European carmakers fuel Chinese innovation

European carmakers are shifting their R&D operations to China, making them willing partners in China’s efforts to become a manufacturing superpower and absorb the global automotive industry’s value chain, explains Gregor Sebastian.

Just over two months ago, on September 29, BMW Brilliance’s full-electric car the iX3 rolled off the production line in Shenyang, China for the first time. To facilitate production, the joint venture (JV) partners - BMW and Brilliance Auto, a Chinese State-Owned Enterprise (SOE), have opened a new battery center which is supplied with cells from Chinese battery giant CATL. To make things convenient, vehicle development also happens locally. The JV partners have run a R&D center in Shenyang since 2017, specializing in electric vehicles (EV) development. For BMW the iX3 is the first, but unlikely the last, EV exclusively developed and manufactured in China for global markets.

At first glance, European carmakers’ recent interest in China as a place for innovation comes at an odd time. While the US and China are weaponizing their economies (see China’s new export control law), and politicians in Europe debate how to make supply chains more resilient, European carmakers appear to be doubling down on their engagement in China.

The reason is twofold: China is the biggest car market and the world’s lead market for EVs. Since 2017, every second EV sale occurred in China - in most cases the model was manufactured by Chinese carmakers. For now, EV’s share of total Chinese automotive sales accounts for only 4.5 percent (1.1 million vehicles annually). But there is high potential for growth. China´s leadership has thrown its political weight behind the success of New Energy Vehicles (NEVs). The State Council has recently approved the NEV 2020-2035 plan that aims to have NEVs, and primarily EVs, account for 20 percent of total vehicle sales by 2025. Having postponed the development of EVs for years European carmakers are now playing catch-up. While they are leaders in developing vehicles with internal combustion engines (ICEs), the changing market environment now requires strategic adjustments in order to defend European market shares and stay profitable in China.

From Made in China to Designed in China

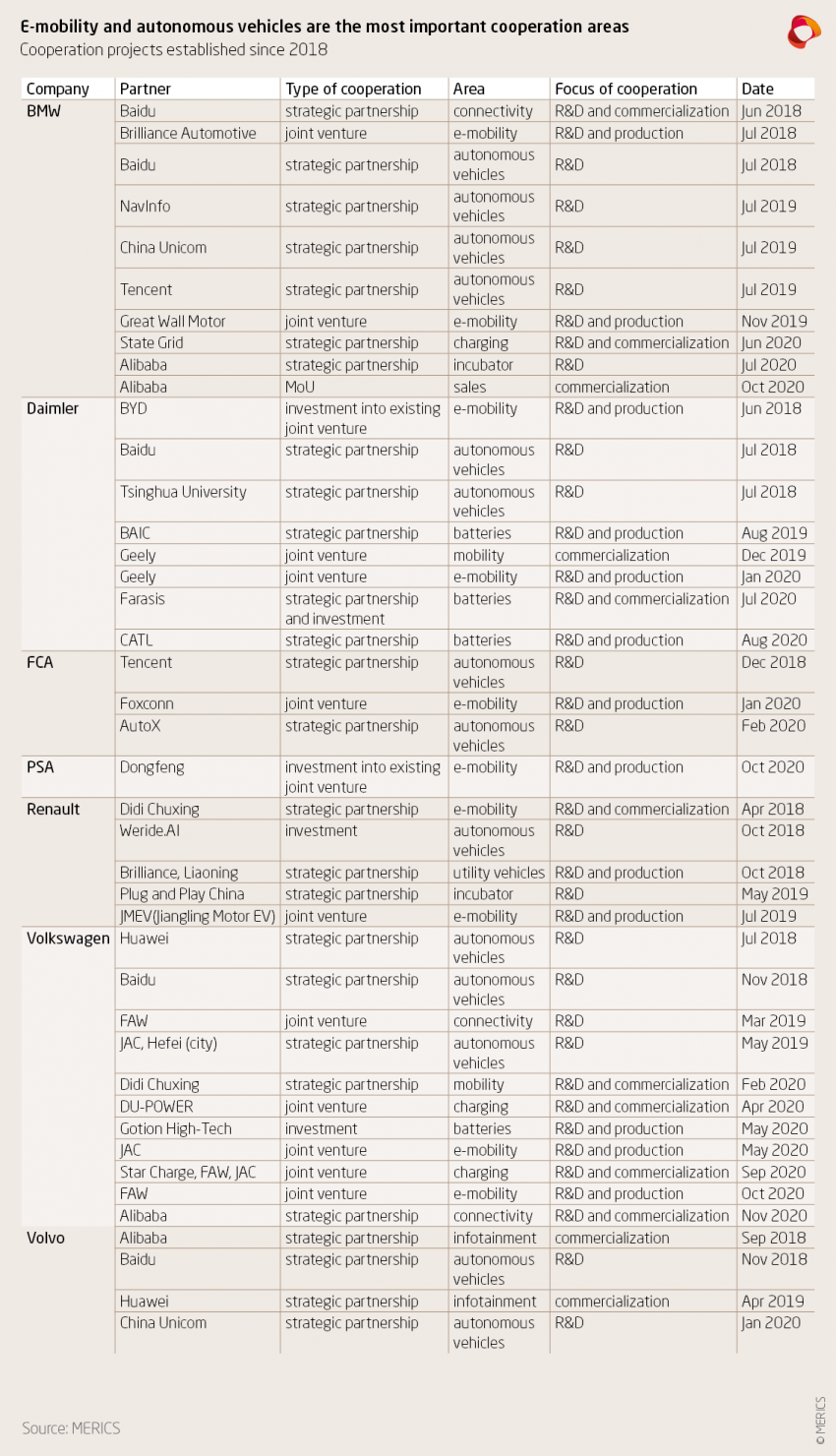

One way to make up for lost time is to partner up - a relatively easy feat when you bring industrial expertise to the table. Indeed, the largest European carmakers (BMW, Daimler, FCA, Groupe PSA, Renault, Volkswagen, and Chinese-owned Volvo) have chosen Chinese partners for 41 cooperation projects since January 2018.

Crucially, almost all partnerships have a strong R&D focus. Roughly half of the R&D projects focus on developing e-mobility solutions with battery makers or Chinese carmakers such as CATL or JAC Motors. The remainder focus on developing autonomous vehicles (AV), often with technology giants such as Baidu, Huawei or Tencent. AV development in China receives considerable government support and the potential market would be huge. As development costs pile up, partnerships help reduce the financial burden.

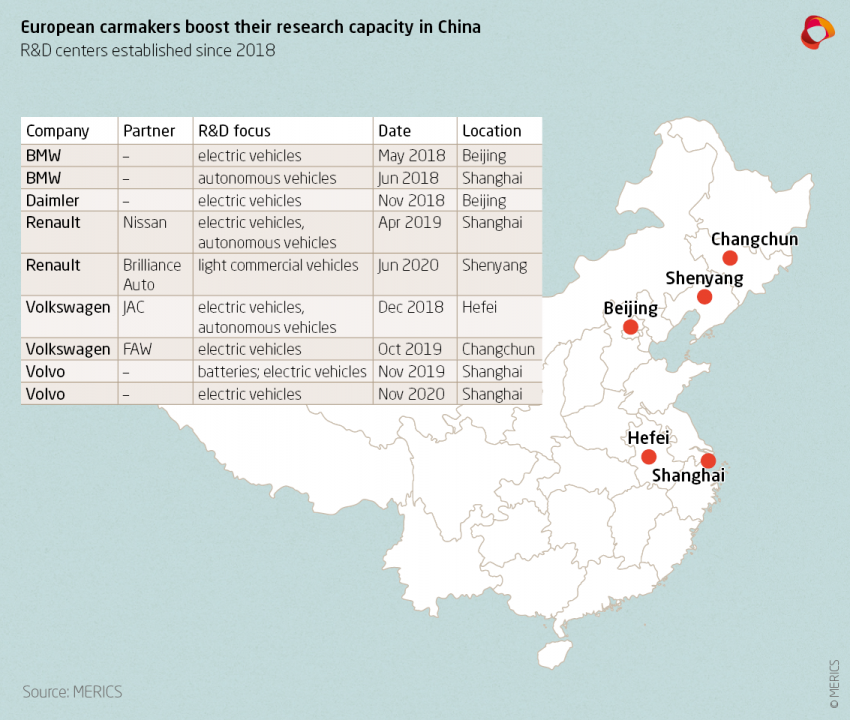

But European carmakers are also not afraid to directly invest in their own R&D centers in China. Since 2018, they have established nine such centers, mainly focused on developing EV and AV technology.

Volkswagen, which hailed China as “centrally important” to its EV expansion, and its JV partners have pledged to invest EUR 15 billion into e-mobility in China by 2024; this is in addition to the EUR 33 billion promised for global R&D investment on e-vehicles. Volkswagen’s recent shopping spree included buying a 26 percent stake in battery manufacturer Gotion High-Tech for EUR 1.1 billion, to strengthen its “electrification campaign in China”. Meanwhile, Daimler’s latest annual report states: “China is not only the world’s biggest car market but also a significant market for new technologies and an important purchasing market.”

Helping Chinese exports conquer the global market

Up to now, most vehicles produced by European carmakers in China were for the Chinese market. Now these companies are visibly shifting to production for export. This will be at the direct expense of European suppliers and production sites. As they develop vehicles using emerging technologies, Chinese tech firms will increasingly be able to export their standards providing them with royalty payments, but also a greater say in future technology development.

Take BMW again – together with its partner Great Wall Motors it founded a new JV in 2018, Spotlight Automotive Limited. Spotlight’s plant in Jiangsu province, with more than 3,000 Chinese employees, will produce the new E-Mini, the iconic British brand, for global markets from 2022. For now, at least, the traditional English brand will also continue to be manufactured in Oxford. For how long is uncertain. BMW recently announced that it would have to let go 400 staff from its British plant – that’s 10 percent of the total.

As for BMW’s JV with Brilliance Auto, which recently produced the iX3, the signs are all pointing to a bright future. In 2018, BMW pledged an additional EUR 3 billion, increasing its ownership share to 75 percent and extending the JV contract to 2040. The German carmaker is also investing in the development of fast-charging technologies together with state-owned State Grid Service EV. The plan is to provide over 270,000 charging piles by the end of 2020. Handy timing, as the new NEV 2020-2035 plan lays focus on these fast-charging facilities to increase the attractiveness of EVs. Above all else, the two partners want to jointly promote their charging technology standards globally.

Too good to be true

For European carmakers, researching new EV and AV technology is indispensable. From a business perspective, relocating R&D to China also seems like a reasonable choice. After all, China’s economic growth in the years to come will ensure high demand and Beijing is keen to support R&D investment in China. However, European carmakers are becoming more reliant on China not only for profits but also for their capacity for innovation. While it is unlikely that Beijing will shut European carmakers out, China’s leadership, ultimately, wants to build stronger Chinese competitors and dominate technological standards. For Beijing, welcoming European carmakers is mostly a means to an end.

More importantly, China absorbing the automotive value chain undermines Europe’s industrial heartlands. Germany will be hit particularly hard. The country is hugely dependent on the automotive sector, which indirectly employs more than 800,000 workers. German decision-makers thought that Germany and China’s economic trajectories would be complementary and have thus far encouraged cooperation projects. Turning a blind eye to China’s economic ambitions might lead to an unpleasant awakening. A future European issue might concern the use of vehicles based on a Chinese technology platform.

When asked last July by the German newspaper Handelsblatt if he was concerned about Daimler’s increasing dependence on China, Daimler’s CEO Ola Källenius remarked: “I hear over and over again this concern about a concentration risk. However, if we were to hold back in China, it would be completely contrary to our growth plans. So that does not make sense.” Carmakers like Daimler appear undeterred by decoupling dynamics and China‘s growing strategic rivalry with the EU. To prevent job and expertise drainage, projects such as the European Battery Alliance are a step in the right direction, but more incentives will be required.