

- In the longer term, when making decisions about the licensing of exports and/or investments of critical technologies under possible new economic security legislation, support for the Russian war effort should become an important factor to consider when determining whether there is a significant national security risk.

European and US decision makers need to be clear that additional listings or sanctions will temporarily push China and Russia closer together. However, the alignment between the two is here to stay and will grow, regardless of such decisions. But after two years of failing in convincing Beijing to curtail its export of non-lethal equipment to Russia, it is time to change the approach in Europe and take measures that can make a difference.

Time is of the essence in ending the war in Europe. To restore peace and stability in Europe, the EU cannot afford to hesitate further on how to end China’s support to Russia’s war efforts through dual-use equipment. It must do this in lockstep with its closest partners.

- Endnotes

1 | The term “West” is used in this text not as a strict geopolitical notion, but broadly including the EU and its member states, transatlantic partners in NATO, as well as likeminded partners, such as Japan, the Republic of Korea, Australia and New Zealand

2 | Julian Borger, Antony Blinken arrives in China with warning for Beijing over support of Russia, The Guardian, available at: https://www.theguardian.com/world/2024/apr/24/antony-blinken-china-visit- us-secretary-of-state-beijing (consulted on 15 June 2024)

3 | European Commission, Press statement by President von der Leyen following the trilateral meeting with French President Macron and President of the PRC Xi Jinping, 6 May 2024, available at: https://ec.euro- pa.eu/commission/presscorner/detail/en/statement_24_2464 (consulted on 15 June 2024)

4 | European Commission and High Representative of the Union for Foreign Affairs and Security Policy, Joint Communication to the European Parliament, the European Council and the Council, “EU – China - A strategic outlook”, 12 March 2019, available at: https://commission.europa.eu/system/files/2019-03/ communication-eu-china-a-strategic-outlook.pdf (consulted on 15 June 2024)

5 | European Council conclusions on China, European Council, 30 June 2023, available at https://www. consilium.europa.eu/en/press/press-releases/2023/06/30/european-council-conclusions-on-chi- na-30-june-2023/ (consulted on 15 June 2024)

6 | Joint Statement of the Russian Federation and the People’s Republic of China on the International Relations Entering a New Era and the Global Sustainable Development, President of Russia, 4 February 2022, available at: http://www.kremlin.ru/supplement/5770 (consulted on 15 June 2024)

7 | See notably: Pascal Abb and Mikhail Polianskii, “With friends like these: the Sino-Russian partnership is based on interests, not ideology”, Zeitschrift für Friedens-und Konfliktforschung, 02 February 2023, vol. 11, pp. 243-254, available at: https://link.springer.com/article/10.1007/s42597-023-00090-2 (consulted on 15 June 2024)

8 | This is further developed in: Kaspar Pucek: ”A Chinese Tributary? The Consequences of Moscow’s In- creased Dependence on Beijing”, Clingendael Alert, June 2024, available at: https://www.clingendael. org/sites/default/files/Alert_The_Consequences_of_Moscows_increased_dependence_on_Beijing.pdf (consulted on 15 June 2024)

9 | China Daily, “Putin: New Multipolar World Order to Replace Unipolar System”, December 5, 2023, available at https://www.chinadailyhk.com/hk/article/364853 (consulted on 25 May 2024).

10 | “RPT China’s imports of Russian oil near record high in March”, Reuters, available at : https://www. reuters.com/business/energy/chinas-imports-russian-oil-near-record-high-march-2024-0420/#:~:tex- t=China’s%20imports%20from%20Russia%2C%20including,the%20General%20Administration%20 of%20Customs (consulted on 15 June 2024).

11 | For some Chinese think tankers like Tian Feilong, it should be looked at as a war against hegemonic power, in which China is positioning itself over a long-term interest.

12 | Ding Xiaoxing (丁晓星), First anniversary of the Russia-Ukraine conflict (俄乌冲突一周年记), China Institute of Contemporary International Relations, 24 February 2023, available at: https://mp.weixin. qq.com/s/xgDwUOn30S4G_fahpbuRmg (consulted on 15 June 2024)

13 | “China’s Position on the Political Settlement of the Ukraine Crisis”, Ministry for Foreign Affairs of the People’s Republic of China, 24 February 2023, available at: https://www.fmprc.gov.cn/mfa_eng/ zxxx_662805/202302/t20230224_11030713.html (consulted on 14 June 2024)

14 | Interviews conducted by the authors with Chinese officials and think tankers between March and April 2024.

15 | CICIR 2024 Global Strategy and Security Risks (全球战略与安全风险), China Institute of Contemporary International Relations, 9 January 2024, available at: http://www.cicir.ac.cn/UpFiles/file/20240109/63 84042948730876441603280.pdf (consulted on 14 June 2024)

16 | Shannon Bugos, “Russia suspends New START”, Arms Control Association, March 2023, available at: https://www.armscontrol.org/act/2023-03/news/russia-suspends-new-start (consulted on 14 June 2024)

17 | Russian-China Dialogue: The 2023 Model, Report Number 87-2023, Russian International Affairs Coun- cil, Institute of China and Contemporary Asia of the Russian Academy of Sciences, Fudan University, October 2023, available at: https://drive.google.com/file/d/1qSyt0PsOmMxe05Aij2Qi7Zbp-7-YYIYq/ view (consulted on 14 June 2024)

18 | http://us.china-embassy.gov.cn/eng/zgyw/202201/t20220127_10635268.htm “Wang Yi Speaks with

U.S. Secretary of State Antony Blinken on the Phone at Request”, Embassy of the People’s Republic of China in the United States, 27 January 2022, available at: http://us.china-embassy.gov.cn/eng/ zgyw/202201/t20220127_10635268.htm (consulted on 14 June 2024)19 | “China’s Position on the Political Settlement of the Ukraine Crisis”, Ministry for Foreign Affairs of the People’s Republic of China, 24 February 2023, available at: https://www.fmprc.gov.cn/mfa_eng/ zxxx_662805/202302/t20230224_11030713.html (consulted on 14 June 2024)

20 | “Full text of Xi’s signed article in French media”, The State Council of the People’s Republic of China, 6 May 2024, available at: https://english.www.gov.cn/news/202405/06/content_WS663814b6c6d-

0868f4e8e6c0a.html (consulted on 14 June 2024)21 | For more on the nature of China’s partnerships and alliances: Alice Ekman, China and the battle of coalitions – The ‘circle of friends’ versus the Indo-Pacific strategy, European Union Institute for Security Studies, May 2022, available at: https://data.europa.eu/doi/10.2815/815557 (consulted on 14 June 2024)

22 | Joint Statement of the Russian Federation and the People’s Republic of China on the International Relations Entering a New Era and the Global Sustainable Development, President of Russia, 4 February 2022, available at: http://www.kremlin.ru/supplement/5770 (consulted on 15 June 2024)

23 | “How Russia war-gamed a Chinese invasion”, Financial Times, 28 February 2024, available at : https:// www.ft.com/content/758ff1ca-6ac1-4188-9b61-c514638447b1 (consulted on 15 June 2024)

24 | Stephen Kotkin, “The Five Futures of Russia”, Foreign Affairs, May/June 2024, available at: https:// www.foreignaffairs.com/russian-federation/five-futures-russia-stephen-kotkin (consulted on 14 June 2024)

25 | AFP, “China, Russia Trade Soared In 2023 As Commerce with US Sank” , in: Voice of Asia, 12 January 2024, available at: https://www.voanews.com/a/china-russia-trade-soared-in-2023-as-commerce-with- us-sank-/7437001.html (consulted on 15 June 2024)

26 | Janis Kluge, “Russisch-chinesische Wirtschaftsbeziehungen – Moskaus Weg in die Abhängigkeit”, Stiftung Wissenschaft und Politik (SWP), 6 December 2023, 40 pp., available at: https://www.swp-ber- lin.org/publikation/russisch-chinesische-wirtschaftsbeziehungen (consulted on 15 June 2024)

27 | Agathe Demarais , “The China-Russia trade friendship may not be quite what you think”, Finan- cial Times, 23 April 2024, available at: https://www.ft.com/content/4bc0973c-c1f3-4df7-821d-

0c262e506bb8 (consulted on 15 June 2024) . According to Janis Kluge, ibid: 35 % of Russian imports came from China in the first half of 2023. More than half of Russia’s imports were related to machine equipment (23%), vehicles (19%) and electronics (15%). The most important exports of Russia were raw materials: fossil fuels (74%), metals/iron ore (10%) and wood (4%); see also Joe Lehay, Kai Waluszewski, Max Seddon, “China-Russia: an economic ‘friendship’ that could rattle the world”, Financial Times, 15 May 2024, available at : https://www.ft.com/content/19eb54ba-f6f7-48ba-a586- b8a113396955 (consulted on 15 June 2024)28 | Janis Kluge, ibid, pp.11-20

29 | Vladimir Milov: “Xi Factor: Vladimir Milov on why China won’t help Putin to succeed”, The Insider, 11 January 2024, available at: https://theins.press/en/opinion/vladimir-milov/268238 (consulted on 15 June 2024)

30 | Janis Kluge, ibid, pp. 14-15

31 | Brian Hart et.al.: “How Deep are China-Russia Military ties”, CSIS, China power Project, 9 November 2023, available at: https://chinapower.csis.org/china-russia-military-cooperation-arms-sales-exercises/ (consulted on 15 June 2024) as quoted in: Janis Kluge, ibid, p.16, Fn. 70

32 | Bloomberg news, 22 April 2024: “Lavrov Says Russia, China Almost Dedollarized Their Trade”, available at : https://www.bloomberg.com/news/articles/2024-04-22/lavrov-says-russia-china-almost- dedollarized-their-trade-tass (consulted on 15 June 2024)

33 | For a good overview, see Nathaniel Sher: “Behind the Scenes: China’s Increasing Role in Russia’s De- fense Industry”, Carnegie Russia Eurasia Center, 6 May 2024, available at: https://carnegieendowment. org/russia-eurasia/politika/2024/05/behind-the-scenes-chinas-increasing-role-in-russias-defense-in- dustry?lang=en (consulted on 15 June 2024)

34 | For a good overview, see Nathaniel Sher: “Behind the Scenes: China’s Increasing Role in Russia’s De- fense Industry”, Carnegie Russia Eurasia Center, 6 May 2024, available at: https://carnegieendowment. org/russia-eurasia/politika/2024/05/behind-the-scenes-chinas-increasing-role-in-russias-defense-in- dustry?lang=en (consulted on 15 June 2024)

35 | Nathaniel Sher, ibid; Brian Spegele, “ Chinese firms are selling Russia goods its military needs to keep fighting in Ukraine” , Wall Street Journal, 15.7.2022 (as quoted in Janis Kluge, ibid: Fn. 72), available at: https://www.wsj.com/articles/chinese-firms-are-selling-russia-goods-its-military-needs-to-keep- fighting-in-ukraine-11657877403 (consulted on 15 June 2024)

36 | Janis Kluge, ibid: p.10; Olena Bilousova et.al., « Russia’s Military Capacity and the Role of Imported Components”, Yermak-McFaul International Working Group on Russian sanctions & KSE Institute, Kiyv, 19 June 2023, 32 pp., p. 17; available at: https://kse.ua/wp-content/uploads/2023/06/Rus- sian-import-of-critical-components.pdf (consulted on 15 June 2024) and Olena Bilousova et.al., “Foreign Components in Russian Military Drones”, Yermak-McFaul International Working Group on Russian sanctions &KSE Institute, Kiyv, 23 August 2023 , available at https://kse.ua/wp-content/ uploads/2023/08/230828%20Drones%20for%20KSE%20site.pdf?_t=1693243181 (consulted on 15 June 2024) and Sarah A. Aaruop et.al. “Russia Says China Agreed to secretly provide Weapons, leaked documents Show”, Washington Post, 13.04.2023, available at https://www.washingtonpost.com/na- tional-security/2023/0413/russia-china-weapons-leaked-documents-discord/ (consulted on 15 June 2024) as quoted in Janis Kluge, ibid, Fn. 74

37 | AFP, “China supporting Russia in massive military expansion, US says”, The Guardian, 12 April 2024, available at: https://www.theguardian.com/world/2024/apr/12/china-supporting-russia-in-mas-

sive-military-expansion-us-says (consulted on 15 June 2024)38 | Olena Bilousova et.al., « Russia’s Military Capacity and the Role of Imported Components”, ibid. p.17; see also on drones: Olena Bilousova et.al., “Foreign Components in Russian Military Drones”, ibid. p.5

39 | Joint Press Conference of President Macron with President Xi Jinping, Paris, 7 May 2024, available at : https://www.elysee.fr/front/pdf/elysee-module-22682-fr.pdf (consulted on 15 June 2024)

40 | EU Council of Ministers press release, “Russia: two years after the full-scale invasion and war of ag- gression against Ukraine, EU adopts 13th package of individual and economic sanctions”, 23 February 2024, available at: https://www.consilium.europa.eu/en/press/press-releases/2024/02/23/russia-two- years-after-the-full-scale-invasion-and-war-of-aggression-against-ukraine-eu-adopts-13th-package-of- individual-and-economic-sanctions/ (consulted on 15 June 2024)

41 | John Paul Rathbone and Joe Leahy in “’Honeypots’ and influence operations: China’s spies turn to Eu- rope”, Financial Times, 29 April 2024, available at: https://www.ft.com/content/6c115d61-7948-457e- ace9-f65c3cbb6ee9 (consulted on 15 June 2024)

42 | As quoted by John Paul Rathbone and Joe Leahy, ibid.

43 | Louis Colart , “Cyberattaques chinoises: cinq élus belges ciblés, dont l’ex-Premier ministre Verhof- stadt », Le Soir, 29 April 2024, p. 1, available at : https://www.lesoir.be/584233/article/2024-04-29/cyberattaques-chinoises-cinq-elus-belges-cibles-dont-lex-premier-ministre (consulted on 15 June 2024)

. In France similar attacks in 2021 were denounced on 30 April 2024 by Senator Olivier Cadic against five French politicians, describing this as an “act of cyber war”, available at “Espionnage de parlemen- taires par la Chine – question d’actualité au gouvernement n° 0879G, https://www.senat.fr/questions/ base/2024/qSEQ24050879G.html (consulted on 15 June 2024)44 | Reuters, 26 March 2024: “China calls hacking allegations by US, UK ‘political manoeuvring’ , quoting PRC MFA spokesman Lin Jian: “We urge the US and British side to stop politicizing the issue of cyber- security, stop slandering and smearing China and imposing unilateral actions, and stop cyber-attacks against China”, available at: https://www.reuters.com/technology/cybersecurity/evidence-britian-pro- vided-hacking-allegations-was-insufficient-says-chinese-2024-03-26/ (consulted on 15 June 2024)

45 | Stephanie L. Freid: “China-Russia-Iran Maritime Drills Send Signal to West”, Voice of America, 15 March 2024, available at: https://www.voanews.com/a/china-russia-iran-maritime-drills-send-signal-to-west/7529934.html (consulted on 15 June 2024)

46 | Emily Ferris and Veerle Nouwens: “Russia’s Vostok 2022 Military Drills: “Not Size or Tanks, but Con- text”, RUSI commentary, 15 September 2022, available at: https://rusi.org/explore-our-research/publi- cations/commentary/russias-vistok-2022-military-drills-not-size-or-tanks-context (consulted on 15 June 2024)

47 | Janis Kluge, ibid p.15-17; Alexander Gabuev: « Putin and Xi’s Unholy Alliance, Foreign Affairs, 9 April 2024, p. 5, available at: https://www.foreignaffairs.com/china/putin-and-xis-unholy-alliance (consult- ed on 15 June 2024)

48 | Robert M. Gates: “The Dysfunctional Superpower – Can a Divided America Deter China and Russia?”, Foreign Affairs, November/December 2023, published on 29 September 2023, available at: https:// www.foreignaffairs.com/united-states/robert-gates-america-china-russia-dysfunctional-superpower (consulted on 15 June 2024)

49 | US Department of Treasury: Office of Foreign Assets Control

50 | Tarayuki Tanaka and Rintaro Tobita, “ US weighs sanctions on Chinese banks over Russia military support”, Nikkei, 11 May 2024, available at: https://asia.nikkei.com/Politics/Ukraine-war/U.S.-weighs- sanctions-on-Chinese-banks-over-Russia-military-support (consulted on 15 June 2024)

About the authors

Ambassador Natalie Sabanadze is a Senior Research Fellow at the Chatham House Russia and Eurasia Programme. She has been a Cyrus Vance Visiting Professor in International Relations at Mount Holyoke College between 2021–23. Prior to this, she served as head of the Georgian mission to the EU and ambassador plenipotentiary to the Kingdom of Belgium and Grand Duchy of Luxembourg since 2013. From 2005–13, she worked as a senior official at the OSCE High Commissioner on National Minorities in The Hague, where she held several positions including head of Central and South East Europe section and later, head of the Eastern Europe, Caucasus and Central Asia section. Chatham House does not express opinions of its own. The opinions expressed in this publication are the responsibility of the author(s).

Abigaël Vasselier is Director Policy & European Affairs and Head of Program Foreign Relations at MERICS. Previously, she worked as Deputy Head of Division for China, Hong Kong, Macao, Taiwan and Mongolia at the European External Action Service (EEAS). Prior to that, Abigaël was a Policy Fellow and Programme Coordinator at the Asia Programme of the European Council on Foreign Relations (ECFR). She has co-authored the book "China at the gates: A new power audit of EU-China relations" (with François Godement).

Gunnar Wiegand is a Visiting Distinguished Fellow at the German Marshall Fund’s Indo-Pacific Program. He is also a Senior Adviser and Member of the Strategic Board of the European Policy Center and a Visiting Professor at the College of Europe in Bruges, Belgium, and the Paris School of international Affairs (Sciences Po).From 2016 to 2023, Wiegand served as the Managing Director for Asia and the Pacific at the European External Action Service (EEAS). Prior to that, he was the EEAS Director for Russia, Eastern Partnership, Central Asia, OSCE and Northern Dimension (2011–2015), and Director for Russia, Eastern Europe and Central Asia at the European Commission (2008-2011).