Manufacturing metrology + Brain-machine tech + Tackling talent shortages

MERICS' Top 5

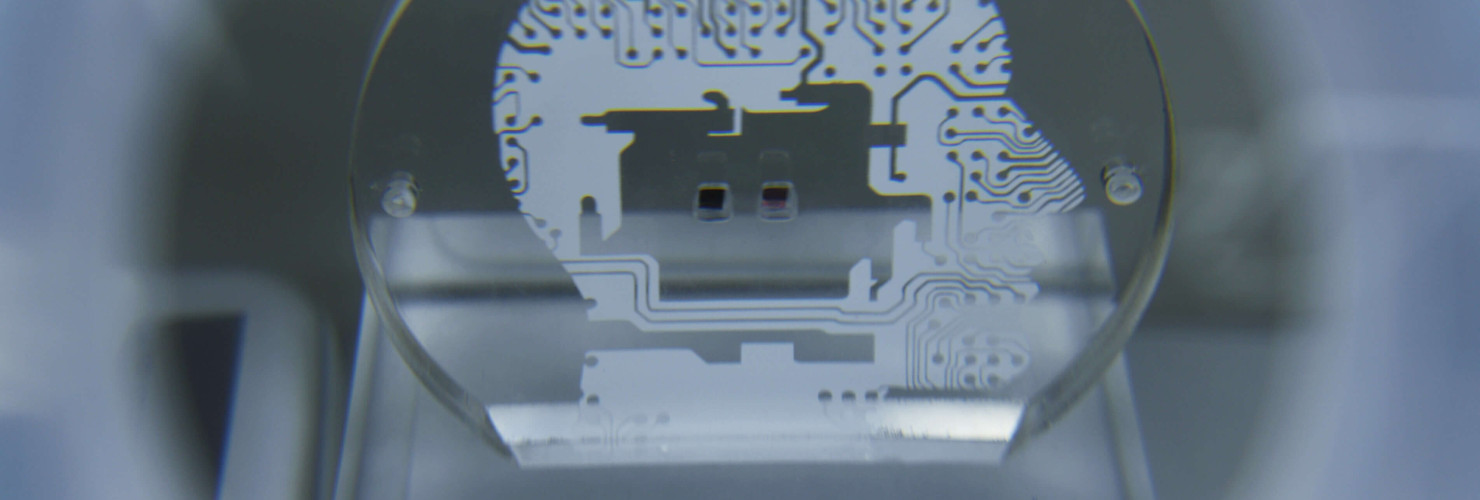

1. Overcoming bottlenecks: China to boost manufacturing metrology

At a glance: The Ministry of Industry and Information Technology (MIIT) published opinions on the development of manufacturing metrology. This subfield of metrology focuses on the industrial application of measurement science. Key goals include:

- Achieve breakthroughs in 100 metrology and calibration technologies, formulate and revise 300 metrology and calibration standards, cultivate 50 high-quality instrumentation enterprises, and establish 10 high-level metrology and calibration technical service institutions within manufacturing industry by 2027

- Address measurement challenges in fields such as quantum mechanics, artificial intelligence, new materials, new energy, advanced manufacturing, and next-generation information technology

- Expand the application of metrology in manufacturing, e.g., by encouraging service institutions and other relevant organizations to offer companies “one-stop” solutions

MERICS comment: Manufacturing metrology involves machine accuracy, component inspections, and validating manufacturing processes to guarantee products conform to specifications. For instance, quality control relies on metrology systems such as coordinate measuring machines and optical inspection systems, while atomic force microscopy systems can measure surface structures at nanometer resolution. Manufacturing metrology is therefore a foundational technology that is fundamental for manufacturing industry, despite a modest market size of USD 1.2 billion in China in 2024.

These opinions are the latest of many recent policies in this area, suggesting China is determined to tackle any deficiencies in the sector. According to state media, standards updates still lag technological advancements; high-end instrumentation and core components are reliant on imports; China does not have enough influence on international standard-setting; and there is a mismatch between the supply of metrology equipment and industry demand. Moreover, China’s local supply ratio for metrology systems for chip tools is reported to be as low as 2.4 percent.

Yet, the opinions carry risks for European companies. If China succeeds in cranking up its metrology manufacturing industry, it may challenge the business of such large multinational companies as Zeiss and Jenoptik. It is also likely to have an impact on smaller hidden champions that are market leaders in their fields, but less accustomed to international competition. For example, the state of Thuringia in Germany boasts a number of hidden champion metrology companies that could be impacted.

Article: Opinions on the Innovation and Development of Manufacturing Metrology (工业和信息化部关于制造业计量创新发展的意见) (Link)

Issuing body: MIIT

Date: June 13, 2025

2. Psychic powers: China strives for leadership in brain-machine tech

At a glance: Seven government agencies led by the MIIT released directives to promote the brain-computer-interface (BCI) sector. The technology translates brain signals into actions, enabling people to control external devices like a computer cursor or robot arm using thoughts. China’s government has set multiple targets for 2027:

- Accelerate the application of brain-computer interface products in industrial manufacturing, healthcare, and consumer life

- Enhance the performance of electrodes, chips, and complete devices to internationally advanced levels

- By 2030, Beijing aims to cultivate two or three leading companies in the field, and for China’s BCI industrial ecosystem to be among the best in the world

MERICS comment: Beijing’s state planners regard BCI technology as a key future industry, with potential applications in healthcare – helping with rehabilitation, diagnosis and treatment – as well as industrial and consumer uses. BCIs could guide robots in hazardous settings such as mines or nuclear plants. Officials even envisage consumer products, from helmets to headphones, that monitor drivers’ alertness to cut traffic accidents.

China is moving quickly in this nascent field. In March, its Center for Excellence in Brain Science and Intelligence Technology implanted the country’s first wireless invasive BCI in a tetraplegic patient, making China the second country after the United States to run a clinical trial of such technology. Regulators have gone so far as to issue pricing guidelines for invasive and non-invasive BCIs, although no invasive (i.e., involving a surgical procedure) BCI devices are yet approved for sale anywhere in the world.

The United States remains the front-runner, with venture capital-backed firms such as Neuralink, Paradromics and Synchron bringing invasive BCIs into clinical trials. However, China’s state-directed efforts may soon narrow the gap. In particular, China’s vast manufacturing sector and consumers’ willingness to embrace new technologies may prove helpful for scaling up industrial and consumer applications. Europe lags behind in product development but boasts world-class academic research in non-invasive BCIs, and some innovative firms like MindMaze and CorTec. Policymakers in Europe still have some (though not much) time to back local players and promote indigenous standards before others dominate the market.

Article: Implementation Opinions on Promoting Innovation and Development of the Brain-Computer Interface Industry (七部门关于推动脑机接口产业创新发展的实施意见) (Link)

Issuing bodies: MIIT, NDRC, MOE, NHC, SASAC, CAS, NMPA

Date: July 30, 2025

3. State Council tackles talent shortages, while getting China’s workforce future-ready

At a glance: The State Council released guiding opinions on training to improve the vocational skills of China’s labor force. The opinions encompass many sectors and talent groups and cover 2025-2027. Key features include:

- Carry out subsidized training for more than 30 million people, focusing on advanced manufacturing, digital economy, low-altitude economy, transportation, agriculture, and the life services industry (such as elderly care services or housekeeping)

- Facilitate training for different parts of the labor force, namely employees, college graduates and other young people, and migrant workers

- Implement these measures, for instance using large companies as training hubs, giving a greater role to vocational colleges, standardizing the evaluation of vocational skill levels, and better supervision of the use of employment subsidies

MERICS comment: The central ambition in the guiding opinions is to address current skill shortages in high-demand fields, such as advanced manufacturing and the digital economy, while providing China’s labor force with the technical skills for ongoing and future changes. Recent data illustrates the severity of the problem. In the New Energy Vehicle (NEV) industry, the talent shortage is projected to exceed one million in 2025, with a supply-demand ratio of only 0.38 in the subsector of intelligent driving engineering. Similarly, China’s artificial intelligence sector lacks more than five million staff, and the semiconductor industry talent gap is forecast to pass 300,000 in 2025.

The opinions have some promising elements. Their focus on vocational colleges and the establishment of micro courses, as well as employment-focused training programs, could help bridge the skills gap between fresh graduates and what companies need. It is positive that 23 out of 32 new higher education institutions approved in May were vocational colleges. However, success will rest on how the opinions are implemented. Important details remain vague. For example, the budget for subsidies for training over 30 million people was not specified nor how the training will be financed.

Finally, some European companies, such as Volkswagen and Voith, already offer vocational training in China to alleviate talent shortages that they face. Foreign companies could benefit from this policy as it targets several fields where they are active, such as advanced manufacturing, biomedicine, or aerospace. However, this does not change the broader trend towards a worsening China-market outlook for many foreign-invested companies because of China’s drive for self-reliance.

Article: Guiding Opinions on Carrying out Large-Scale Vocational Skills Enhancement Training (国务院就业促进和劳动保护工作领导小组关于开展大规模职业技能提升培训行动的指导意见) (Link)

Issuing body: State Council

Date: July 15, 2025

4. Money matters: China aims to refine financing for manufacturing upgrades

At a glance: The People’s Bank of China published new guidance on using financial tools to support the manufacturing sector and “new industrialization”, (meaning boosting industrial output via innovation and digital/green technologies, rather than capital and labor inputs). The policy aims to strengthen industry while managing financial risks and avoiding excessive investment. Some of the key goals for 2027 include:

- Support R&D and the commercialization of R&D outputs, including through the expansion of long-term capital investments

- Promote the transformation of traditional industries and help strengthen future or emerging industries

- Establish, and improve, a mechanism for coordinated risk prevention and control, strengthen credit risk management, improve monitoring of fund use, and help curb excessive competition

MERICS comment: While not an overhaul of China’s economic model, these policies demonstrate a growing focus on efficiency among policymakers. The policy shows China remains committed to the long-standing strategy of broad-based support for its manufacturing sector. Going forward, the financial system will still be tasked with helping firms to move up the value chain, upgrade production processes and increase industrial supply chain resilience. However, the guidelines put a new emphasis on the need to address some of the structural weaknesses of this approach.

Local governments and state-run banks have overdelivered on party-state goals that back certain industries, resulting in rapid growth but also overcapacities and falling profitability. Also, due to poor coordination, resources often overlap, so firms have incentives to double-dip on state financing. New draft guidelines for the management of government guidance funds now call for greater coordination between central and local funds to enhance concentration in certain areas.

Tackling the identified weaknesses will be a challenge, as officials need to balance competing targets on growth, jobs and financial stability. This often leads them towards the leadership’s most repeated priorities, which are advancing industrial upgrading while maintaining employment. Any real progress may require direct intervention from the central government, or a significant rebalancing of performance criteria for local officials. If this adjustment is successful, it will improve the efficiency of Chinese industrial policy. And it will continue to create ever greater competitive pressures for European industry.

Article: Guiding Opinions on Financial Support for New Industrialization (中国人民银行等七部门联合印发《关于金融支持新型工业化的指导意见》) (Link)

Issuing bodies: PBoC, MIIT, NDRC, MOF, NFRA, CSRC, SAFE

Date: August 5, 2025

5. Leveling up: Policymakers push for digital upgrades to machinery sector

At a glance: The MIIT and other agencies released a plan to advance the digitalization of the machinery industry. Its primary task is to accelerate high-end, intelligent, and green industrial transformation. The goal is to reduce production costs, improve production speed and further advance China’s industrial self-reliance. By 2027, officials are expected to:

- Expand the application of digital and smart technologies to product R&D and design, manufacturing, operations management, and maintenance services

- Increase the proportion of enterprises with smart manufacturing capability maturity, at level two or above, to 50 percent and establish at least 200 outstanding smart factories

- Accelerate the deployment of smart equipment in machinery, logistics, mining, rail, and agriculture, engineering equipment and other sectors

MERICS comment: China’s machinery industry has surged over the past decade, eroding one of Europe’s traditional industrial strongholds. Value-added output in the country’s electrical machinery and equipment sector grew by an average of ten percent a year between 2015 and 2024. Since 2020, China’s machinery exports have outstripped Germany’s. European firms now face intensifying competition, not only in China but also on their home turf and in third markets. The Chinese formula – sinking vast sums into capacity before launching products and tolerating losses in pursuit of market share – has proved formidable. A drive to digitalize Chinese factories could make that challenge even fiercer.

The plan’s broader goal of using digital equipment to fast-track industrial upgrading may be difficult to achieve. A decade ago, policymakers placed smart manufacturing at the heart of their “Made in China 2025” plan. Yet, according to data collected by the China Electronics Standardization Institute, the 43 percent of companies in China are still only at the planning stage (level 1) for adopting smart manufacturing practices, 31 percent are in the basic implementation stage (level 2) and only seven percent are in advanced adoption stages (levels 4 or 5).

Still, digital upgrades to China’s machinery industry bring risks from heightened competition and Chinese overcapacity for Europe. These are likely to affect large firms and small and medium-sized enterprises (SMEs). Policymakers should step up their monitoring of the effects, especially for SMEs where impacts are more likely to be overlooked otherwise.

Article: Implementation Plan for Digital Transformation of the Machinery Industry (工业和信息化部等八部门关于印发《机械工业数字化转型实施方案》的通知) (Link)

Issuing bodies: MIIT, MOT, NHC, MARA, MOHRSS, MOHURD, MEM

Date: August 1, 2025

Noteworthy

Policy news

- June 11: The MIIT and the National Development and Reform Commission (NDRC) issued a notice on the cultivation of biomanufacturing pilot capacity building platforms, which are supposed to help with the commercialization of biotech R&D results. The goal is to establish at least 20 such platforms and create more than 400 different products by 2027. (MIIT notice)

- June 13: The MIIT released administrative measures for science and technology enterprise incubators, which help startups with issues including financing, market expansion, or technical support to promote the transformation of scientific and technological achievements into industrial products. The measures differentiate between standard incubators and excellent incubators and set different conditions for organizations on each tier. (MIIT notice)

- June 20: The MIIT and five other departments invited companies to apply for the 2025 round of “smart factory gradual cultivation action”. This program is designed to select smart factories divided into four tiers: basic, advanced, excellent, and pilot. Pilot level factories are expected to lead globally in advanced manufacturing and explore future manufacturing models. (MIIT notice)

- June 23: The MIIT and the Ministry of Agriculture and Rural Affairs (MARA) released instructions to collect typical cases of innovation and development in the non-grain bio-materials industry. Typical cases should focus on household plastic products, engineering plastic products, agricultural film plastics, biomedical materials, and food packaging materials. (MIIT notice)

- July 1: The National Health Insurance Administration (NHIA) and the National Health Commission (NHC) published measures to promote the development of innovative drugs, aiming to incorporate more innovative drugs into China’s basic medical insurance drug catalogue and commercial health insurance innovative drug catalogue. (NHIA notice)

- July 1: The Ministry of Finance (MOF) and two other departments announced a tax rebate for foreign investors to encourage reinvestment of profits. Specifically, investors can credit ten percent of the value of reinvested profits in China between January 2025 and December 2028 against tax payable that year. (MOF announcement)

- July 21: The MIIT and two other departments invited applications for the second batch of their manufacturing talent support plan. The program aims to select and support 100 innovative entrepreneurs, 300 advanced manufacturing technology talents, and 500 advanced foundational technology talents in 2025. (MIIT notice)

- July 31: The MIIT and four other departments published a notice on promoting the standardized construction of chemical parks to support the petrochemical industry’s development, while mitigating safety and environmental risks. (MIIT notice)

Corporate news

- June 12: The German multinational Freudenberg Group opened its China Technology Center and a new factory in Wuxi through its joint venture with Japanese firm NOK. The USD 27.84 million project includes smart manufacturing workshops and advanced R&D laboratories. (China Daily)

- June 25: Bosch Home Comfort Group, the German company’s heating and cooling solutions unit, opened 400 stores in China last year and plans to open 300 more this year, following double-digit sales growth in China last year. (Yicai)

- June 30: China’s Innovent Biologics Inc. secured approval for its drug mazdutide, presenting Novo Nordisk A/S and Eli Lilly & Co with their first serious Chinese rival in the obesity drug market. China’s weight loss market is expected to grow rapidly, with 600 million Chinese adults projected to be overweight by 2050. (Bloomberg)

- July 10: Renault’s electric vehicle unit Ampere is collaborating with Chinese investors CICC Private Equity Investment Management, Hangzhou Capital and Hangzhou Hi-Tech Investment Holding Group to establish a strategic new energy vehicle industry fund, targeting areas such as batteries, autonomous driving, smart cockpits, automotive software, and embodied artificial intelligence. (Yicai)

- July 16: China’s artificial intelligence hardware market, excluding smartphones and automobiles, is predicted to reach USD 153 billion in 2025, showing annual growth of 13.4 percent. (Yicai)

- July 24: China is stepping up its approval of innovative drugs. Authorities approved a record 43 innovative drugs in the first half of 2025, a 59 percent year-on-year increase, in areas including cancer, metabolic disorders and immune diseases. (SCMP)

- July 28: British pharmaceutical company GlaxoSmithKline signed a USD 12.5 billion license deal with China’s Jiangsu Hengrui Pharmaceuticals for rights to develop a drug for chronic obstructive pulmonary disease and 11 preclinical programs. This is the latest in a list of deals between multinational firms and Chinese drug developers. (SCMP)