For China, "involution" is a blessing as well as a curse

The same mechanism that generates wasteful investment and a race to the bottom also forges China's national champions primed to crush foreign rivals, says MERICS Senior Associate Fellow Yanmei Xie.

Spare a thought for Chinese Communist party cadres. In September 2023, at Xi Jinping's behest, they plunged headlong into building “new quality productive forces.” Barely two years on, the supreme leader scolded them for overzealous investment in those emerging tech sectors and ordered an all-out campaign against “involution.” As if that is not confusing enough, the party's upper echelon convened this week for its fourth plenum and issued a communiqué calling for acceleration towards manufacturing and technological self-reliance.

At least now Beijing admits to the existence of rampant industrial overcapacity and the many ills it spawns: underutilized capacity, brutal price wars, squeezed corporate margins, and stubborn deflation. “Involution” is simply a buzzy internet shorthand for all these self-consuming pathologies. And the new anti-involution campaign is really a rerun of old struggles against the excess and imbalance bred by state-driven investment. As with past campaigns, any relief—for both Chinese companies and their foreign competitors—will be fleeting.

Local leaders chase investment, growth, and industrialization in a fierce competition

Why does involution defy repeated attempts to purge it? Because the foundational structure of China's political economy breeds it. In the Chinese system, central authorities keep an iron grip on political, personnel, and strategic decisions but grant local cadres wide latitude in economic policy. Regional officials are rewarded or punished not only for absolute achievements but also relative performance against peers. The result is a fierce competition in which local leaders chase investment, growth, and industrialization.

This model has fueled China's impressive economic dynamism, but also reliably generates excessive investment duplicated across regions, especially in whatever sector happens to be the strategic flavor of the day. Central crackdowns can at best temporarily suppress overcapacity or push it to new industries but never eliminate it.

When Xi took power in 2012, he vowed to shift China's economic gear from “high-speed” to “high-quality” growth. Under this new formula, it is no longer enough for local cadres to churn out GDP. They instead must channel resources into industries blessed by the president and steer clear of those that have fallen out of favor. The risks of straying from presidential priorities go far beyond missing a promotion: halfhearted implementation can trigger an anti-corruption probe.

Small wonder that provinces compete to build the biggest AI hub, the largest semiconductor cluster, or the newest EV-manufacturing base. In the first half of this year, the agricultural province of Anhui imported as much semiconductor equipment as coastal manufacturing powerhouse Jiangsu. Shaanxi, better known for coal mines than code, has launched an “action plan” to incubate a CNY 100 billion (USD 14 billion) AI industry within a decade.

The CCP's revolutionary lore likens the party to wild grass, which “defies wildfire and regenerates with the spring breeze”. The same could be said of China's industrial overcapacity.

What begins as glut at home could end as supremacy abroad

However, this does not mean that involution will eventually consume China's industrial machine. On the contrary, the same mechanism that generates wasteful investment and a race to the bottom also forges national champions primed to crush foreign rivals.

Chinese companies that survive grueling involution emerge hardened. They learn to scale rapidly, slash costs relentlessly, and survive on razor-thin margins. Cut-throat price wars at home only sharpen their hunger to capture overseas markets. China now makes 55 percent of the world's steel, 57 percent of commercial vessels, 76 percent of lithium-ion batteries, more than 60 percent of EVs, and 80 percent of photovoltaic products, despite chronic involution gripping these sectors. This manufacturing prowess means Beijing has little incentive to overhaul its system of economic governance beyond periodically pruning the excess of state-directed investment.

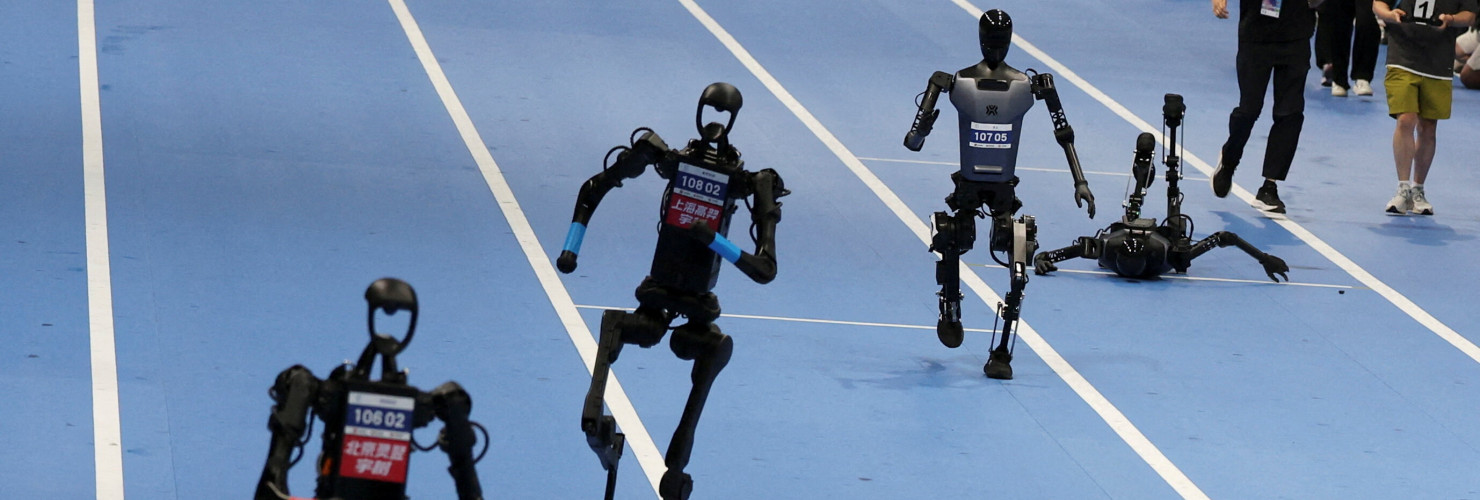

The fourth plenum communiqué reaffirms Chinese full-spectrum techno-industrial ambition by directing efforts to “upgrade traditional industries as well as foster, strengthen, and expand emerging and future industries.” Involution will therefore spread into new domains. The country now has 58 satellite makers and 30 rocket companies and more than 60 humanoid robot manufacturers. Domestic commentators already warn of capacity outstripping demand and of companies needing to “go out” to foreign markets to survive. The pattern repeats itself: what begins as glut at home could end as supremacy abroad.

This article was first published by the Financial Times on October 23, 2025.