Humanoid robots + China's charm offensive towards foreign firms + 5G

MERICS Top 5

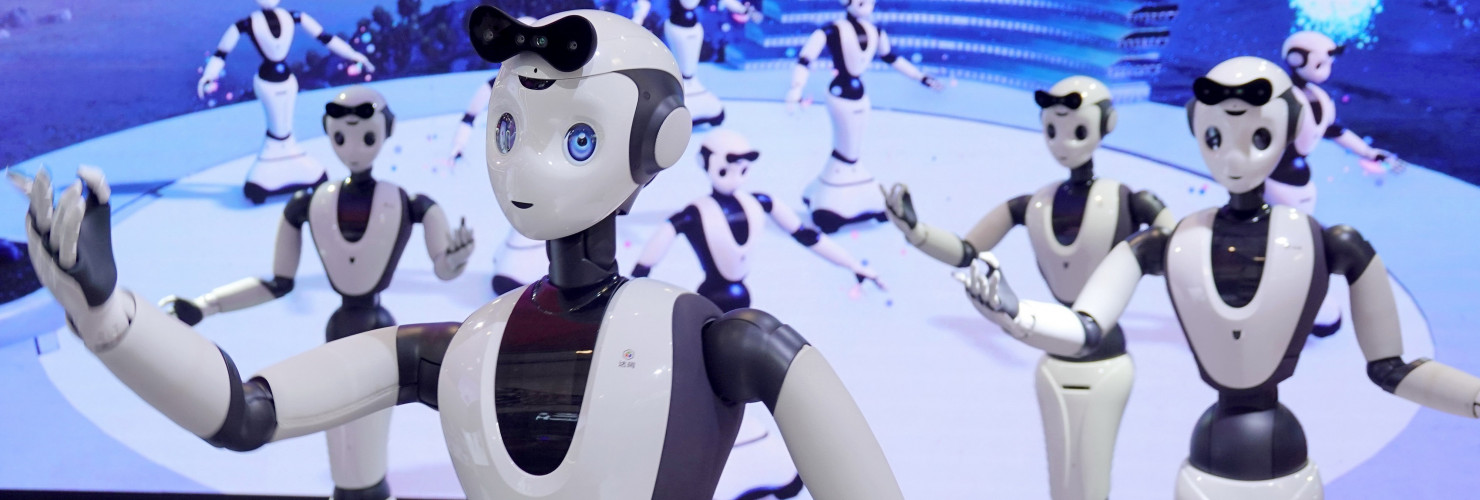

1. Great robo-leap forward: MIIT charts path toward humanoid robots

At a glance: The Ministry of Industry and Information Technology (MIIT) released guidelines to support the development of humanoid robots, i.e., robots built to mimic human motion and interaction. The plan extols the potential of such robots to revolutionize manufacturing and service industries, positioning them as the next "disruptive technology" comparable to the advent of computers and smartphones. By 2027, policymakers aspire to deeply integrate humanoid robots into the real economy. Interim targets set for 2025 include:

- Achieve breakthroughs in key technologies related to environmental perception, behavioral control, mechanical arms, lightweight skeletons and more

- Ensure the safe and effective supply of core components, including sensors, actuators, controllers and power sources

- Reach mass production of humanoid robots at an international advanced level

- Cultivate two or three companies with global influence and a cohort of specialized small- and medium-sized enterprises

MERICS comment: From Beijing’s perspective, humanoid robots represent the culmination of advancements across cutting-edge technologies, offering immense potential for economic growth. They bring together AI, high-end manufacturing, and new materials. The potential application scenarios cover manufacturing, service sectors (medical care, housekeeping), rescue operations and even defense.

For the moment, the industry is still in its infancy and faces challenges such as unreliable technical performance, as well as high costs and prices. Higher performance will need to be reached before large-scale implementation can begin to bring costs down. All the same, major Chinese robotics and tech firms have already begun development of humanoid robotics products, such as Fourier Intelligence, Xiaomi and Xpeng. Fourier Intelligence has even announced that its GR-1 robot has entered mass-production.

China’s proactive embrace of humanoid technologies, coupled with its support for AI and big data, could confer a competitive advantage, while also enhancing the nation's appeal as a production hub for foreign firms. Yet it will not be a one-horse race. Japanese and American firms are also developing their own products and building on strengths in robotics, sensors and semiconductors. The industry looks set for intense competition between companies from Japan, the US and China over the coming decade.

Article: Guiding Opinions on the Innovation and Development of Humanoid Robots (工业和信息化部关于印发《人形机器人创新发展指导意见》的通知) (Link)

Issuing body: MIIT

Date: November 2, 2023

2. Foreign firms should be wary of China’s latest charm offensive

At a glance: China’s Ministry of Commerce (MOFCOM) issued a letter to local authorities, instructing them to conduct a “special clean-up” of provisions and measures which put foreign companies at a competitive disadvantage in China’s market. Specifically, the instructions require officials to revise and rectify any provisions subjecting foreign companies to:

- Stricter or longer application processes for market access licenses or product certification applications

- Exclusion from preferential policies, government subsidies, or other support measures

- Discrimination in public procurement

Local governments must publicize the results of their reviews and report the relevant situation back to MOFCOM. The letter also encourages foreign businesses to use the recently launched online complaint portal to air specific grievances.

MERICS comment: Beijing is in the middle of a charm offensive towards foreign businesses, and European ones in particular. Over the years, foreign companies in China have become increasingly disillusioned by repeated regulatory crackdowns and strict yet vague data security legislation, as well as a grim economic outlook. The MOFCOM letter aims to reverse the resulting historic slowdown of FDI flows into China by reassuring foreign investors that China is addressing their long-standing concerns over unequal market access and unfair competition.

While the specificity of required actions in the “special clean-up” initiative are a positive sign, its “concessions” are not new. China’s Foreign Investment Law from 2020 already enshrines equal treatment for foreign companies on the same issues listed above, through articles 30, 9 and 16, regarding license applications, policy support and procurement respectively.

Moreover, the central leadership’s overarching aim of securitizing the economy and erasing value chain bottlenecks remains unchanged. Strategic self-sufficiency ambitions, which demand preferential support for local brands, are always prioritized over ensuring a level playing field for foreign investors. Foreign companies should therefore manage their expectations. Still, while taking on board all these caveats, the initiative should be seen as good news for now. Although Beijing's end goal is clear (and bad news for foreign firms), the pace and modes through which it seeks to get there matter greatly for foreign firms in China.

Article: Letter Regarding the Special Clean-up Work on Unreasonable Differential Treatment of Domestic and Foreign Capital (商务部办公厅关于请做好内外资不合理 差别待遇专项清理工作的函) (Link)

Issuing body: MOFCOM

Date: November 8, 2023

3. Creative ideas needed to get more factories on 5G networks

At a glance: The MIIT issued plans to promote the use of 5G in manufacturing. Cities are urged to become “5G+industrial internet” pilot zones, which involves:

- Increasing government support through special projects, digital infrastructure construction, investments and loans

- Promoting the integration of the digital economy with the real economy

- Promoting the creation of pioneering prototypes with local characteristics that can be replicated and extended

- Building a “5G+industrial internet” cluster and innovation ecosystem around the pilot zone that radiates to the surrounding region and that leads the whole country in new-style industrialization

The MIIT released the plans alongside a “Wuhan Declaration” that aims to promote collaborative innovation on the industrial internet. The document mentions developing more applications and capitalizing on advances in artificial intelligence. Leading research institutes as well as telecommunications and digital hardware companies signed the declaration.

MERICS comment: Industrial internet has been a priority for MIIT at least since the 2015 announcement of Made in China 2025, and a recurring candidate for subsidies in times of economic headwinds. The current push implements the “Action plan for the innovative development of the industrial internet (2021-2023).” The “5G+industrial internet” pilot zones have now become the focus because China’s 5G infrastructure roll-out is world-leading, with 318,900 5G base stations, 8,000 5G+industrial internet projects and 89 million connected devices.

China has been much less successful in other parts of the industrial internet, such as software, platforms and cybersecurity. The 2021 action plan calls for three to five industrial internet platforms with international impact by 2023. 240 industrial internet platforms were set up by October 2023, in key sectors like equipment manufacturing, steel, mining, petrochemicals, building materials and ports. But none of these have traction outside China. Chinese experts also argue that SMEs, especially, lack the expertise to translate the available generic platforms to their specific needs.

Also because of the long-standing elusiveness of this challenge for China, foreign providers will continue to capture a significant share of the industrial internet market, which grew 14 percent in 2022 to reach CNY 864 billion.

Article: Work Rules (Temporary) and Guidelines for “5G+ Industrial Internet” Comprehensive Application Pilot Zones (“5G+工业互联网”融合应用先导区试点工作规则(暂行), “5G+工业互联网”融合应用先导区试点建设指南) (Link)

Issuing body: MIIT

Date: November 23, 2023

4. Driving for dummies: Autonomous vehicles to take road tests

At a glance: Four agencies led by the MIIT announced a pilot program to allow qualified autonomous vehicles (AVs) to perform road tests in designated areas. Key aspects of the program include:

- Vehicle manufacturers and fleet owners can form alliances to submit proposals to local governments for road tests in limited areas. The cities included in the proposal should have appropriate policy, safety measures and relevant infrastructure in place. MIIT and the other agencies will select proposals to approve.

- The program is aimed at AVs with Level 3 (conditional automated driving) or Level 4 (highly automated driving) automation designated by the Chinese Autonomous Driving Classification, where the maker has demonstrated the ability to manufacture at scale.

- An accompanying guidebook on implementing road tests includes details on how to visibly mark test vehicles, insurance requirements for individual vehicles, and legal responsibilities in the case of accidents.

MERICS comment: China has long viewed “Intelligent, Connected” EVs as a critical opportunity to catch up with and bypass traditional automotive manufacturing powerhouses such as the United States, Europe and Japan. Its 2020 Development Plan for New Energy Automotives stresses the importance for EVs to adopt advanced technology such as autonomous driving. The latest encouragement from the government to establish road testing frameworks serves to reinforce this focus. Chinese electric vehicles already made up close to 20 percent of its domestic new car sales in 2022. This is in keeping with its announced plans of achieving 50 percent of domestic new car sales and having highly automated driving cars on the road by 2025. The overall goal of the plan is to achieve wide adoption of intelligent autonomous vehicles by 2035.

Wary of the prospect of China’s EV exports flooding its internal market, the EU has started an anti-subsidy probe into Chinese EVs. Meanwhile, its own developments in EVs and AVs still lag behind that of China’s, due to challenges including dependency on imported components and raw materials, and lack of unifying standards. It is making progress at the latter – the German automotive industry just announced new safety standards for AVs in urban settings.

Article: Notice on Carrying out Pilot Work on the Access and Road Test of Intelligent Connected Vehicles (四部委关于开展智能网联汽车准入和上路通行试点工作的通知) (Link)

Issuing bodies: MIIT, MPS, MOHURD, MOT

Date: November 17, 2023

5. Data dilemma: Thorny data security penalties pose a challenge for business

At a glance: The MIIT issued draft guidelines on penalties for data security violations in the industrial sector. The document standardizes administrative penalties and guides data security regulators to exercise their discretion lawfully and appropriately. The regulations:

- Define both the 21 types of illegal activities, such as failing to establish a security management system for the full life cycle of data, and the scope of illegal data exports (articles 10 and 11)

- Outline a ranking of violation severity, ranging from relatively light to serious breaches of data security; for instance, serious breaches include when more than 100 million pieces of general data (non-sensitive data) have been tampered with, destroyed, leaked etc. (articles 13-15)

- Distinguish the appropriate level of penalties to apply according to four levels, from no administrative penalties, to reduced penalties, minor penalties and heavy penalties, and the circumstances in which they shall be applied (articles 18-22)

- Specify benchmark penalty ranges for 14 different circumstances according to differing penalty levels (annex)

Companies and other actors have until December 22, 2023, to submit feedback.

MERICS comment: The document is not designed to clarify definitions for key concepts such as important and core data, leaving these questions unanswered for foreign firms. Rather, the draft guidelines specify how officials should apply the Data Security Law (DSL) and indicate that the original guidelines for and administration of penalties to date will continue. As already outlined in the DSL, the maximum fine stipulated for companies is CNY 10 million. Implementation of the DSL so far has imposed fines on companies in the range of CNY 50,000 to CNY 1 million.

However, the most concerning factor for foreign data processors is the possibility of having their operating licenses revoked. They are also liable to criminal investigation, should it be determined that they have broken the law. This is a particularly high risk if the company’s business model relies on transferring large amounts of data across borders or handles important or core data. Companies need to proactively adopt data security strategies to ensure their data handling practices are legal and avoid regulatory risks.

Article: Discretionary Guidelines for Administrative Punishments regarding Data Security in the Field of Industry and Information Technology (Trial) (Draft for Comments) (公开征求对《工业和信息化领域数据安全行政处罚裁量指引(试行)(征求意见稿)》的意见) (Link)

Issuing body: MIIT

Date: November 23, 2023

Noteworthy

Policy news

- October 26: The MIIT announced the list of 212 smart manufacturing demonstration factories and 605 model application scenarios for 2023 (MIIT notice)

- November 6: The National Development and Reform Commission (NDRC) published a pilot scheme to advance carbon peaking, which will promote 100 carbon peaking pilot projects nationwide in cities and industrial parks (NDRC notice, CGTN article)

- November 10: The MIIT launched applications for the fourth batch of smart photovoltaic pilot demonstration activities, which aims to integrate energy technology with modern information, new materials and advanced manufacturing technology (MIIT notice)

- November 13: The Ministry of Finance issued new regulations aiming to strengthen the data-security management of accounting firms, particularly those who have been hired by listed firms and state-owned companies (MOF notice, South China Morning Post article)

- November 14: The MIIT announced a pilot program to accelerate the rollout of NEVs in public sector vehicle fleets (i.e., official vehicles, city buses, taxis etc.) across 15 cities; the program aims to deploy over 600,000 public domain NEVs in the coming years (State Council article, Xinhua article)

- November 22: The MIIT launched applications for the 2023 Industrial Internet pilot projects, which cover seven categories, namely new technologies, factories, carriers, parks, networks, platforms, and security (MIIT notice)

- November 24: The NDRC issued guidelines to accelerate the establishment of a product carbon footprint management system; it aims to introduce carbon footprint accounting rules and standards for approximately 50 key products by 2025 (NDRC notice, China Daily article)

Corporate news

- October 31: German seed producer KWS Saat announced it will sell its Chinese corn business due to new regulations that could mean its corn, developed through conventional breeding techniques, would be unable to compete with genetically modified corn over the longer term (Reuters article)

- November 2: German pharmaceutical firm Boehringer Ingelheim stated that it plans to invest more than CNY 4 billion in China over the next five years to accelerate research and development and launch human medicines and animal health products (Yicai article)

- November 4: Internal sources revealed that Gallup, the polling and consulting group, is pulling out of China, after strict rules governing public opinion surveys carried out by foreign groups has made its operations increasingly difficult (Financial Times article)

- November 10: The value of deals completed at the China International Import Expo (CIIE) reached an all-time high USD 78.4 billion, an increase of 6.7 percent year on year, according to a unit of the Ministry of Commerce (South China Morning Post article)

- November 13: Huawei released two new EVs developed with local partners, namely the Avatr 12 luxury coupe manufactured by Chongqing Changan Automobile Co., and the Luxeed S7 sedan made by Chery Automobile Co. (Bloomberg article)

- November 14: China successfully launched the world’s fastest internet with 1.2 terabit per second link, two years ahead of industry predictions; Tsinghua University, China Mobile, Huawei Technologies, and Cernet Corporation collaborated on the project (South China Morning Post article)

- November 24: British semiconductor firm Graphcore confirmed that it is slashing staff in China and will no longer sell products in the country, citing Washington’s latest export restrictions on sales of advanced artificial intelligence (AI) chips (South China Morning Post article)

- November 24: The Aero Engine Corporation of China displayed the CJ-1000A – the first-ever high-bypass turbofan engine whose intellectual property rights belong entirely to China – at the first Shanghai International Commercial Airshow; once certified, will be used to power the homegrown narrow-body airliner COMAC C919 (Yicai article)