Supporting China’s SMEs affected by Covid-19 is crucial to avoid a socioeconomic disaster

The economic shutdown in response to the Covid-19 outbreak has left its impact on the whole of China’s economy, not least its small and medium-sized enterprises (SMEs). Representing the lion’s share of GDP and employment, they are crucial for China’s stability. Beijing has taken steps to cushion the blow for SMEs, but there is no guarantee it will succeed. If these measures fail, China will take a severe hit not only to its economy, but also to its social stability.

The spread of Covid-19 and the subsequent lockdown of virtually all of China’s society and economy has had dramatic and unprecedented consequences. Charts tracking economic indicators across almost every sector have taken a nosedive.

In the first quarter, China’s gross domestic product (GDP) contracted by 6.8 percent. This marks the first time China has recorded negative growth since 1976. The urban unemployment rate has also reached record levels at 6.2 percent. As China slowly returns to pre-virus life, there are signs of an upswing – but with both domestic and global demand struggling, a full recovery is unlikely to happen quickly. Xi Jinping has recently signaled that he wants support for large state-owned enterprises to be ramped up, but meanwhile many of China’s SMEs are buckling under the pressure. If they are left to fail, the contagion effect could be widespread and severe.

SMEs are particularly vulnerable, but vital for China’s stability

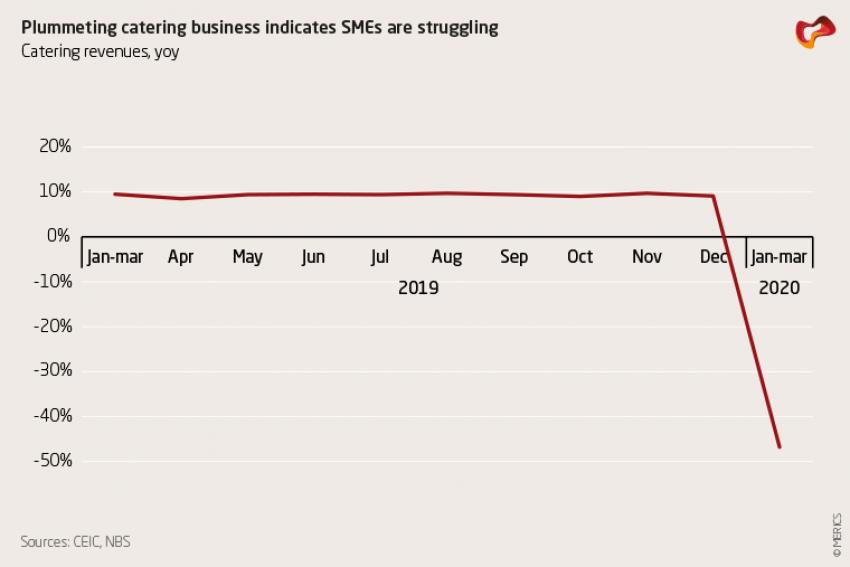

China’s 50 million SMEs – largely active in retail, manufacturing of consumer goods, and food supply – are exceptionally exposed to the devastation caused by the outbreak and the government’s response. Unlike large conglomerates with ample cash reserves, credit lines and government support as protection, SMEs have little shelter from the storm. A recent survey found that more than 85 percent of China’s SMEs could go bankrupt within three months without financial support. China’s catering industry, which is mainly run by smaller companies, has already contracted by 47 percent year-on-year.

By the end of March, almost half a million businesses across China had closed – many in bankruptcy – and new business registrations had fallen by more than 30 percent compared to last year. Most of these companies are SMEs. Unregistered businesses, such as street vendors, are likely hit especially hard.

Getting back to work is an uphill struggle. Xin Guobin, Deputy Minister of Industry and Information Technology, said in March that while over 95 percent of larger companies had resumed operations, only 60 percent of SMEs had followed suit. Although it was reported that the production rate of smaller firms had passed 82 percent by the end of April, the sentiment among SMEs remains pessimistic.

The importance of a speedy recovery for China’s small-scale entrepreneurs cannot be overstated. SMEs account for 80 percent of jobs, 60 percent of GDP and about half of national tax revenue. They are vital drivers of China’s economy, populating the middle class and leading the country’s transition to consumption-based growth. Large-scale liquidations would threaten not only the country’s overall economic performance, but also its social stability.

Support for SMEs is top of the agenda

Beijing has made relief to SMEs a focal point in its battle against the economic damage caused by the Covid-19 outbreak. Within the first ten days after China’s Spring Festival, 600 policies in support of smaller firms were launched – with more in the pipeline. Preferential taxes, cuts in rental and insurance costs, and deferrals in electricity payments are all intended to reduce the liquidity strain on SMEs. However, tweaking operational costs alone will not be enough.

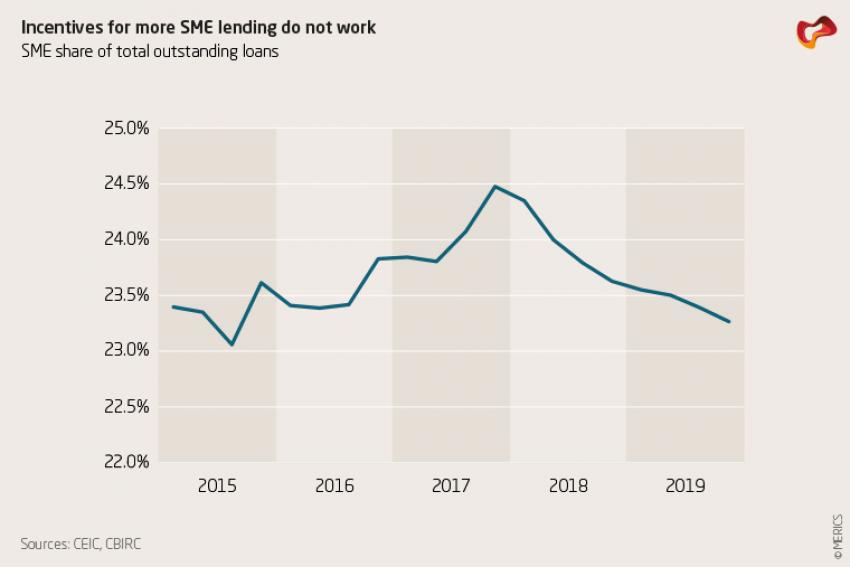

China’s banking industry has been called in, allowing firms to delay loan interest payments whilst increasing lending to SMEs. The People’s Bank of China (PBOC) is providing an incentive by making reserve requirement cuts conditional on targeted lending. It sounds good, but much of this is not new – the authorities started incentivizing banks to support financially stricken SMEs back in 2017, as part of the deleveraging campaign.

Indeed, the Chinese government has sought to strengthen SMEs for years. Competitive neutrality – the equal treatment of all companies, regardless of their ownership and country of origin – and major initiatives such as “Made in China 2025” are all intended to promote the role of small firms, particularly in national innovation chains. Special funds also exist to support innovative SMEs. Yet none of the attempts to get money to distressed SMEs has been particularly successful.

The PBOC has repeatedly called for financial "irrigation" and "inclusion". But banks have become wary of the risks involved in lending to smaller firms. Only 23.3 percent of outstanding loans went to smaller companies at the end of December 2019, down from around 25 percent in 2018. Without financial cushioning and effective state support, SMEs remain chronically underfinanced. They are thus particularly vulnerable to the pandemic and the subsequent lockdown.

If the SME bailout fails, the consequences will be dire

Premier Li Keqiang recognizes the gravity of SME predicament. “Smaller businesses have been hit the hardest […]. Their restart […] affects the entire industrial chain and is vitally important for keeping employment stable,” he said in March. If China’s SMEs go bust, there will be a knock-on effect on the operations of other firms. Many people would lose their jobs and their income streams would dry up, making it difficult to meet their financial obligations. If people cannot pay their mortgages, they could lose their homes. Further social damage in the form of broken families, divorces and suicides could follow. At the very least, domestic consumption would struggle even more to recover. Meanwhile, China’s financial system would be damaged because its banks are directly exposed to the risk of outstanding mortgages and defaulting SMEs. The compound effects on China’s economic, financial, social and – ultimately – political stability would be disastrous.

With an unprecedented crisis of such magnitude, it is impossible for the Chinese government to completely offset the damages. China does not have the same monetary and fiscal power it had during the global financial crisis of 2008, nor does it have a strong social safety net in place. It seems inevitable that SMEs will be left to fend for themselves. The livelihood of many people is at stake – and with the tragedy still unfolding, the government remains under pressure to act.