Robotics sector + "Complete industrial chain" + Industrial internet

MERICS TOP 5

1. Robots here, there, everywhere: Beijing to accelerate robot rollout

At a glance: 17 government agencies led by the Ministry of Industry and Information Technology (MIIT) issued a plan for China’s “Robot+” initiative, which seeks to spur on the application of robots in ten key economic and social areas – from manufacturing to energy, healthcare, elderly care and education. Key targets included are:

- Double the density of industrial robots from 2020 levels to reach 492 robots per ten thousand manufacturing workers by 2025 (this goal was originally set in 2022)

- Achieve breakthroughs in more than 100 kinds of innovative robotics application technologies and solutions

- Promote over 200 robotic applications, focusing on more advanced and innovative use cases

- Establish "Robot+" application benchmark enterprises, and construct several application experience as well as test and verification centers

MERICS comment: The “Robot+” initiative was included as a new measure in the 14th FYP for the Robotics Sector to encourage the development of new robot products and services and accelerate their adoption and demand. As can be seen from the number of government bodies involved in the drafting of the plan, the potential fields of application are widespread across industries. The approach complements China’s ambitions to leverage digital technologies such as big data and AI to promote industrial upgrading and improve living standards. Increased automation will be essential for China to raise productivity with a population that is not only ageing, but also shrinking.

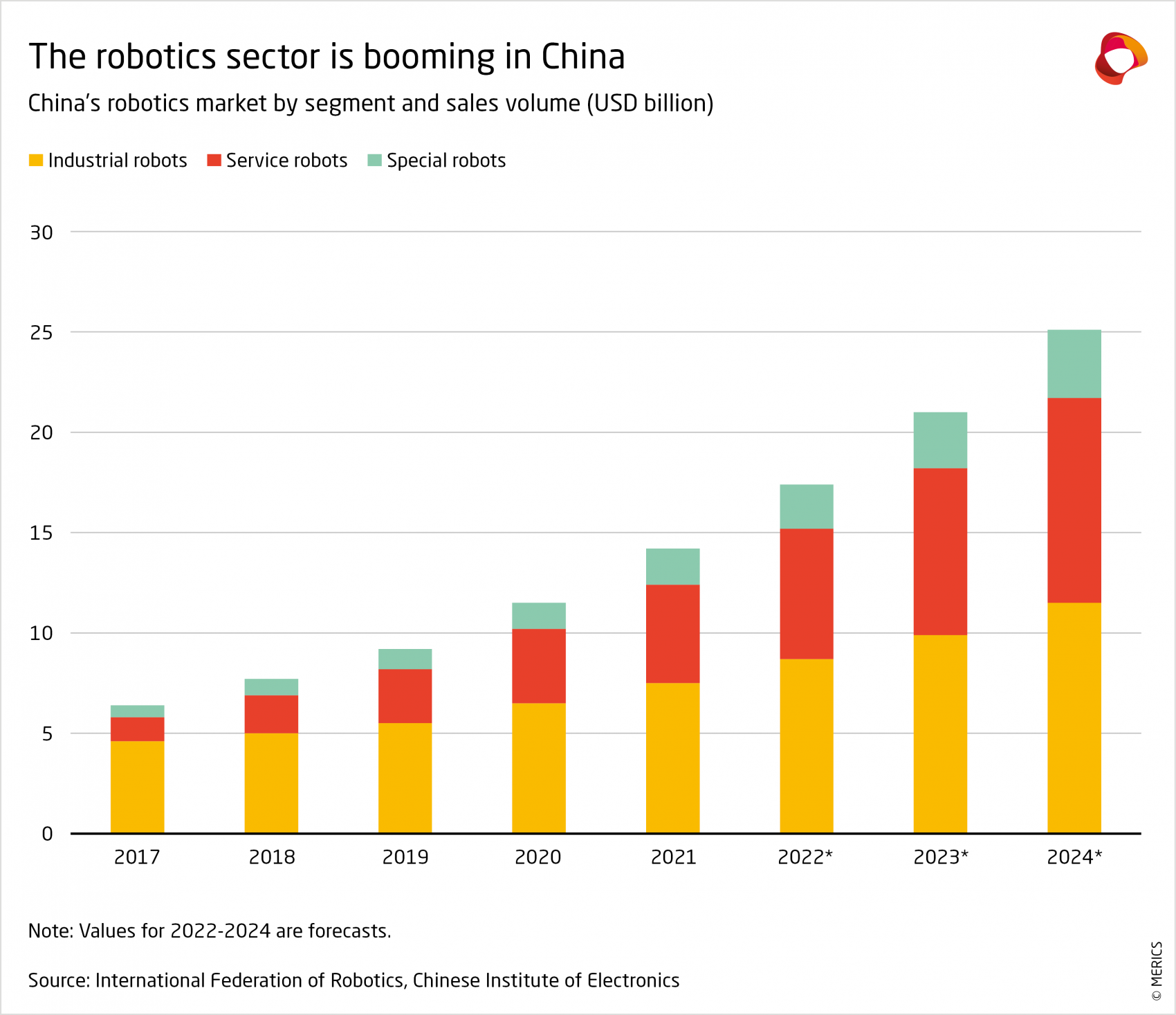

The sales figures for robots in China show that the shift to an automated society is already underway. The strongest growth is expected to come from the service robot sector, due to China’s aging population and increased applications across multiple sectors is set to increase demand (see exhibit). The “Robot+” initiative will provide further momentum for this transition and likely promote domestic technologies over foreign competitors. For service sectors where robots are being installed for the first time, this will lend a significant advantage to indigenous suppliers. Several local producers already dominate the domestic market in their respective areas, including Tinavi Medical Technologies (health care), Ecovacs Robotics (household robots) and Keenon Robotics (catering).

Article: Implementation Plan for "Robot +" Application Actions (工业和信息化部等十七部门关于印发《“机器人+”应用行动实施方案》的通知) (Link)

Issuing bodies: MIIT, NDRC, MOF, MEE, MOA, SAMR

Date: January 19, 2023

2. MIIT minister doubles down on efforts to strengthen China’s industrial base

At a glance: Half a year into his new job as party secretary and head of the MIIT, Jin Zhuanglong wrote an article in the CCP’s leading theoretical journal Qiushi (Seeking Truth). In an increasingly volatile geopolitical environment, the importance of S&T innovation and industrial transformation has only increased. He outlines key tasks to promote a ‘new type of industrialization’ that will propel China towards manufacturing superpower status:

- Promote the upgrading of manufacturing by consolidating firms in traditional sectors, such as iron and steel, and strengthening China's leading position in sectors like EVs, PV and power equipment

- Improve the industrial technology innovation system by integrating the innovation and industrial chains, for instance through faster commercialization of new research

- Make industrial and supply chains more resilient by identifying and closing technological gaps, but also build up competitive advantages (commonly associated with chokepoints that China could employ against other countries)

- Leverage green and smart technologies like 5G, big data or low-carbon production methods to build new competitive advantages

MERICS comment: China sees itself locked in a geopolitical struggle with the United States, which according to Jin is “escalating its containment and suppression of China’s advanced manufacturing industry”, a reference to the semiconductor export controls. Reducing dependence on foreign technology has been a long-standing aim, which previously played second fiddle to concerns about economic development. Now, policymakers are determined to minimize their vulnerability to external shocks, while remaining integrated with the global economy on its own terms.

For foreign firms the consequences of this shift are primarily negative. First, China’s focus on technological self-reliance has already and will continue to increase political interventions in the economy, which creates a more insecure business environment for foreign firms. Second, attempts to foster domestic alternatives to foreign firms, including through the incubation of high-tech SMEs, could shrink the market available to foreign firms in China and increase competition in third markets in the long-run. Still, for companies with critical tech China’s focus on bottleneck technologies and digitalization of manufacturing also presents new opportunities. The strategic relevance of foreign firms that produce components and technologies China wants stands to increase.

Article: Accelerate the Promotion of a New Type of Industrialization (加快推进新型工业化) (Link)

Issuing body: Qiushi, republished by the MIIT

Date: February 16, 2023

3. Hand-in-hand: Industry leaders unite to develop full value chain capabilities

At a glance: The MIIT together with SASAC (State-owned Assets Supervision and Administration Commission) released an annual update on China’s "complete industrial chain" (CIC) initiative, which seeks to build up domestic capabilities in key technologies where foreign firms have traditionally dominated. The notice specified 16 technologies where groups of companies and universities will cooperate on R&D, product design, materials and process development, as well as testing and mass production. Examples for focus areas and the organizations involved include:

- Industrial robot rotate vector (RV) reducers, led by Qinchuan Machine Tool with five partners, including Siasun Robotics, GSK CNC Equipment and Xi'an Jiaotong University

- Fiber lasers, led by Wuhan Raycus Fiber Laser, together with eighteen partners such as Huazhong University of Science and Technology, the MIIT Fifth Electronics Research Institute, CATL and SAIC-GM

- High-end carbon fiber and aerospace prepregs, split between two groups – each with about ten partners, led by AVIC Manufacturing Technology Institute and Weihai Tuozhan Fiber on the one hand and Zhongfu Shenying Carbon Fiber on the other

MERICS comment: Beijing’s CIC initiative is part of the Made in China 2025 (MiC2025) policy package. The program was first outlined in 2016 and listed an initial 16 focus areas, including robotics components, sensors, high-speed rail rolling stock bearings and graphene. Annual updates have adjusted the target areas and entities in charge of leading technological development. The scheme is designed to promote collaboration between firms situated at different stages along the supply chain, while also bringing research closer to industry to increase the commercialization of research outputs.

Many of the foundational technologies listed in the application demonstration projects since 2016, including robotics, semiconductors and aerospace, have yielded few results so far. The technologies in the lists are predominantly niche and upstream, where the barriers to developing such specialized products are particularly high. Facilitating collaboration between firms on joint product development could be challenging, particularly if they are also competitors. The new list demonstrates that policymakers have not given up, but achieving breakthroughs will likely remain an uphill battle. Hence, the risks of increased competition for European businesses active in these fields would be low to moderate.

Technologies listed in the 2022 "complete industrial chain" notice:

- Industrial robot rotate vector reducer

- High-end additive manufacturing equipment with scanning oscillator

- High-end bearings for rail transportation

- High performance control chips for rail transportation

- High-grade computer numerical control system

- Computer numerical control machine tool spindle, ball screw, linear guide

- Fiber laser

- Display parts exposure machine

- 8.5 generation liquid-crystal display glass substrate

- 5G + BeiDou high-precision positioning system

- High-end carbon fiber and aviation prepreg

- Semiconductor etching gas

- 4-6 inch gallium nitride microwave millimeter wave devices

- 14. Sputtering targets for integrated circuits and high-purity metal purification technology

- Advanced high-performance aluminum alloy material preparation technology

- High-voltage cable insulation materials and shielding materials

Article: Notice on the 2022 "Complete Industrial Chain" Application Demonstration Directions for Key Products and Processes and the List of Promoted Institutions (工业和信息化部办公厅国务院国资委办公厅关于印发2022年度重点产品、工艺“一条龙”应用示范方向和推进机构名单的通知) (Link)

Issuing bodies: MIIT, SASAC

Date: January 30, 2023

4. Industrial Internet pilots and product catalogs advance localization goals

At a glance: To promote China’s Industrial Internet sector, the MIIT released three lists outlining government supported Industrial Internet pilots, apps and software products. In the Chinese context, Industrial Internet refers to the Internet of Things, but also related data- and cybersecurity solutions and industrial software applications.

- The list of Industrial Internet Pilot Projects includes approximately 200 pilots. Examples include a network security classification project by the Zhongtian Iron and Steel Group in Changzhou.

- The list of Excellent Industrial Internet Software Products includes 68 products, most of which are company resource planning, manufacturing operating management system or computer assisted design (CAD) software.

- The list of Excellent Industrial Internet App Solutions (191 in total) focus on specific use cases. For instance, Tianjin Gongyan’s app can be used for carbon footprint accounting for CNC machines.

MERICS comment: Facilitating the incorporation of Industrial Internet technology has been a high priority for Beijing since the MiC2025 strategy and the Internet + Advanced Manufacturing initiative. These lists are designed to accelerate this process and contribute to upgrading traditional manufacturing industries and reducing dependencies on foreign suppliers, like ABB or SAP. As China’s leadership strives to keep the manufacturing share in the economy high and productivity gains have slowed in recent years, boosting industrial upgrading also through Industrial Internet capabilities has only become more important.

For foreign producers, who currently dominate the high-end Industrial Internet applications, the government’s promotion of related pilots and product catalogs is bad news. The fact that none of the lists include foreign companies is testament to Beijing’s desire to create autonomous and controllable (read: free of foreign technology) supply chains in this sector. Indeed, the 14th Five-Year Plan for Smart Manufacturing explicitly calls for indigenous providers to occupy 50 percent of the industrial software market by 2025. Local governments will continue to free up resources for companies in the pilot list. SOEs, and increasingly more private companies, will focus on procuring these government handpicked, and thus ‘politically safe’, software and apps. Over time, foreign manufacturers based in China – especially in potentially sensitive sectors – could be left with no alternative but to use Chinese software.

Article: Announcement on the 2022 Industrial Internet Pilot Demonstration List (关于2022年工业互联网试点示范名单的公示) (Link)

Issuing body: MIIT

Date: February 23, 2023

5. New innovation bases to unite domestic firms on technical standards

At a glance: The Standardization Administration of China (SAC) issued an application guideline for national technical standard innovation bases (TSIB). These bases are to promote high-quality development and upgrade industries by bringing a broad range of stakeholders together. The guideline encourages proposals to bridge research and industry, and to explore new co-development models that involve domestic and foreign actors. SAC will approve up to 20 new bases by 2025, naming as priorities:

- 12 emerging areas: Artificial intelligence, quantum information, blockchain, digital twins, operating systems, high-end chips, high-end equipment, the metaverse, rural digitalization, new generation information technology and the digital economy

- Six key areas for socioeconomic development: Biotech, new energy, carbon peaking and neutrality, lifestyle and healthcare, common prosperity and agricultural high-tech

MERICS comment: These bases are part of Beijing’s efforts to replace imports and set global standards and goals that inform the “National standardization development strategy”. This strategy stipulates that the number of national TSIBs double to 100 by 2025, to spur “self-controllable” co-innovation by Chinese firms up and down the supply chain, and to codify the results in widely used technical standards. That SAC now calls for the addition of a mere 20 more bases suggests a more gradual approach that perhaps stems from challenges with implementation.

Regardless, Beijing remains committed to this approach. This was reiterated by the “Strategy for becoming a quality superpower”, which links industrial upgrading to improving perceptions of domestically made products and the creation of global Chinese brands. Among other things, this requires “building a batch of collaborative platforms on quality standard innovation for industrial clusters” of which TSIBs are the prime example.

As such, these strategies are a continuation of MiC2025. SAC issued its first call to establish 50 national TSIBs in 2017 with an eye to advancing MiC2025, promoting regional development (especially in large city clusters) and linking up with other countries through the Belt and Road Initiative. Six years later the priority areas are instead defined primarily by technologies where the US has a chokehold over China and where China may develop its own asymmetric advantages. Overall, the prospects for international collaboration are greatly reduced.

Article: Application Guideline for National Technical Standard Innovation Bases (2023-2025) (国家技术标准创新基地申报指南(2023—2025年)) (Link)

Issuing body: SAC

Date: February 9, 2023

NOTEWORTHY

Policy news

- January 29: The Ministry of Ecology and Environment (MEE) issued a notice to select and promote advanced technologies that prevent and control solid waste and soil pollution (MEE notice)

- January 29: The National Medical Products Administration approved two domestically developed Covid-19 antiviral drugs, the oral pills SIM0417 (called Xiannuoxin) and VV116, targeting mild to moderate symptoms (NMPA notice, South China Morning Post article)

- February 3: The MIIT launched a pilot program with the goal of making new-energy vehicles (NEVs) account for 80 percent of vehicle fleets run by public institutions in selected cities by 2025, which tasks provincial authorities with choosing several cities to participate and receive associated subsidies (MIIT notice)

- February 7: The MEE released new instructions for provincial authorities on how to manage greenhouse gas emission reporting for enterprises in the power generation industry from 2023 to 2025, including annual emission reporting and verification processes (MEE notice)

- February 8: The State Administration for Market Regulation, together with MIIT, published guidelines for improving the measuring capabilities of enterprises, in areas such as R&D, manufacturing and resource management (SAMR notice)

- February 14: The National Development and Reform Commission issued measures to promote the recycling of decommissioned industrial equipment, particularly to harness metal resources in such equipment (NDRC notice)

Corporate news

- January 31: XPeng Inc. received approval from the Civil Aviation Administration of China to conduct manned tests of its electric vertical take-off and landing (eVTOL) vehicle (Caixin article)

- February 3: Yicai Global reported that China Telecom’s research arm has developed China’s first fifth-generation low-power micro base station using only homegrown chips and devices (Yicai article)

- February 9: Hesai Group, a developer of lidar technologies used in self-driving cars, raised USD 190 million in its initial public offering on the Nasdaq, marking the largest listing by a Chinese issuer in the US since 2021 (Investopedia article)

- February 10: Memory chip producer YMTC reportedly cancels up to 70 percent of its orders from supplier Naura Technology, amid tighter restrictions on the export of US chip technology to China and a slowdown in the global memory market (South China Morning Post article)

- February 13: NEV maker BYD and other Chinese auto suppliers have begun actively hiring, with BYD reportedly signing up new workers for its plant in Zhengzhou (Yicai article)