Mapping China’s global port network: on the backfoot in 2024, but still well entrenched

China’s influence on global ports has seen more setbacks than progress in 2024, with a net decrease in the number of ports it owns outright or operates for third parties, say Clark Banach and Jacob Gunter. But the slight decline in the size of China’s port network should not distract from the fact that it remains largely coordinated from Beijing.

This analysis is a follow-up to a 2023 report on China’s global footprint in critical maritime infrastructure and the implications thereof. The report argued how and why China has expanded its global port influence network and highlighted the risks for recipient countries. In this year’s update, Clark Banach and Jacob Gunter examine where China has gained and lost ground in 2024 and explore possible explanations by looking at both internal factors in China that limited further expansion and external factors that constrained continued growth.

The analysis features a detailed and interactive map. It allows readers to pinpoint a port and access information on how China’s involvement in the facility has evolved and what kinds of contracts are in place. Readers who want to understand how China built its influence – and the risks this poses for countries that host port facilities – should also turn to the earlier publication. For further insights into the project, listen to our latest podcast.

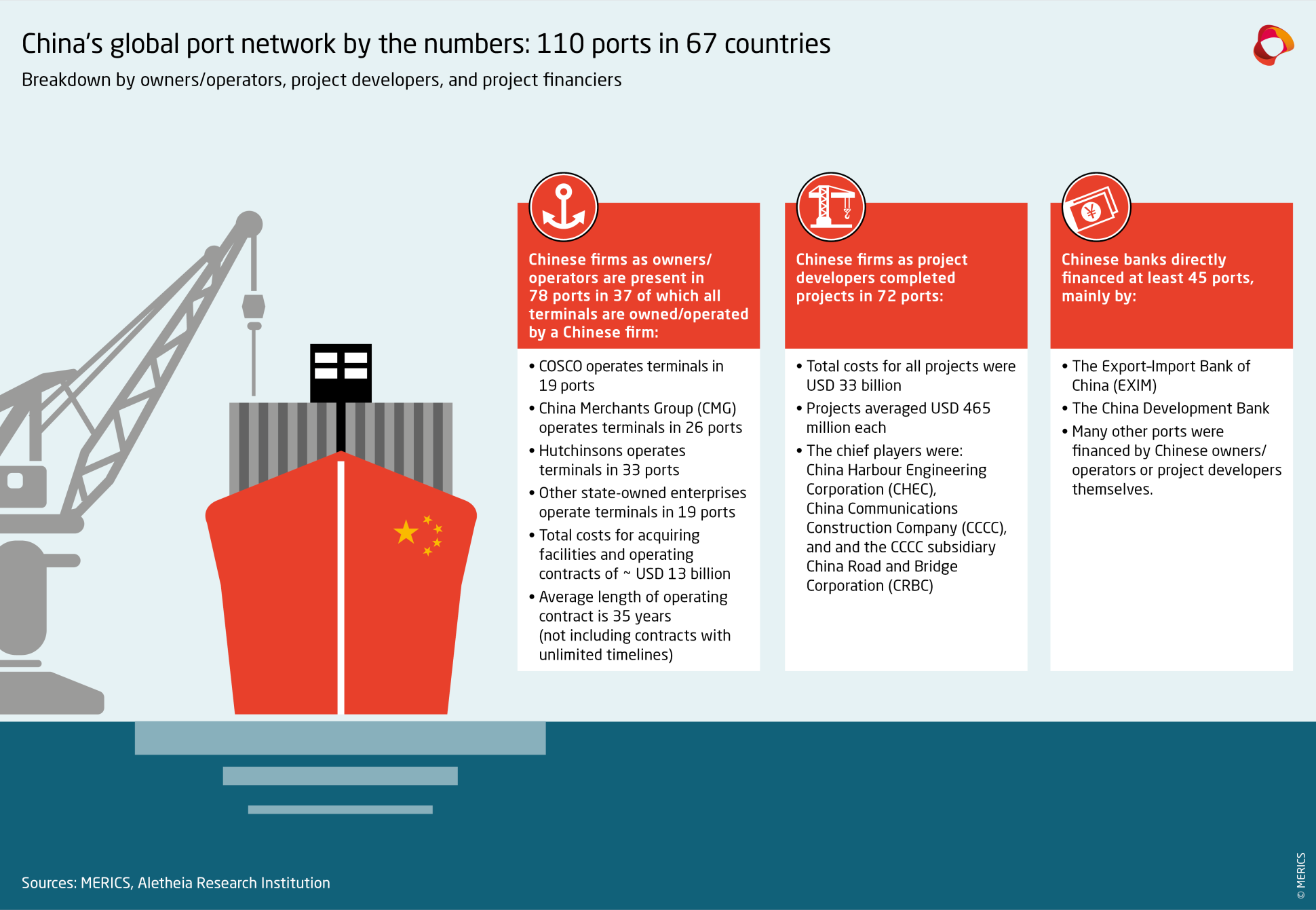

Mapping China’s influence on container terminals – state-owned enterprises run the show

China’s influence on global ports has seen more setbacks than progress in 2024, with a net decrease in the number of ports it owns outright or operates for third parties. Some notable examples include a Chinese state-owned enterprise (SOE) that sold its share in a lease for the port in Melbourne to US interests, a Chinese management company withdrawing at the last minute from a 20-year concession to run the Chinese-developed Lobito Mineral Terminal in Angola, and Hong Kong-based Hutchison Port Holdings failing to get its operating contract for the King Abul Aziz Port in Saudi Arabia renewed.

It is worth keeping in mind that it was never Beijing’s intention to lay claim to every port facility in the world. China’s shippers, port operators and port developers and financiers now have enough say over much of the infrastructure Beijing appears to deem sufficient for its global ambitions. This has shifted the question from how big the network might become to what China plans to do with it now that it seems to have the desired reach.

A slight decline in the size of China’s port network should not distract from the fact that it remains largely coordinated from Beijing. Of the profusion of Chinese companies identified in this study, most are state-owned enterprises– and even the most international among them are not like Western multinational corporations (MNCs). While they pursue business opportunities in the search of profit, they are also directly under Beijing’s control and are often required to meet non-commercial strategic goals set at the center of the party-state. Chinese container shipper COSCO might be smaller than European giants MSC or Maersk, but it is more usefully viewed as part of a network of SOEs coordinated by the State-owned Assets Supervision and Administration Commission (SASAC), which is itself directly under the supervision of the State Council, China’s cabinet.

While most of the Chinese companies identified and mapped below are under the control of SASAC or China’s provincial or local governments, there is one notable exception – Hutchison Port Holdings, a major player in the port industry that is part of the Hong Kong-based and stock-listed CK Hutchison conglomerate. Our analysis distinguishes between Hutchison and Chinese SOEs even though Hong Kong’s autonomy is diminishing and collaboration between Hutchison and mainland SOEs is often close. Since we cannot assess Hutchison’s independence in ways that would be possible in liberal market economies, readers must make up their own minds about on its position within China Inc. Although it is important to note an increase in collaborations between Hutchison’s and SOE’s as well as between Hutchison’s and foreign governments.

Growing domestic and international concern about China’s influence in countries with Chinese-run ports appears to be an important factor in Beijing’s changing fortunes. Chinese investments are becoming increasingly controversial amid some Chinese-led projects that have gone awry, efforts to “de-risk” economies from overt dependence on China, and growing fears about national security risks. For example, following Panama’s election of President Laurention Cortizo in 2019, the Panama Maritime Authority (PMA) was charged with reviewing the concession of a Chinese-led consortium to build a container port, leading to the cancellation of the contract for non-compliance in 2021.

Another factor is the economics of the shipping industry. Ever-increasing port capacity leads to diminishing returns for operators – and does not drive more trade. In addition, the growing number of countries with increased restrictions on Chinese manufactured goods is changing shipping routes, creating excess capacity at some existing shipping hubs and new demand at emerging hubs. Some Chinese port investments could benefit from the latter trend, but several locations that have seen capacity increases thanks to Chinese demand may no longer be economically viable.

Internal factors explain the limits of further expansion

The fact that China is losing some ground in its port projects, ownership, and operations is also driven by domestic considerations. Beijing is currently navigating a difficult economic situation at home, which means it doesn’t have the resources it had at hand during the height of the Belt and Road Initiative (BRI) acquisition and development era. While central and local governments are strapped for cash and struggling to raise funds, China will find it difficult to proceed with some projects and let alone to add many new ones, especially if returns are not guaranteed. Diverting capital to finance a China-supplied 5G network, a solar farm, or electric buses in a developing country is likely to be seen as a better use of resources.

Some port projects have not progressed as Beijing had hoped, requiring changes in strategy to minimize losses. One example is a port project in Venezuela. Because Caracas has failed to stop the country’s economic collapse, Venezuela has little to export in containers and no reason to expect rising demand for Chinese goods. The port project, which was originally intended to be a container port for trade in goods, has been completed as an oil facility. This facilitates Beijing's energy diversification efforts and Venezuela’s wish to pay off some of its debt to China – currently about 10 billion USD.

Ports still have significant value to Beijing

Despite current challenges, Chinese companies are getting better at navigating overseas projects and investments. Chinese executives have gained considerable international experience and are competing more effectively overseas. This is also likely to be the case for port holdings, even as 20 years of expansion plateaus – China’s first-mover advantage means its influence on global shipping – and Chinese companies’ unparalleled market access – are secure for now.

How other port companies adapt will depend on their willingness to pay a premium for (re-) gaining control. In some locations, interested parties may be willing to pay more for strategic or security reasons. But in parts of the world where container-network hubs have shifted away from recently expanded port facilities or where the expected surge in demand never materialized, Chinese companies may end up looking to renegotiate to ditch projects that have become millstones.

In the coming years, Beijing will rely less on creating demand and securing supply chains for industries such as steel, cement, cranes, railways, trucks and other less technologically critical sectors. Instead, the green and digital projects will take center stage as they are expected not only to increase Beijing's influence, but also to create demand for China’s key high-tech companies in telecom equipment, green energy and electric mobility. This will happen as the US, Japan and even Europe increasingly scrutinize the supply chains of these Chinese sectors ever more closely.

About the authors

Jacob Gunter is a Lead Analyst Economy at MERICS. He covers China's political economy, industrial policy, innovation, self-reliance, decoupling, and examines how the EU can better economically compete with China in third markets.

Clark Banach is Program Director at Aletheia Research Institution and a former Futures Fellow at MERICS. His recent research investigates the long-term effects of Chinese-affiliated port projects and an extended Maritime Silk Road on world trade flows.

Acknowledgements

We would like to thank our research partners at Aletheia Research Institution, as well as the OSINT team consisting of Elie Castanie, Michael DiBernardo, Serine Enstad, and Pranoi Raphel Raju, for their tireless dedication to gathering and validating sources for this project.

This analysis is part of the project “Dealing with a Resurgent China” (DWARC) which has received funding from the European Union’s Horizon Europe research and innovation programme under grant agreement number 101061700.

Views and opinions expressed are however those of the author(s) only and do not necessarily reflect those of the European Union. Neither the European Union nor the granting authority can be held responsible for them.