Semiconductors

Semiconductors are crucial to many of China’s strategic goals: digitalizing the economy, boosting high-tech exports such as electric vehicles (EVs) and solar panels, and developing modern weapons. With its state-led “Big Fund,” China has invested more than CNY 686 billion (EUR 87.5 billion) into the industry since 2014, in addition to local government support and private investment.

Indigenizing the semiconductor industry has gained urgency, as US sanctions and export controls have cut off access to advanced semiconductors critical for development in AI, military and other fields. Since the US sanctioned the telecoms giant Huawei in 2019, Huawei has quietly become the central force in the state’s effort to develop homegrown chips, alongside other companies.

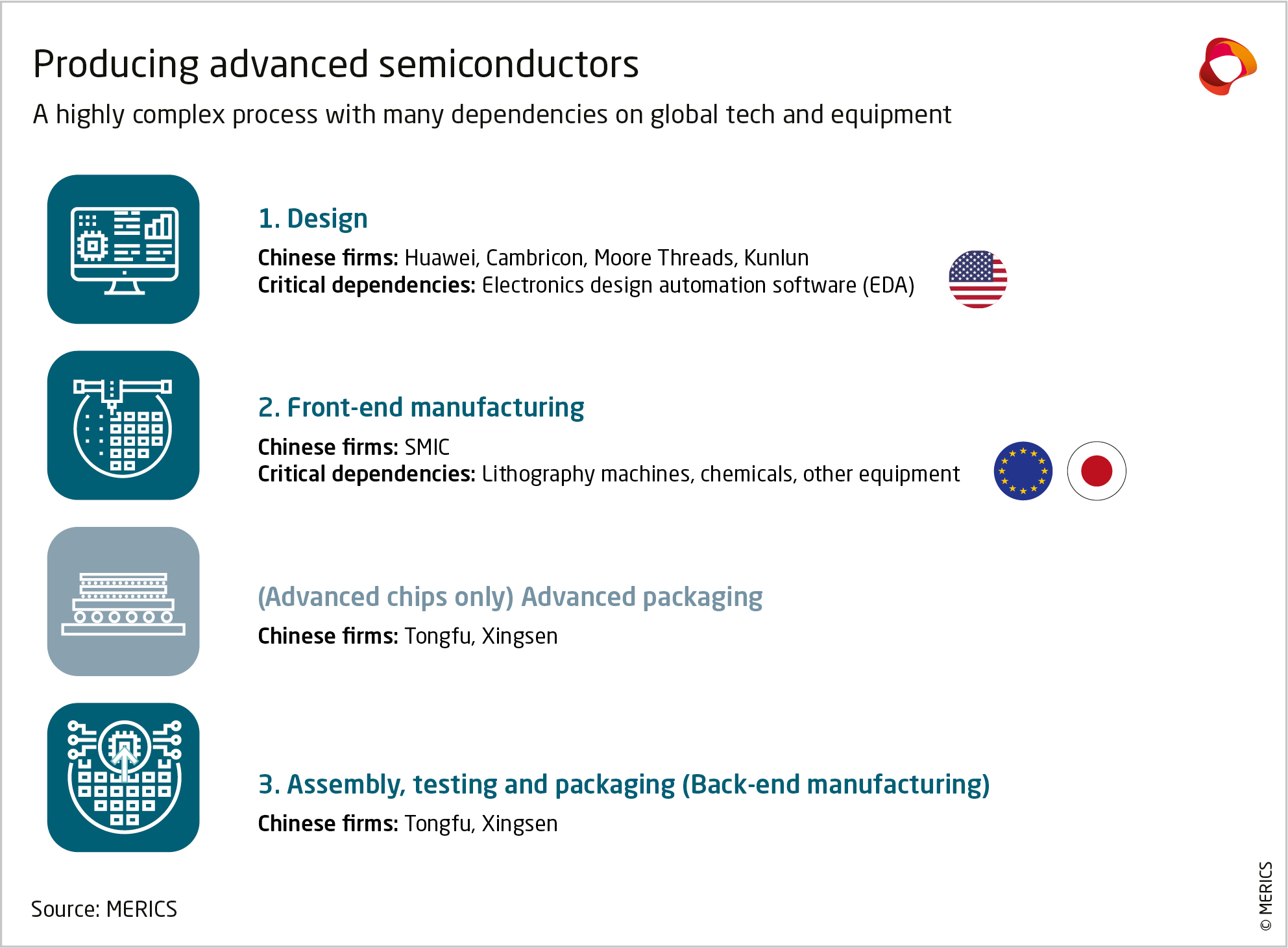

China is a major producer of semiconductors using older manufacturing technology and is a leader in backend processes – chip assembling, testing, and packaging. But it lags in making advanced semiconductors and lacks the tools to manufacture them. US export controls have cut off access to critical foreign-made equipment.

Nevertheless, leading manufacturer SMIC has produced an advanced 7nm smartphone chip and a line of AI chips, both for Huawei. Taiwan’s TSMC, the world’s leading semiconductor contract manufacturer, first pioneered a 7nm process in 2018 (has since produced several rounds of further innovations), suggesting SMIC lags by roughly five years. However, China’s lack of access to Extreme Ultraviolet Lithography (EUV) machines, essential for making advanced semiconductors and exclusively produced by the Netherlands’ ASML, may hamper further progress.

Graphics dashboard

China faces the daunting task of trying to own the entire manufacturing process for semiconductors, which is highly complex with many steps. This is even more so with advanced semiconductors, which requires specialized equipment from other countries.

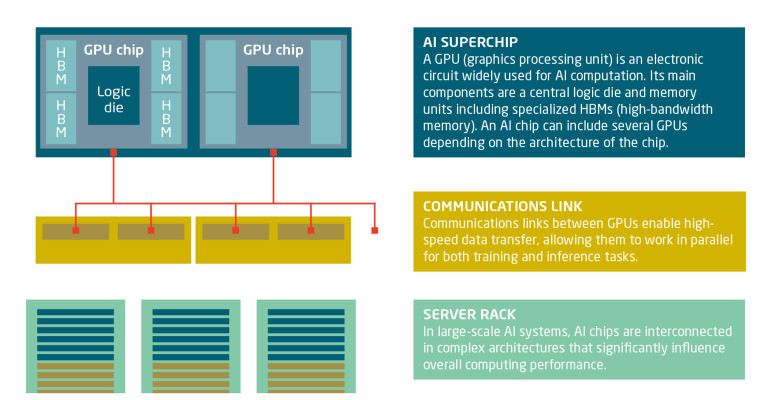

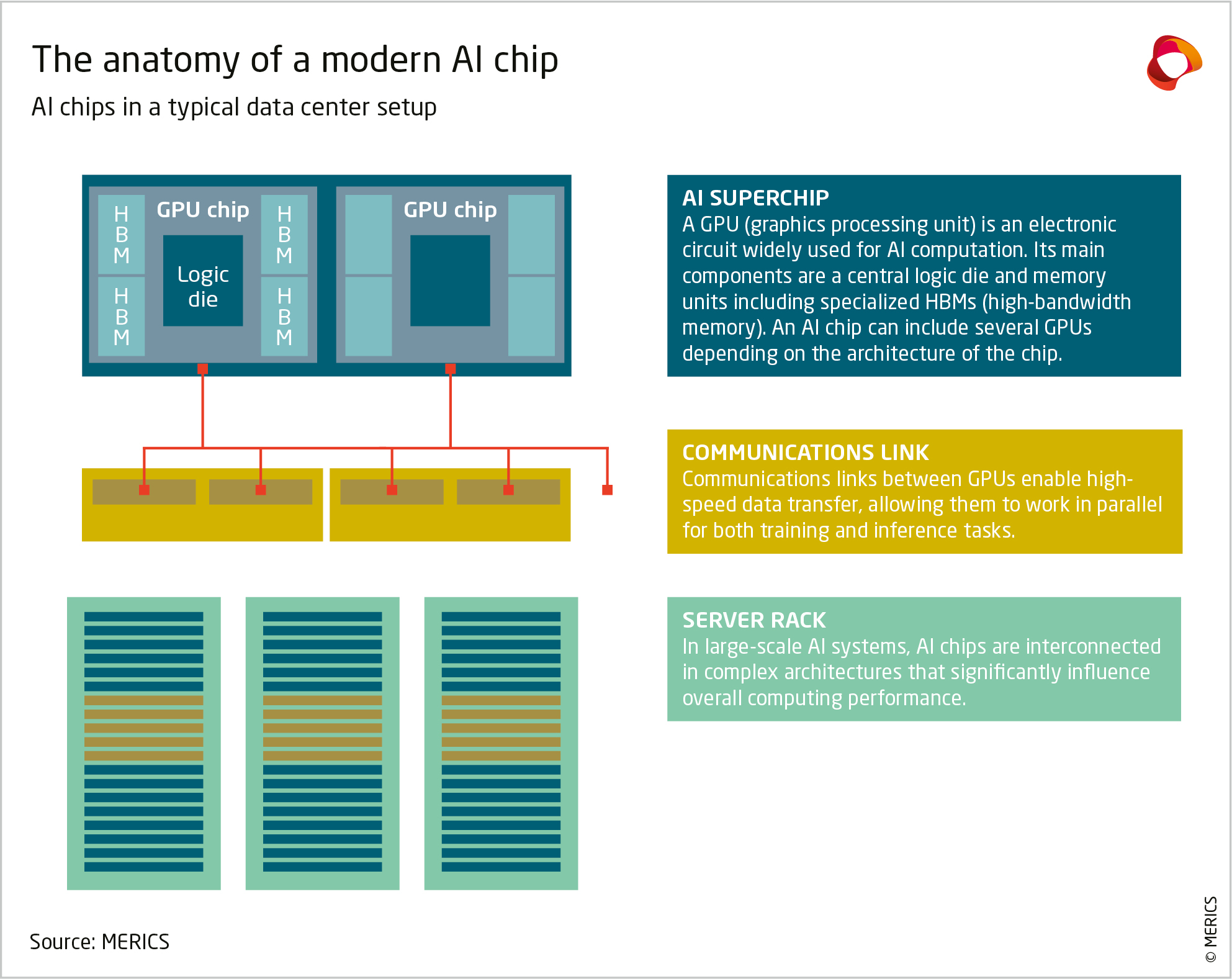

Modern AI chips contain GPUs, powerful processing units capable of parallel processing computing tasks, and high-bandwidth memory (HBM) units storing computation results. The chips are then connected with specially designed communications links in massive clusters. The engineering architecture of a data center, as well as the chips themselves, can affect its overall computational performance.

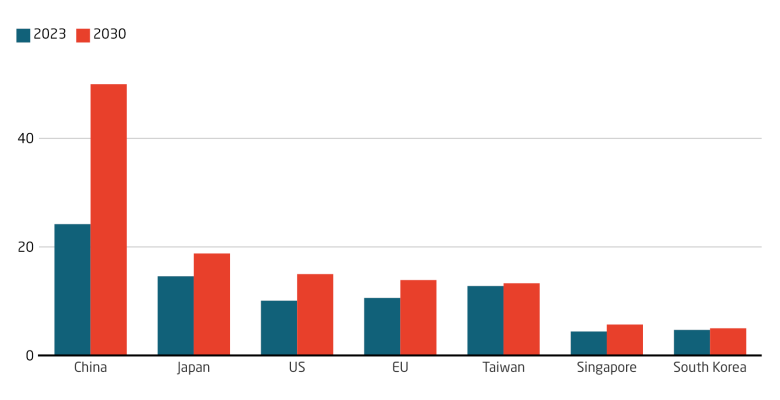

Currently China has the largest production capacity for legacy chips, which are older, established semiconductor designs. Chinese companies have already committed to a doubling in capacity by 2030 (compared to 2023 levels). European semiconductor companies will see increasing competition from China, where profits often take a backseat.

Semiconductors in China: Timeline of crucial events

The US adds Huawei and its subsidiaries to the Entity List, restricting exports to them. This impacts Huawei's supply chain, with 33 of its 92 core suppliers based in the US.

US applies Foreign Direct Product Rule to Huawei, blocking its technology access globally. Companies are barred from using US technology (mainly semiconductors) to supply Huawei.

Top Chinese scientist suggests China use open-source RISC-V chip design architecture to overcome Western sanctions, and create an ecosystem around “RISC-X” in Belt and Road countries.

US expands export controls on advanced semiconductors and manufacturing equipment, restricting tech specs of chips and including arms-embargoed countries.

Huawei and SMIC release Kirin 9000S, a 7nm 5G chip for Huawei's latest high-end smart phone – even after US export controls blocked equipment considered necessary to make such chips.

Second tranche of Big Fund raises CNY 2 trillion (EUR 25.6 billion) to support Chinese semiconductor industry – beyond just fabs – to create an ecosystem for making semiconductors in China.

COVID-19 severely disrupts supply chains for automotive chips. Car companies must cut output due to the shortage. Chinese chip companies evolve to meet the demand of its auto industry.

US institutes country-wide semiconductor export controls, a major policy shift that restricts all of China’s access to "chokepoint" technologies, not just certain entities.

Third phase of China Integrated Circuit Industry Investment Fund (Big Fund III) raises CNY 3.4 trillion (EUR 44.3 billion) from state-owned investors for semiconductor industry, the largest to date.

Tech progress

- A research team at Tsinghua University has developed a new extreme ultraviolet (EUV) photoresist material based on polytelluroxide (PTeO) for chip manufacturing, achieving an 18-nanometer line width. If this technology can be brought to production, it could potentially address longstanding challenges in EUV lithography. (Source (CN): EET, July 29, 2025)

- Chinese chipmaker Loongson Technology released a new series of chips and server solutions. Their 3C6000 series is now developed domestically without the need for foreign licenses because of their own architecture. Benchmarks show that they are on par with Intel “Ice-Lake” chips from 2021. (Source (CN): EEFocus, June 26, 2025)

Domestic dynamics

- Tencent declared that the company has sufficient inventory of GPUs for model training and doesn’t plan on buying NVIDIA H20 chips. The company is also exploring non-Western options to meet the growing demand for inference. (Source (CN): EET, August 18, 2025)

Foreign involvement

- Innoscience, a Chinese power chip maker using Gallium Nitride, joined a list of 18 Nvidia partners for its upcoming shift towards an 800VDC power architecture in its data centers. As the only Chinese entrant, Innoscience’s entry into Nvidia’s supply chain is being celebrated by markets. (Sources (CN, EN): EEFocus, August 6, 2025, Nvidia, July 31, 2025)

- The US has announced an end to the Validated End User status for TSMC’s Nanjing fab, after doing the same for Samsung and SK Hynix sites in China recently. The waivers will expire at the end of the year, after which the firms will have to seek individual approval for shipping equipment covered by US export controls. (Source (EN): Bloomberg, September 2, 2025)

Semiconductors in China: Profiling the actors

Publications