Mapping achievements of de-risking from China + EU-China Summit

ANALYSIS

China de-risking – Mapping achievements, charting the course

By François Chimits and Grzegorz Stec

“We see a strong push to make China less dependent on the world, and the world more dependent on China. Geopolitics and geoeconomics cannot be seen as separate anymore,” said European Commission President von der Leyen at the November EU Ambassadors Conference.

Indeed, the European Commission is getting serious about de-risking the EU’s relations with China. President von der Leyen strengthens her commitment in recent remarks at a European China Conference in Berlin and in her more assertive messaging to Chinese leaders during the EU-China summit.

The message is clear: the EU Commission plans to de-risk the bloc’s bilateral relations with China, but how it will be done depends on Beijing’s willingness to have some overdue structural and constructive discussions. The EU can pursue de-risking in a cooperative spirit of “constructive rivalry” or more unilaterally and forcefully. But just how advanced is the EU in rolling out its de-risking agenda?

EU’s push for de-risking

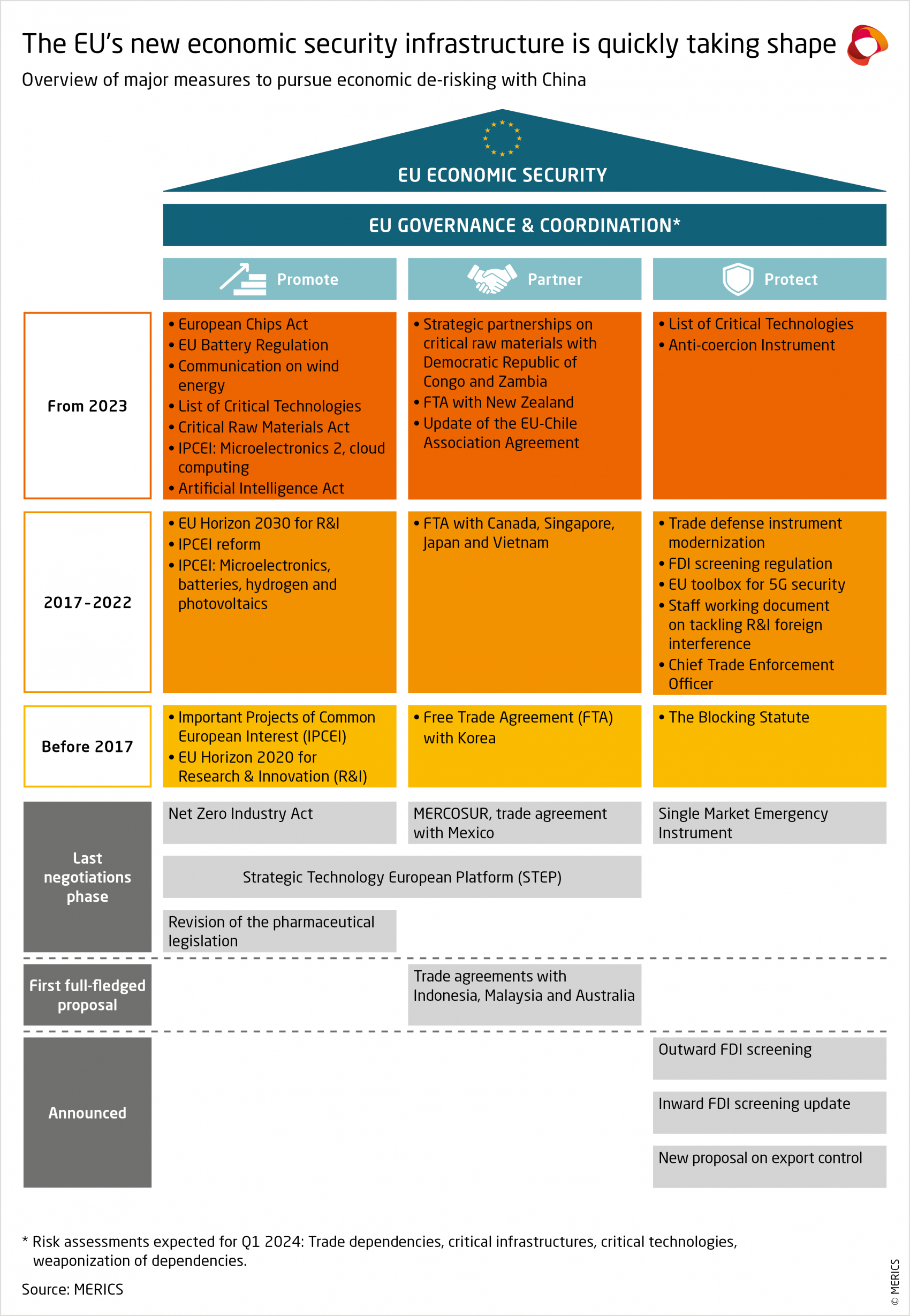

Following the March de-risking speech by President von der Leyen, the starting signal for the Commission to make de-risking a reality was the June Joint Communication on Economic Security. It set the Commission’s overarching framework for its de-risking agenda, with the elephant in the room of most of the prescribed policy measures being China.

Much has already been achieved since June.

The geoeconomic toolbox of the EU has indeed grown. A powerful Anti-Coercion Instrument has been finalized, providing a way to raise the cost of aggressively leveraging European vulnerabilities. The framework of European export controls has been made more flexible to be able to cover new types of products in EU-level measures as with the recent Dutch export control on semiconductor machinery directed at China.

Some of the long-brewing trade agreement negotiations have been concluded, facilitating import and export diversification from China. The update of the EU-Chile agreement also comes with innovative provisions to secure European access to minerals there.

The EU is also directly addressing vulnerabilities in critical sectors. The soon to be launched Strategic Technology European Platform (STEP) should enable greater EU public support in critical sectors, on top of the multiple important projects of common European interest (IPCEI) launched by coalitions of member states (see exhibit). A list of critical technologies has been published, setting the stage for a risk assessment by member states in the short run and for policy remedies in the future. Particular care was attached to partners with civil-military fusion plans, hence singling-out China in practice despite the country-agnostic claim. The Critical Raw Material Act is setting the EU on a diversification of supply chains often dominated by China.

The ramp-up of efforts against Chinese distortions, not necessarily de-risking per se, also play a role. The Commission has launched five new trade defence investigations on Chinese goods since June. Beyond the high-profile one on electric vehicles, Chinese titanium, plastic inputs and some phosphate chemicals are likely to face new tariffs on the Single market.

While the Commission has jump started de-risking, the key future challenges of EU economic security and China de-risking ambitions lay with member states. The economic security agenda intersects the domains of EU competency in external economic relations and member state competency in national security. Their legal approbation and political support are hence necessary on multiple pending files.

For the EU to be able to effectively further bolster European economic security and de-risk bilateral relations with China, member states would need to grant Brussels more powers. Effective de-risking requires member states to be in consensus as to what to do, how to do it and who to partner with. Finally, de-risking also requires a stronger consensus on the role of the public sector in industrial policies as geopolitics and geoeconomics increasingly become intertwined.

Things are however set to accelerate. The results of the first round of the internal risk assessments on trade dependencies by the Commission and critical technologies by member states should come early next year and help in charting next steps. The European Parliament elections and new Commission lend themselves to setting an ambitious agenda.

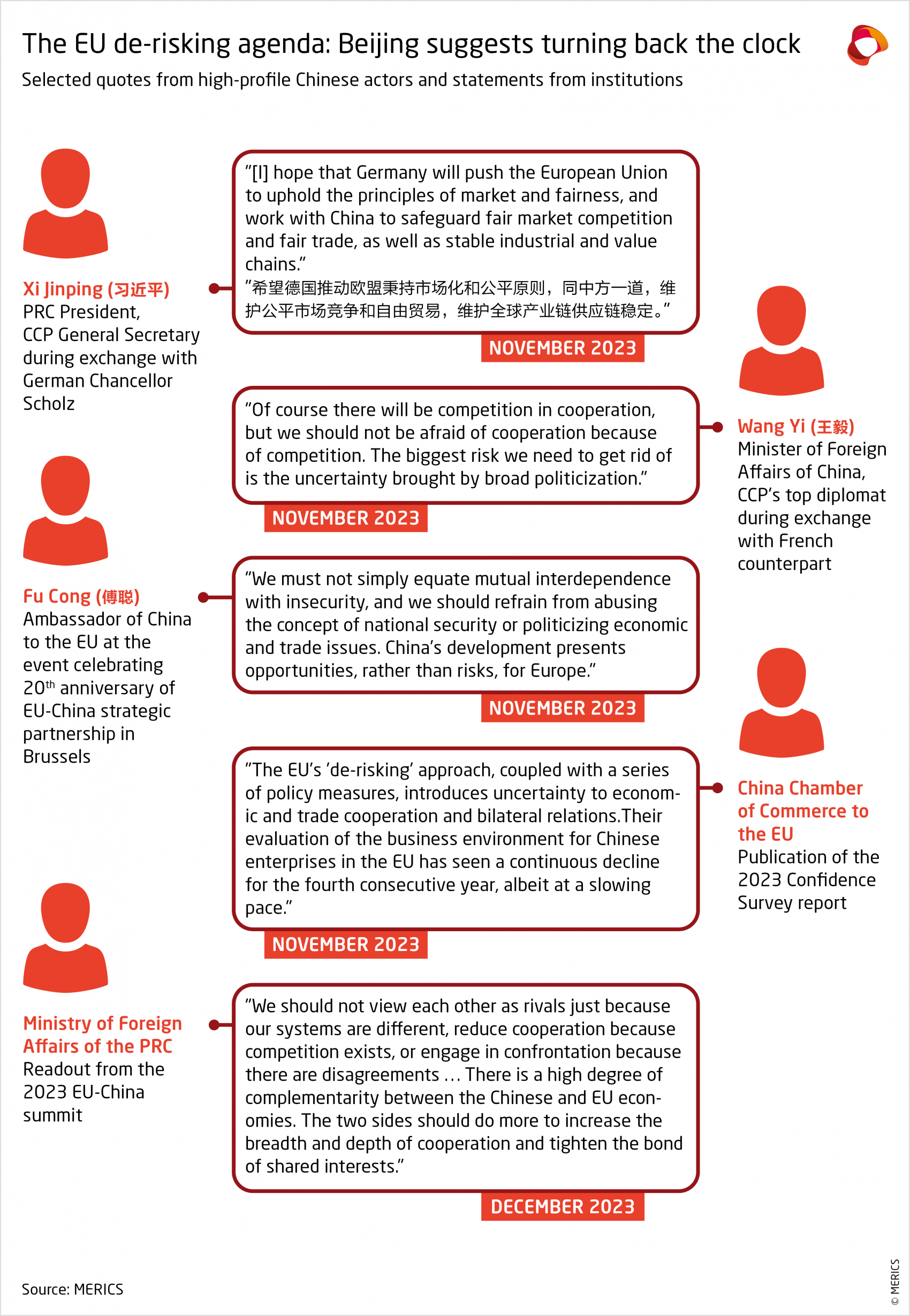

China’s push back

Undermining these ambitions and stalling implementation of the de-risking agenda is one of Beijing’s key priorities in relations with the EU. From Beijing’s perspective, EU de-risking bears parallels to Washington’s even more forceful approach to economic security. Besides, measures undertaken by the EU generate multiple irritants to the relationship and hurdles for the country’s economic stability, particularly amid the economic slowdown.

Prior to the summit, high-level Chinese figures signaled that they want the EU to tone down aspects of its economic security agenda, labelling them as political. In November, that message was delivered together alongside another on prospects of bilateral cooperation by President Xi Jinping to German Chancellor Olaf Scholz, French President Emmanuel Macron and Spanish Prime minister Pedro Sanchez, as well as by Minister of Foreign Affairs and CCP’s top diplomat Wang Yi in his exchanges with European counterparts.

Chinese business circles in Europe also voice their dissatisfaction with de-risking. The recently released China Chamber of Commerce to the EU’s (CCCEU) business confidence survey of 180 companies indicated that 72 percent felt the impact of de-risking policies with comments that it introduces more “uncertainty” as the EU is “turning inwards” and “violates own free trade principles.” 63 percent believe the EU’s de-risking trajectory poses a challenge to their business operations. Still, this does not seem to discourage Chinese companies from expanding in the EU market. 90 percent of companies report higher revenues than a year before, with 80 percent planning to expand investments into the single market.

But despite all the signals of dissatisfaction, Beijing does not provide Brussels with an alternative suggestion on how to address the EU’s structural and strategic concerns be it on China’s support for Russia, mercantilist distortions to favor Chinese players, trade imbalances or human rights concerns.

That position is captured in the event organized by the China Mission to the EU on the 20th anniversary of the EU-China strategic partnership days before the summit. Issues that are of concern to the EU were largely overlooked in favor of questioning the systemic rivalry aspects of the relationship and repeated talking points on potential cooperation and trust building.

De-risking outlook

The limited major deliverables of the EU-China summit show that, while keeping the channels of communication open has unquestionable value, the scope for the relationship to go far beyond technical agreements and damage control remains limited.

If Beijing is not willing to acknowledge the EU’s concerns and have an in-depth complex discussion, the two sides will continue to talk past each other given their mismatched expectations. Crucially, this is not new with similar conclusions being drawn from the last EU-China summit.

That lack of progress increases the chances that Brussels will turn to more robustly using the toolbox of de-risking policies to address issues where Beijing does not want to practically address them together. Beijing may, however, turn its attention to lobbying the European capitals once again, which makes it even more important to hold a common European line and signal continuity between the upcoming EU mandate transition.

Read more:

- Institut Montaigne: China Trends - Sailing the Seas of Economic Security

- The Diplomat: How the EU’s Security Approach Affects China-Europe Relations

UPDATE

The EU-China Summit: EU’s de-risking thrust

On December 7, Presidents Ursula von der Leyen, Charles Michel and High-Representative Josep Borrell met in Beijing with President Xi Jinping and Premier Li Qiang for the first in-person summit in four years. While Beijing put a positive spin on the state of EU-China relations, Brussels emphasized the looming prospect of deploying de-risking policies to push China to treat earnestly and take action on the EU’s structural and strategic concerns.

What you need to know:

- Rebalancing economic relations – Brussels voiced its concerns about the EU’s trade deficit of EUR 400 billion and highlighted uneven market access, the question of Chinese subsidies distorting the EU market as well as concerns about a potential flooding of EU market with Chinese overcapacity exports amid lower consumption in China. In turn, Beijing remains concerned about the EU’s de-risking measures, which it sees as protectionist.

- Russia sanctions – The EU raised the case of 13 Chinese or China-based companies allegedly circumventing EU sanctions and enabling Russia’s military capability. The EU has sanctioned three China-based Russian companies in June, but has so far held off from sanctioning Chinese entities. However, even if progress is achieved on those cases, the perspective of China trying to affect Russia’s position on its war in Ukraine to align with EU goals remains unrealistic.

- International stability – The two sides discussed the situation in the Middle-East though with no clear tangible results at this stage, in addition to the EU further voicing concerns about stability in the Taiwan Strait and South China Sea.

- Standards & Human rights – The EU welcomed China’s international commitment to cut methane emissions Both sides also agreed to discuss global AI standards. Human rights were discussed as a cross-cutting agenda topicx

- The two readouts: The Chinese and European press releases differed significantly in their tone. Beijing has once again called for upholding “the apt description of our relationship as a comprehensive strategic partnership” glossing over aspects of competition and systemic rivalry in the relationship. The Chinese readout focused on a “high degree of complementarity” between the two economies and potential for collaboration in particular on AI and between the BRI and the EU’s Global Gateway initiatives.

- EU’s readout - “Summit of choices”: The phrase used by President von der Leyen captures the intention of the European side during this summit. As the EU has been building up its economic security and de-risking toolbox and has launched new trade investigations into Chinese export products such as electric vehicles, it is now credibly positioned to expect from Beijing constructive progress on perceived challenging structural and strategic issues.

- Deliverables postponed: Deliverables such as market access for cosmetics, medical devices and selected agricultural products; the expansion of the Geographical Indicators list, and clarification of China’s cross-border data regulations remain pending. However, further discussions on these points were moved to high-level dialogue platforms bringing together EU Commissioners with Chinese Ministers to avoid technical discussions from obscuring the exchange on strategic issues during the summit.

Quick take: The EU voiced clearly that it is ready to move forward unilaterally with its economic security and de-risking measures should Beijing not meaningfully and technically engage with the EU to address the bloc’s key structural economic and strategic geopolitical concerns. The EU’s introduction of new measures in that space makes it better positioned to motivate Beijing to take action.

However, there are two challenges ahead for Brussels. First, it needs to take precautions against Beijing’s strategic stalling tactics of a more receptive rhetoric and establishment of technical groups which would only be geared towards postponing the need for rather than facilitating policy action. The EU needs to commit to acting if progress is not visible in a timely manner before the end of the current EU mandate. Second, with a more assertive message from Brussels, Beijing will likely intensify courting the member state capitals to prevent the bloc from taking more assertive policy moves. Brussels needs to ensure that the EU27 hold a joint line and support the de-risking push in relations with China.

Read more:

SHORT TAKES

European Parliament weighs in on relations with Taiwan and with China

On December 13, the European Parliament’s Foreign Affairs Committee (AFET) issued its report on recommendations for other European Institutions approach to EU-China relations. The recommendations were divided into three baskets: “Engaging China to tackle global challenges,” “Opposing China’s human rights violations,” and “De-risking from China to ensure Europe’s open strategic autonomy.”

On the same day, the International Trade Committee (INTA) adopted a resolution on EU-Taiwan trade and investment relations. The resolution called to secure a “bilateral investment agreement” with Taiwan for boosting economic ties, particularly with regard to renewable energy and sustainability industries and resilience of critical supply chains including semiconductors. The MEPs also called on the EU to explore cooperation in resilience to hybrid threats as well as to support Taiwan in preserving its security “by strengthening its ‘silicon shield’” and in its quest for increasing its presence in international bodies.

- European Parliament: Report on a European Parliament recommendation concerning EU-China relations

- European Parliament: Resolution on EU-Taiwan trade and investment relations

Italy leaves Belt and Road Initiative

Hoping to avoid retaliation, Rome handed Beijing a note about its BRI withdrawal in a low-key diplomatic fashion without any public announcement. The Belt and Road Initiative agreement would have been automatically renewed by the end of the year. The agreement, signed four years ago made Italy the only G7 participant of the initiative, but failed to deliver benefits Rome hoped for – including a planned EUR 20 billion worth of investments.

- Corriere della Sera [IT]: Italy left the Silk Road: Farewell note delivered to Beijing

- Nikkei Asia: Italy tells China it is leaving Belt and Road Initiative

COP28 in Dubai has delivered on Chinese sweet-spot

The 28th UN Climate Change Conference has managed to produce some deliverables. 120 countries this week vowed to triple global renewable energy capacity by 2030. Given the EU and China’s July promise to contribute to “joint efforts” and the low expectations for the conference, the deliverables signal a “successful COP.” Cynics might say that such an objective quite nicely benefits the largest world producer of renewables. Meanwhile, traditional irritants for Beijing in international climate negotiations have not advanced. For instance, no commitments were made on phasing out coal, nor on a contribution of high emitting developing countries to support the transition of less advanced economies.

- MERICS: China at COP28 + UAE between US and China + Evergrande reprieve

- China Dialogue: COP28 Preview: China in the world’s spotlight

- EURACTIV: ‘Blame China’: EU Parliament’s high-stakes gambit at COP28 – EURACTIV.com

Estonia and Finland request Beijing’s cooperation in damage of Balticconnector pipeline probe

The request is related to damages allegedly caused by the Chinese container ship New Polar Bear, which dragged its anchor between October 7-8, damaging a gas pipeline and two telecommunication cables connecting Estonia and Finland. As part of the process, the Estonian and Finnish representatives are to investigate the vessel in Tianjin. The investigation raises the question of the EU’s and NATO’s resilience against hybrid attacks – including by Chinese entities.

Huawei to set up its first European factory in Brumath, France

The factory geared towards producing mobile phone network equipment was initially planned to begin construction in 2020 with a EUR 200 million investment. Following the pandemic-related delays, the factory is now expected to open in 2025. The move follows Paris' decision to progressively exclude Huawei from its 5G networks, by not renewing licenses for the company's equipment after their expiration. But in July, following interactions with Beijing, Paris reneged on their initial decision by extending Huawei’s 5G licenses in selected cities.