German carmakers are placing a risky bet on China

Volkswagen, BMW and Mercedes-Benz have announced further investments in a market that has changed rapidly to their disadvantage, argue Alexander Brown and Andreas Mischer.

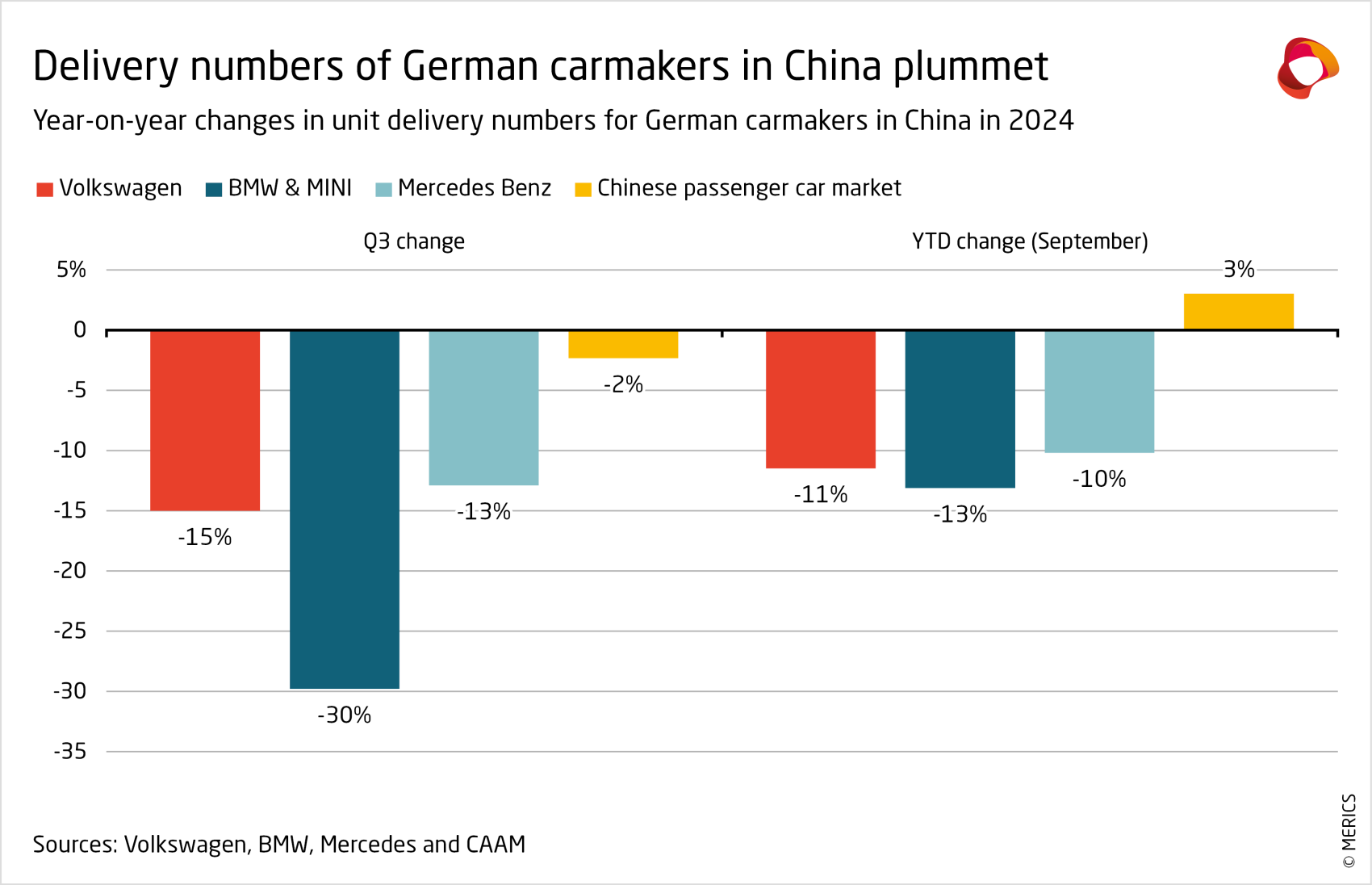

The tide appears to have turned against German carmakers in China. Volkswagen sold a million fewer cars there in 2023 than it did in 2018, representing a 25 percent decline in just five years. The luxury car brands Mercedes-Benz and BMW fared better for a little longer, seeing all-time highs in 2022. But then sales declined in 2023 and dropped sharply in 2024, showing that such strong results were not sustainable. In the first nine months of the year, deliveries by all three companies fell by 12 percent on average, while China’s car market grew by around 3 percent (exhibit 1).

Nevertheless, German car companies have doubled down on the world’s biggest car market, almost the size of the US and Europe combined, by announcing hefty new investments in 2024. Volkswagen and BMW are each pouring an additional EUR 2.5 billion into their Hefei innovation hub and Shenyang production base respectively, while Mercedes-Benz is investing EUR 1.8 billion with its Chinese joint venture (JV) partner BAIC – commitments that come on top of a record EUR 11 billion in new investments in China the trio announced in 2022. The partnerships built with Chinese suppliers and local research and development (R&D) operations are considered key drivers of innovation.

Undoubtedly, China will remain part of the long-term success of German automakers. But the challenges they face in the country will not go away. Their slow start in the electric vehicle (EV) race and Beijing’s support for domestic car makers means that the premium placed on “German engineering” is no longer a given. The trio underestimated China’s rapid shift to EVs and digitalization as well as Chinese competitors’ rapid improvements in quality and innovation. These mistakes are now proving costly.

Against this backdrop, German carmakers should recalibrate their targets for the Chinese market. Relying on future growth in China – especially while considering factory closures in Europe, as VW is doing – could lead them down a slippery slope, given the dismal China sales all three companies have announced so far for 2024. Germany’s car giants should focus on stabilizing rather than expanding their operations in China, freeing up investment to strengthen their competitive position in other markets with better growth prospects.

Foreign market share is shrinking as China’s car market changes rapidly

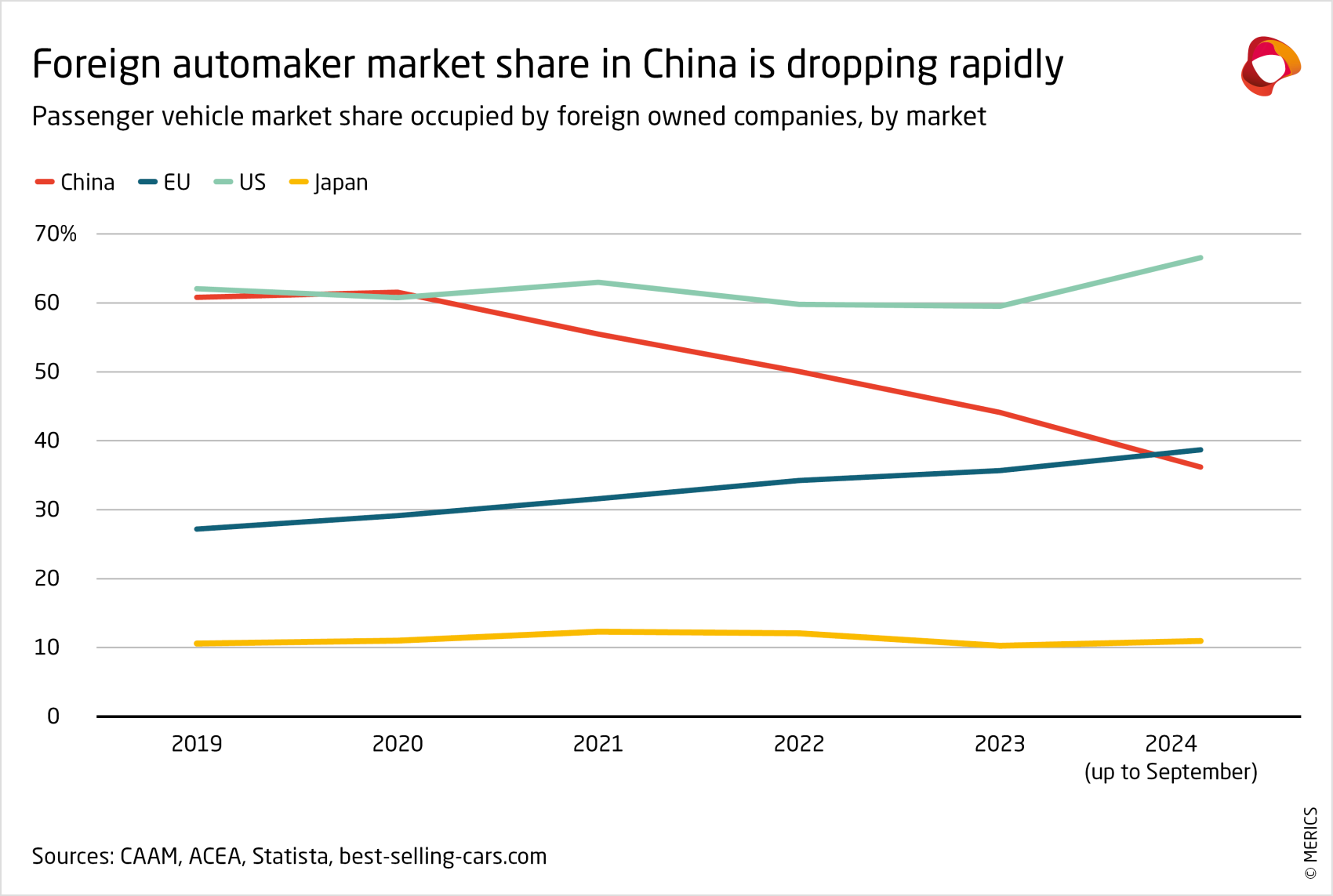

China’s passenger car market is changing rapidly to the disadvantage of foreign players. It is moving away from the US model – where foreign companies make slightly more than 60 percent of all cars sold – to something more like the Japanese model, where domestic manufacturers dominate with a market share of around 90 percent. Given the current trajectory of their sales in China, the market share of foreign car makers looks set to drop to below 20 percent in the next three or four years – a decline of two thirds in under a decade.

The main reason for this is the rapid transition of Chinese consumers to electric and hybrid cars, known in China as new energy vehicles (NEVs). Their share of China’s car market shot up from just 5.4 percent in 2020 to 32 percent in 2023 and hit 39 percent of cars sold from January to September 2024 – and domestic carmakers are meeting most of this demand. SAIC Volkswagen is the only (partly) German company among the top NEV suppliers in China, ranking tenth with a mere 2.3 percent of the market from January to September 2024. With the exception of Tesla, all of the biggest companies are either wholly or partly Chinese owned.

China’s rapid shift to NEVs and the dominance of Chinese manufacturers explain why German carmakers now face an uphill battle in this market. The market share of foreign companies in China has fallen from 62 percent in 2020 to 36 percent in the period of January to September in 2024 (exhibit 2). German carmakers have seen their market share decline from 24 percent to 15 percent. It is hard to see how even several billion euros in additional investment by German carmakers can make a meaningful dent in this trend. Staying on top as the most successful foreign carmakers in China looks like an ambition with dubious benefits.

Chasing the mirage of the Chinese market could ruin German carmakers

But the response of German car executives to growing competition from Chinese players has been as if nothing had changed. They are ramping up research and development and production capacity in the country, as if the answer to their woes in China is simply “more China.” Hoping to benefit from China’s global leadership in NEVs and related technologies such as software, all three major German carmakers are working with Chinese partners – Volkswagen with Xpeng, BMW with Baidu and Mercedes-Benz with Geely.

Behind these moves is the hope that German carmakers will eventually find a way to revive their past success and the hefty profits they made in China. For many years, heavy investment and collaboration with Chinese partners worked to establish a premium position in the Chinese market. But this formula is highly unlikely to continue delivering. The German trio will find it difficult to make up lost ground as Chinese companies are one step ahead in NEVs and enjoy a home market advantage. There is a risk that German carmakers remain overly optimistic about their chances in China.

German carmakers should not pull out of China as a result. But they should recalibrate their expectations to ensure long-term success. Overly ambitious targets in China could lead to a dismal return on investment and undermine their global performance. Instead, companies that fail to satisfy their ambitions might use China as an export base – although rising trade barriers in Europe, the US and elsewhere will raise the cost of this strategy.

Alternatively, they could use their resources more efficiently to strengthen their position in third markets as Chinese competitors are going global. Either way, German carmakers need to find alternatives to the Chinese market. From 2022 to 2023, Volkswagen’s unit deliveries rose by 20 percent in Europe and by more than 15 percent in both North America and South America, while those in China crept up less than 3 percent. The biggest foreign car maker in China is already demonstrating that strong growth in other markets is possible.