Franco-German tandem on China + AUKUS + Trade and Technology Council

Changes on horizon for the Franco-German tandem on China

The Franco-German tandem has been a driving force of the EU’s China policy, but one of the wheels (France) may take the lead in the coming months, affecting the EU’s stance on China. Germany is likely to be busy with government formation until later this year. Spring elections in France provide a further incentive for French President Emmanuel Macron to take the lead of the EU’s ongoing revision of its China policy. First Afghanistan, then the security alliance AUKUS between the US, UK and Australia have provoked additional discussion on the bloc’s foreign policy, and cast a shadow over Transatlantic alignment.

Berlin and Paris have shaped the EU’s position on China

France and Germany have a track record of coordinating their China policies and shaping the EU’s position on China. Their consensus played an instrumental role in the development of the EU investment screening mechanism in 2018 and the conclusion of negotiations on the Comprehensive Agreement on Investment (CAI) in 2020.

Chancellor Angela Merkel and Macron have also been pooling their political capital in interactions with China to support and steer the EU’s China policy. The pair, alongside two subsequent Presidents of the European Commission, jointly met with President Xi during his visit to Paris in 2019 and participated in the official call following the conclusion of CAI negotiations. They also engaged Xi in April, attempting to stabilize EU-China relations after the mutual exchange of sanctions.

The motivations of the two actors differ, as Germany is more concerned with economic relations while France is focused on developing European strategic autonomy. However, both agree on the need to keep the dialogue with Beijing open while mitigating the risks presented by China, and together they have influenced the general line of EU China policy.

The dynamics of this coordination may, however, be about to change.

German elections limit foreign policy clout

The results of the elections in Germany have not provided a conclusive indication of the post-Merkel direction of German China policy. The SPD’s Chancellor candidate Olaf Scholz, whose party narrowly won the most votes, has not clearly indicated his stance on China, leaving options open. But should the SPD form a coalition with the Greens and FDP, their calls for a more assertive stance on China may make it into Berlin’s official line. Although it does not look likely at this stage, the talks could still lead to the CDU/CSU retaining their position in the ruling coalition and a continuation of their engagement policy towards China. In either of the scenarios, however, it is unlikely for German China policy to change drastically given the existing economic interests of the country.

Regardless of what direction the new administration takes, forming a government and articulating its position on China will take weeks, if not months. During this transition period Berlin’s oftentimes more moderating voice is bound to be heard less in EU debates on China policy, especially with Angela Merkel stepping down.

French elections and Council Presidency provide Paris with momentum

The spring elections in France will coincide with the French Presidency of the Council. The overlap is likely to incentivize Macron to take a more proactive and assertive stand at EU level. That would include on China policy, possibly doubling down on the EU’s strategic autonomy. The creation of AUKUS, partially at France’s expense, will also weigh in on the direction the French Presidency of the Council takes.

Nonetheless, different preferences within the EU will put a strain to France’s ambitions. Not all EU member states are ready to buy into an ambitious agenda for strategic autonomy.

Driving on one wheel

Germany’s focus on domestic matters will give France more opportunities to lead EU China policy debate in coming months and seek to advance its bold foreign policy vision of European strategic autonomy. In response, Beijing may well try to leverage the shift and court the French administration by reiterating its support for the strategic autonomy agenda – that is, as long as its edge is aimed at the United States and not at China.

However, with diminished support from its German partner, France may face pushback from smaller European member states, leading to a more heated internal debate about European foreign policy. Central and Eastern European members in particular are not comfortable with the French President’s reservations towards NATO and the United States.

The informal European Council discussion on China organized by the Slovenian Presidency in early October will be the first test of whether France can take a lead on European China policy. Exploring options to support Lithuania, which has been a target of China’s economic coercion, would be one easy way for the Elysée to alleviate some of the concerns of its CEE partners and boost its standing by sending a message of European unity.

Read more:

China Debates: AUKUS and the EU’s Indo-Pacific strategy – how China reacted

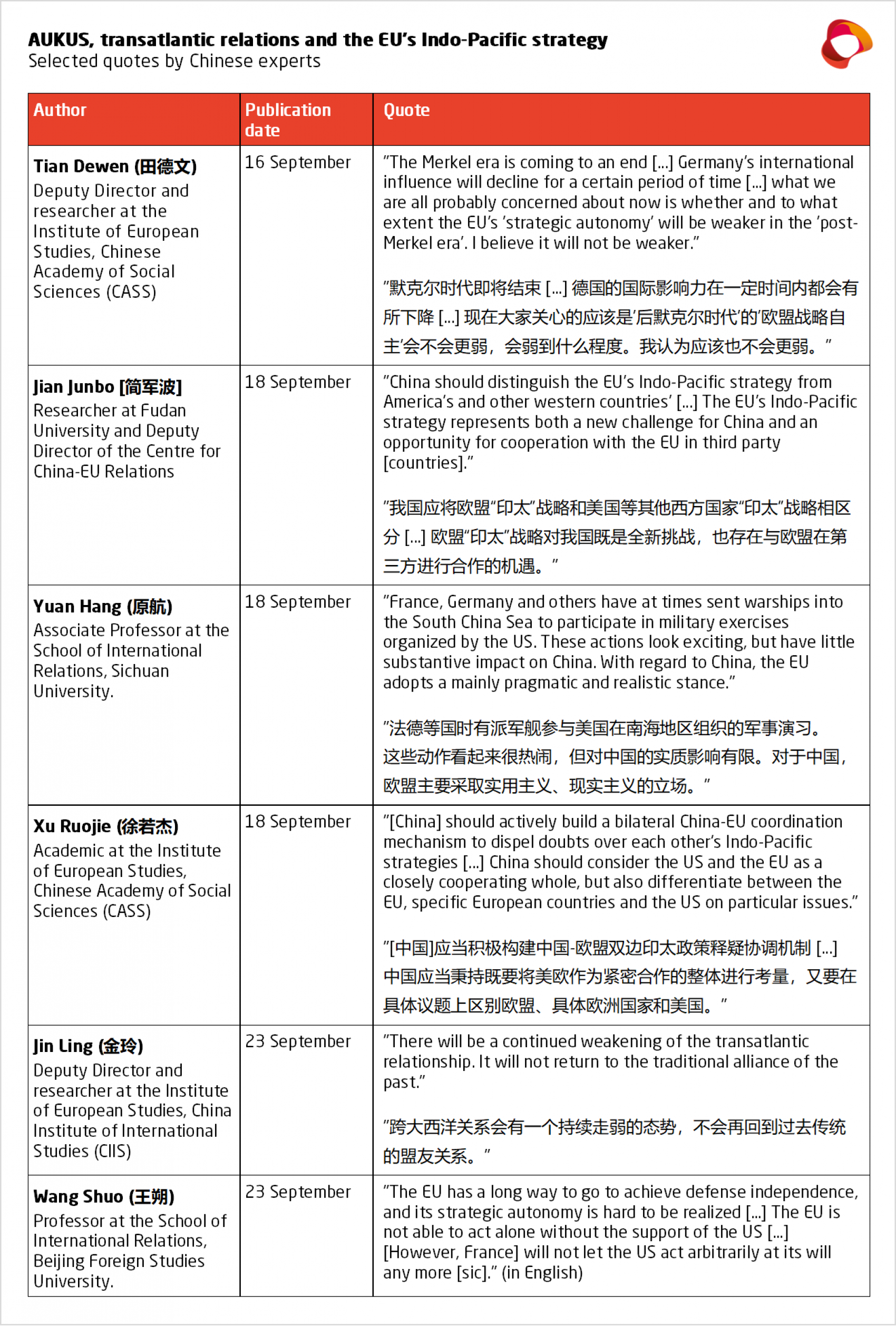

The announcements of AUKUS on September 15, followed a day later by the EU’s Indo-Pacific strategy, spurred much debate among China’s intellectual elite. While the former is perceived as a direct threat to Beijing’s interests in the region, the latter is viewed as relatively benign. Strengthening ties with the EU continues to be the guiding principle advocated by Chinese analysts.

Chinese reactions to AUKUS

In its characteristic fashion, the PRC’s Ministry of Foreign Affairs (MFA) was quick to lambast AUKUS for all its alleged flaws and “Cold War zero-sum mentality”. Chief among the MFA’s criticisms is the arguably legitimate claim that AUKUS poses a threat to nuclear non-proliferation in the world. Chinese analysts share this view. Like their government, they appear concerned that the new trilateral security partnership could hasten a military build-up in the region and create instability.

A recent seminar, organized by Tsinghua University’s Center for International Security and Strategy, called on Beijing to “take active measures” to counter both AUKUS and the general politicization of the Indo-Pacific. No reference to a direct military response was mentioned explicitly, but China’s expansion and modernization of its military continues apace in the meantime.

Worsening transatlantic relations bode well for EU-China relations

While AUKUS is evidently perceived by many in China as a serious national security threat, the recent diplomatic fall-out between Paris and Washington over this issue has highlighted what they see as fundamental fissures in EU-US relations. This makes, in their eyes at least, a concerted military effort by the EU and Washington to confront China in the Indo-Pacific less likely.

Chinese analysts have been predicting that the recent EU-US rapprochement would not last. All point to the deep-seated distrust that allegedly now plagues relations between the two. With Germany now searching for Merkel’s successor, a historically US-sceptic country (France) is expected to become the main driving force, in the short term at least, behind EU policymaking. This is good news for China. Rarely have the Chinese been so confident about the EU’s push towards strategic autonomy.

The EU’s Indo-Pacific strategy seen as “toothless”

It is against this background that Brussels’ recent Indo-Pacific strategy was received. Security cooperation between the United States and the EU will necessarily continue, most say, but the EU will increasingly be trying to reduce its dependence on Washington.

Jin Ling, an analyst at the China Institute of International Studies (CIIS), argues that the EU is less interested in the Indo-Pacific than Washington. The EU’s main focus, she says, will remain on the security threats coming from its own neighborhood.

Xu Ruojie, a researcher at the Chinese Academy of Social Sciences (CASS), agrees and uses a recently published poll by ECFR to contend that many EU member states have little interest in getting too involved in the Indo-Pacific. He calls on his government to “take advantage of the differences within the EU, consolidate China’s ‘circle of friends’ there” and “increase bilateral contacts and policy coordination with France, Germany and the Netherlands” (the only three member states to have their own Indo-Pacific strategies).

Most analysts in China remain highly skeptical of the EU’s ability to muster the financial and military means needed for its Indo-Pacific strategy to succeed. Jian Junbo, an academic at Fudan University, holds that the EU’s interest in the region should not only be seen as a challenge to China, but as an opportunity to cooperate with Brussels on a wide range of issues. He nevertheless advocates “establishing China’s own regional policy towards the Indo-Pacific in order to better address the pressure brought to bear by the West”.

Implications for the EU

If these views reflect some of the thinking going on in Zhongnanhai, then Chinese leaders are likely to view the EU’s Indo-Pacific strategy as largely inoffensive – at most an irritant, for now at least. Beijing looks set to continue focusing most of its attention on finding ways to encourage the EU’s strategic autonomy and on fostering closer ties with Brussels and certain EU member states. Paris will no doubt be a key target of Beijing’s courtship in the months to come.

Analysts in China are also expecting a degree of turbulence, at least in the short term, in Berlin’s relations with Beijing, particularly if the Greens come to power in some kind of coalition. But as Dong Yifan recently put it, “China has the confidence and patience to wait for the warm spring of China-Germany ties”. The Franco-German tandem is too important for Beijing to jeopardize.

The unusual call by a CASS researcher for his government to use political differences among member states to its own advantage is also of note and could signal the potential for a renewed push by Beijing to foster some degree of discord within the Union when it comes to the Indo-Pacific and China.

Read more:

- Speech by Tian Dewen at the annual meeting of the China-Europe society [CN]: Franco-German cooperation and the future of the EU's "strategic autonomy" (Quote 1)

- China-CEEC Think Tanks Network – Expert write-up [CN]: Evaluating the EU's Indo-Pacific strategy (Quote 2, 3 and 4)

- Speech by Jin Ling (abridged version) at the annual meeting of the China-Europe society [CN]: Rebuilding EU-US relations – from allies to partners? (Quote 5)

- Global Times op-ed by Wang Shuo: Will France play ‘NATO withdrawal’ card after being stabbed in the back by US? (Quote 6)

Buzzword of the week

3 in 1

This week has witnessed a flurry of activity aimed at reigniting Europe-China relations. European actors held three high level meetings with China, starting on September 27 with a high-level Dialogue on climate between Commission Vice President Frans Timmermans and China’s Vice-Premier Minister Han Zheng. On the same day, NATO Secretary General Jens Stoltenberg held a meeting with China’s Foreign Minister, Wang Yi. Finally, on September 28, HR/VP Josep Borrell and Wang Yi co-hosted an EU-China strategic dialogue. These meetings opened the way for an attempt to bring back an agenda with more space for cooperation. However, they have also highlighted how stark differences remain.

Read more:

Trade and Technology Council makes some headway despite tensions

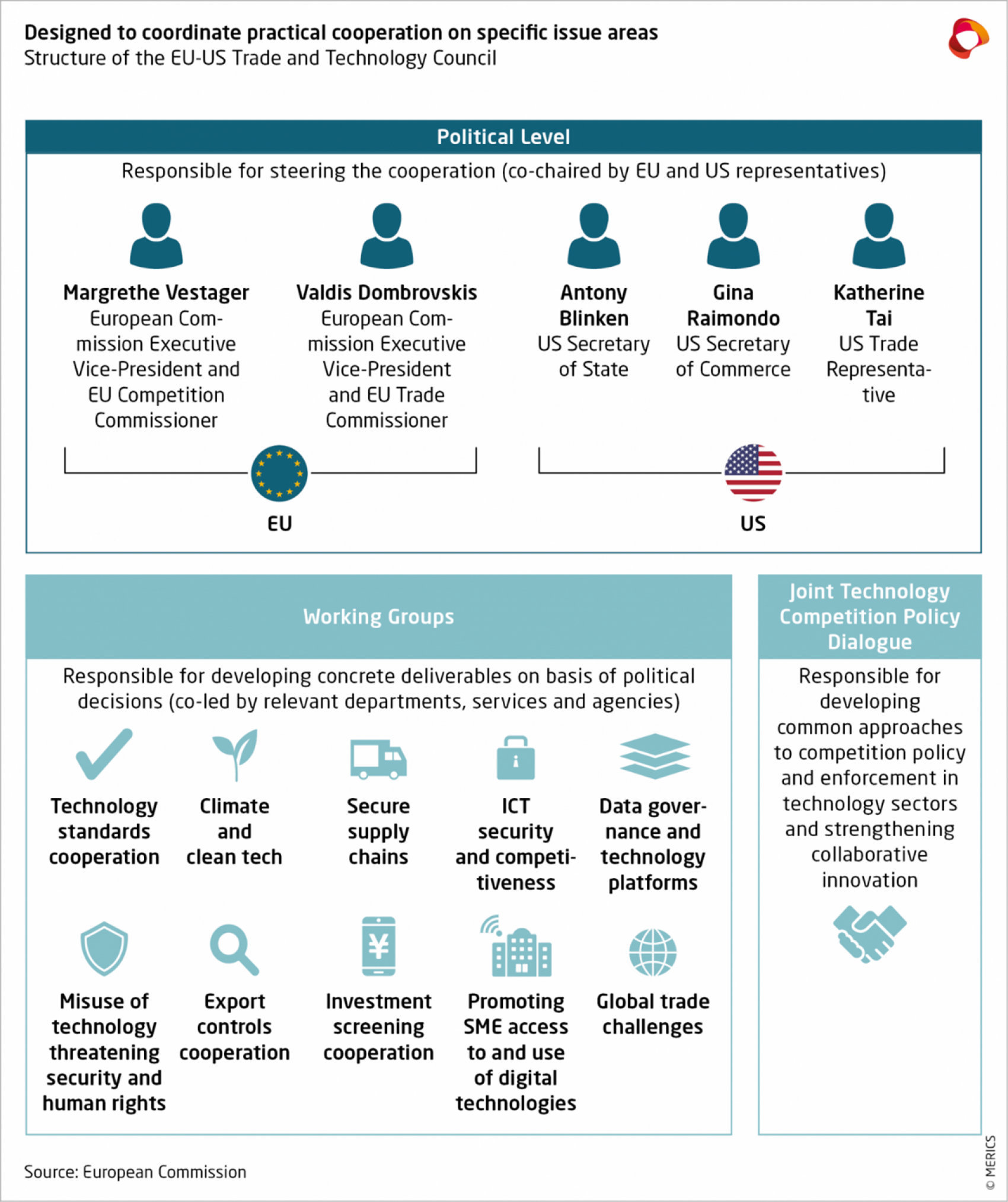

The first official meeting of the EU-US Trade and Technology Council (TTC) took place in Pittsburgh on September 29.

What you need to know:

- What’s TTC: The council was initially proposed by the Commission in December 2020, is an effort to align the trade and technology policies of the transatlantic partners. See details below:

- Controversies: The fate of the meeting hung in the balance last week as Paris unsuccessfully lobbied for the TTC to be postponed in the wake of AUKUS and later sought to alter points on semiconductors, global trade, and add emphasis on EU strategic autonomy.

- Outcomes: The EU and the United States agreed to:

(1) regularly exchange information on investment screening trends and practices,

(2) conduct technical consultations and information exchanges on export controls including dual-use technologies with specific action plan for next steps,

(3) jointly work, alongside like-minded partners, towards development of trustworthy AI regulations respecting human rights,

(4) cooperate on reducing strategic dependencies in semiconductor value chains, but no clear commitments were mentioned,

(5) tackle shared global trade challenges with particular interest in updating the WTO rulebook and addressing distortions by non-market economies in fields such as labor standards or unfair competition.

Quick take: The successful inaugural meeting of the TTC provides the EU and the United States with a framework for further cooperation. While China is not explicitly mentioned in the statement, the topics covered signal that the transatlantic partners are eager to build a shared position on issues linked to economic security and promotion of values affected by China.

However, translating the broad alignment into concrete actions that go beyond exchange of information and tackling other issues on which their views and interests diverge, such as data transfer regulations, will show the extent to which TTC constitutes a quality change in transatlantic coordination. Further work on TTC will be as challenging as it is vital.

Read more:

- European Commission: EU-US Trade and Technology Council Inaugural Joint Statement

- Politico: EU envoys create 11th-hour hitch for transatlantic tech alliance

A sudden strategic dialogue between Borrell and Wang

The EU and China held the 11th Strategic Dialogue on September 28. The exchange, which normally precedes the annual EU-China summit, came abruptly this time, and amid an already busy agenda.

What you need to know:

- Timing: Plans for the meeting were announced only a few days beforehand. At the time, the EU was still busy dealing with the aftermath of AUKUS, the Quad summit was taking place, Germany was getting ready to go to the polls and the dialogue was scheduled for the day before the long-awaited TTC.

- The agenda: The agenda included amongst others the situation in Afghanistan and Myanmar, the EU’s Indo-Pacific strategy, climate change and the pandemic. As announced, the EU did not shy away from difficult issues such as human rights and Taiwan. Borrell wished for the restarting of an EU-China Human Rights Dialogue before the end of the year. While committing to the “One China Policy”, the High Representative stressed the interest of the EU and member states to further develop the relationship with Taiwan.

- EU-China: HR/VP Josep Borrell reaffirmed the EU’s commitment to a multifaceted approach towards China. In early October, among other issues, leaders will also debate Borrell’s soon-to-be-released proposal for an updated China strategy. They will also discuss when (and where) to hold the next EU-China summit.

Quick take: At a time when communication between the EU and China is scarce, exchanges between counterparts are welcomed. However, in emphasizing the EU’s commitment to all the dimensions of its approach to China, the High Representative implicitly suggests that despite the desire to reopen collaborative channels, the relationship will retain its competitive and systemic rivalry aspects. One notable absentee is the direct reference to Lithuania. The matter is nonetheless indirectly present in the communication of the EU’s intentions towards Taiwan without singling out one member state.

Read more:

The EU Chamber of Commerce warns about an inward-looking China

The EU Chamber of Commerce in China (EUCCC) released its “European Business in China Position Paper 2021/2022” on September 23. The document calls for a renewal of China’s “1978 spirit of reforms” and warns of the long-term risks of an inward-looking China.

What you need to know:

- Vision: Assessing the perspective for EU business in the upcoming year, the position paper focuses on China’s implicit pledge for increased self-sufficiency and the cost that might bring to European businesses in China as well as to the country itself. The document concludes that, in the long term, such an approach could cause China’s GDP to be 65 percent lower than in a scenario where it adopts comprehensive opening reforms. However, in the short term, European business will still benefit greatly from China’s market – even with all the limitations in place – as up to 2026, China will still provide one fifth of global growth.

- 14th Five Year Plan: The FYP brought good and bad news for EU businesses in China. The good news is the focus on quality – an area where many European enterprises can make a valuable contribution. The bad news is the objective to increase self-sufficiency, reduce the role of foreign companies in China and increase the level of dependence of foreign markets on China.

- Self-sufficiency: The pledge for self-sufficiency and a mercantilist economic approach will cause increased international pushback, making it more difficult for China to become a technological superpower and reach its 2060 carbon neutrality target.

Quick take: The space for optimism is narrowing. Even opportunities for European businesses, such as the contribution to quality-focused production, will be short-lived if China’s overall approach remains to reduce dependence on the outside world. That is probably the reason behind the recurring plea for a change of direction in China’s economic approach. Without that, the future of European business in China looks challenging.

Read more:

- European Chamber of Commerce in China: European Business in China Position Paper 2021/2022

Chinese smartphone giant Xiaomi investigated in Europe over dormant censorship software

Lithuanian Defense Ministry advised citizens “to not buy new Chinese phones, and to get rid of those already purchased” following a report released on September 21 by its National Cyber Security Centre.

What you need to know:

- The report’s findings: In the course of examining three Chinese smartphone models, the Lithuanian authorities claim to have found a censorship function in Xiaomi’s Mi 10T 5G phone. The phone’s system applications can allegedly identify and censor 449 terms in Chinese, although the function is deactivated for the European market. The phone reportedly also sends encrypted data to a Singaporean server. The researchers also identified a security flaw in Huawei’s P40 5G but found no issues in the OnePlus 8T 5G model.

- It’s big: In the second quarter of this year, Xiaomi became the top smartphone seller in Europe, having shipped 12.7 million units to the European market. Much of that is owed to the decline in Huawei’s smartphone sales, after the company lost access to Google services and faced controversy around its 5G equipment.

- Xiaomi’s response: Xiaomi denied the accusations and said that it follows GDPR regulations. The company claimed that it only uses advertising software that protects users from such content as pornography or offensive materials, describing this as an industry standard. Xiaomi also said it engaged third-party experts over the Lithuanian report, without providing further details.

- German investigation: On September 25, the German Federal Office for Information Security launched its own investigation into Chinese smartphone manufacturers.

Quick take: If the results of the Lithuanian study are supported by further investigations, Chinese smartphone makers may become another point of tension in EU-China relations, similar to 5G equipment.

Already several European member states, including Germany, do not permit officials to use Chinese smartphones in their professional capacities. The findings may prompt discussion on the creation of EU guidelines making such security measures common practice across the bloc, which would be a hit for Chinese manufacturers.

Read more:

Short Takes

Greek Parliament approves COSCO’s Piraeus deal despite controversy

On September 30, the MPs supported the amendment that would see COSCO increase its 51 percent stake in the port of Piraeus by additional 16 percent.

- Efsyn.gr [GR]: SYRIZA and KKE demand roll-call vote for the transfer of 16% of PPA to Cosco

- Financial Post: Greece paves way for China's COSCO to raise Piraeus Port stake

European Economic and Trade Office in Taipei released “2021 EU-Taiwan Relations” report

The publication points to links between the EU’s Indo-Pacific strategy and EU-Taiwan relations. A follow up to last year’s inaugural EU Investment Forum in Taipei is scheduled for October 14 (online).

- European Economic and Trade Office: 2021 EU-Taiwan Relations published

- Nikkei Asia: EU split on Taiwan question as it fears fraying China ties

- Körber Stiftung: Escalation in the Taiwan Strait: What to expect from Europe?

Czech Republic bans Chinese and Russian presence from its nuclear power plants

The bill, signed by Czech President Miloš Zeman, covers all major energy sources and also affects the Dukovany nuclear power plant project.

- The Prague Monitor: President excludes Russia and China from Dukovany tender

- Hospodářské noviny [CZ]: China expects Czechia to reconsider the exclusion of Chinese companies from the completion of Dukovany

UK Ministers discuss removing China General Nuclear from Sizewell C nuclear power plant

The UK government could use state funding to replace the GBP 20 billion contract that would have given CGN a 20 percent stake in the plant.

China’s logistics giant COSCO inks deal over Tollerort terminal in Hamburg

Under the deal with Hamburger Hafen und Logistik AG (HHLA), COSCO will gain a 35 percent stake in one of the four container terminals at the Hamburg port.