Trump 2.0 and China's EU policy + MERCOSUR + Trade tensions

Analysis

Trump 2.0: How will China adjust its Europe policy?

By Francois Chimits and Grzegorz Stec

The overarching goal of China’s Europe policy has long been to drive a wedge between the EU and US to prevent a common transatlantic China agenda. But the election of the mercurial Donald Trump puts Beijing’s Europe policy to the test.

China’s leaders are hoping for a self-inflicted transatlantic split but are equally concerned about a deal or pressure on European allies to align with intensified US efforts to contain China. Even if not fully formed or articulated, broad strokes of Trump’s agenda are clear – increase pressure on China, push allies to increase defense spending, use tariffs with the goal of reindustrializing the US and strike favorable deals that leverage America’s comparative advantage in bilateral relations.

Just what Trump ultimately aims to achieve with his China strategy and how exactly he wants to achieve it are, however, less clear. His cabinet nominations include people with a wide range of political viewpoints – traditional neoconservatives, newcomers without political experience, and even conspiracy theorists. This personnel line-up, the experience of Trump’s previous term, and his campaign promises offer three broad scenarios, each with a distinct impact on EU-US and EU-China relations:

Trump the transactional dealmaker. In his first term, Trump often followed the transactional strategy of leveraging uncertainty and pressure to secure deals intended to boost US exports. The 2020 Phase 1 trade deal with China exemplified this mercantilist approach. A similar deal now could harm EU commercial interests, as European exports often compete with US products. Additionally, heightened US-China trade tensions risk diverting even more of China’s overcapacity exports toward the EU.

Trump the anti-globalization unilateralist. Trump’s closer interactions with the far-right arm of the Republican Party point to a more isolationist and unilateral agenda. This may mean a return to the US withdrawal from climate commitments, the weakening of external security commitments, a general increase in tariffs with breach of WTO rules and rejection of multilateral institutions. It would open the door for China to approach Europe as a potential partner to maintain the stability of selected multilateral initiatives, but Beijing will also likely use the instability to push his own agenda of readjusting the international order.

Trump the China-container-in-chief. Trump may also prioritize his hardline approach and all-out strategic competition with China, including sweeping tariffs, such as the proposed 60 percent tariff on all imports from China. Many of the people slated to join his team, including the nominees Secretary of State Marco Rubio, National Security Adviser Mike Waltz, and Trade Representative Jamieson Greer, favor a structured containment policy aimed at not just managing competition with China but winning it outright. For the EU, this could mean heightened pressure to align with a more aggressive China policy from its key security ally and a vital energy provider.

Ultimately, Trump’s second term is likely to present a confusing mix of these scenarios. Many initial signals, such as proposed tariffs, remain uncertain – leaving open whether they are flexible negotiation tactics or part of a broader agenda.

Beijing is preparing for all scenarios

With domestic economic challenges, Beijing is more vulnerable, but it is also more prepared. Compared to 2017, China has significantly bolstered its toolbox for withstanding external pressure, be it through enhancing legal and regulatory means to counter and retaliate against foreign sanctions, revamping export control regimes, replacing foreign inputs into critical technologies or, more recently, releasing an underwhelming stimulus package, leaving space for stabilization measures once the Trump-related disruptions materialize.

Amid all those adjustments, two fundamental objectives of China’s Europe policy are set to remain: (1) Preventing transatlantic alignment that Beijing fears could lead to coordinated China containment or Indo-Pacific involvement of NATO. (2) Preventing EU market and tech access restrictions to maintain economic stability and alleviate pressure from the closure of the US market.

In turn, the tactics and tools China deploys may change under the new geopolitical reality created by Trump’s return to the White House – likely with more carrots for Europe at first to capitalize on likely transatlantic tensions.

In 2020, Biden’s electoral victory pushed Beijing to offer concessions in the previously stalled negotiations of the Comprehensive Agreement on Investment (CAI). This time, China may similarly offer a breakthrough in ongoing consultations on Chinese electric vehicle (EV) exports. For instance, Beijing is currently forcing a unique negotiation with its party-state controlled business association. But Beijing might consider accepting the EU’s demand of firm-specific deals on minimum export prices for China-made EVs, to offset China’s heavy subsidies and supportive measures and stave off price dumping. Once the deal is reached, China could then drop the retaliatory measures that it imposed in response to the EU’s EV tariffs, such as targeting European pork or brandy exports.

Such a move would aim to show Europeans that the EU’s more moderate and rules-driven approach to dealing with tensions with China is starting to work and that alignment with the assertive US, which is not always fully aligned with Europe’s best interest, is not the only option that works in dealing with Beijing.

Measures will likely involve “trading” EV investments in selected member states against some favorable political position by the corresponding capital as well as proposing to help stabilize Trump’s disruptions to international climate policies and multilateral bodies by displaying a more cooperation stance to European craving for international stability. For instance, during Trump’s first term, the EU and China cooperated in establishing a Multi-party Interim Appeal Arbitration Arrangement to unlock the WTO dispute settlement system derailed by Trump blocking new appointments to the appellate body.

Yet, it is not just carrots. China is also preparing sticks that can be used against both the US and the EU. Threats of further export controls on critical minerals or the punishment of member states for voting in favor of the EU EV tariffs are among the tactics it could deploy.

China’s approach to Europe will depend on both EU-US relations and on the EU’s assertiveness, credibility and unity. The EU managed to pass the test of imposing tariffs on China-made EVs, but China will carefully watch Europe’s reaction to receiving “conclusive” intelligence of China-based production of military drones for Russia to deploy in Ukraine. Such instances shape Beijing’s perception of how seriously it needs to take Brussels and the EU at large.

For Europe, coordination and clarity of goals will be key

Both Washington and Beijing will be eager to maximize their bargaining power with the EU by focusing offers and pressure on individual capitals. The months ahead will be a test of whether member states can restrain short-sighted bilateral impulses. Building a more coordinated European approach remains the best long-term strategy, even on national security matters.

Amid China’s softer tone in intensified bilateral diplomatic exchanges and potential new offers, the Europeans should not lose sight of Beijing’s position strategically important issues. China is unlikely to give ground on issues of fundamental divergence – whether China’s challenge to European security architecture through its support of Russia, European economic competitiveness issues stemming from differences in economic models, or the conflicting positions on the rules-based international order.

It does not mean all of China’s offers should be rejected outright, but any deal must be weighed against the strategic divergence of interests and the collateral cost to transatlantic discussions.

The safest investments lie in enhancing European resilience measures, boosting credibility through making use of measures like the anti-coercion instrument and enhancing Europe’s competitiveness. Such moves can yield returns in all geopolitical scenarios and are therefore the best bet for results, as they emanate from Europe’s own agency rather than reactions to changes in US-China dynamics.

Read more:

Soapbox-MERICS Data Highlight

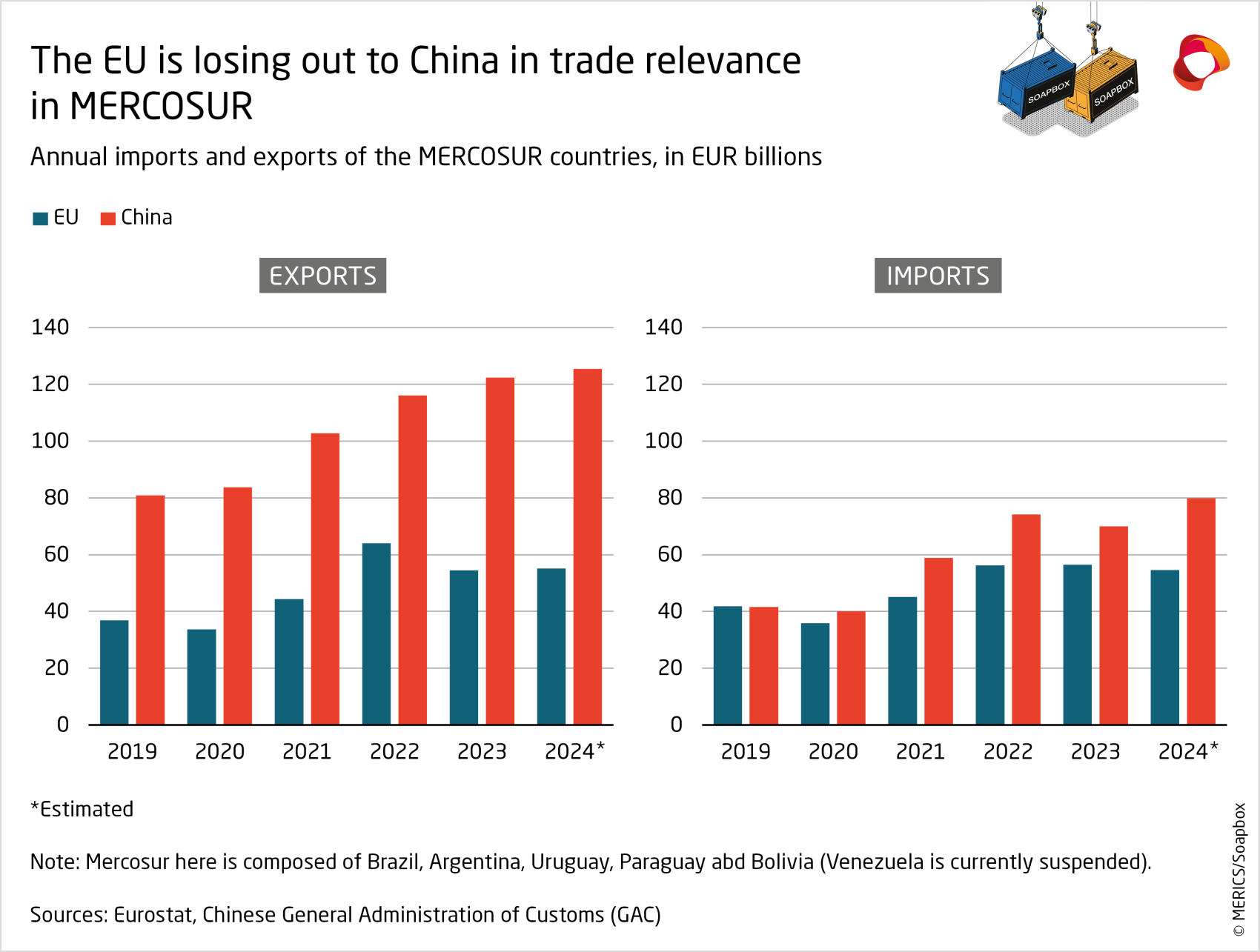

While the EU trade agreement with MEROCSUR is still pending, China is gaining trade grounds in the region

The Soapbox-MERICS Data Highlight offers data visualizations of EU-China economic relations. We have partnered with trade specialist Rafael Jimenez Buendía, Lecturer of International Trade at Taltech University in Tallinn, Estonia, and co-founder of “Soapbox,” a free weekly newsletter focused on China trade. In this edition, Rafael and MERICS economics analyst François Chimits examine why the EU is losing ground to China in trade with the MERCOSUR countries of Argentina, Brazil, Uruguay, Paraguay, and Bolivia (Venezuela is currently suspended).

Rafael Jimenez Buendía:

China's trade with MERCOSUR is accelerating at a pace that outstrips the EU's, underscoring China's expanding influence in the bloc. Imports to the region from China have grown almost three times faster than from the EU in recent years, while its exports to both partners are seeing similar growth.

China has a substantial trade deficit with the MERCOSUR bloc, driven exclusively by its demand for commodities like soybeans, mineral ores, crude oil, and meat. Notably, China has shifted to sourcing soybeans primarily from Brazil instead of the US. In return for commodities, China exports a variety of manufactured goods to the MERCOSUR bloc, from cars to photovoltaic panels. With strong demand from Brazil, China’s electric car exports MERCOSUR are expected to have jumped in 2024 to around $2.6 billion, up from only $100 million two years ago.

MERICS Senior Economist François Chimits:

The EU and MERCOSUR are “very close” to finalizing their 25-year negotiation of a substantial trade pact, the European Commission stated in mid-November. Such an agreement would see the South American block lower its trade barriers on European industrial products in exchange for better access to the European market for agricultural products.

At a time when trade is contested and European farmers politically strong, geo-economic competition with China for markets and key supplies appears to be a determining factor for such a deal. The incoming EU quasi-foreign minister, Kaja Kallas, told Parliament bluntly, “If we do not sign a deal, China will.”

But with rising political opposition and pending issues on the comparability and traceability of agri-food standards, the deal is still shrouded in uncertainty. What does appear certain is that trade numbers indicate Asia’s trade clout in South America is overtaking Europe’s.

Update

EU-China trade tensions continue to build

It might sound like a familiar story: EU-China trade tensions keep piling up. As Brussels has implemented tariffs on China-made electric-vehicles (EVs), Beijing has delivered on retaliatory measures that breach WTO rules – and is floating new ones. This has not deterred Brussels from opening new cases to regulate Chinese distortions. To give a sense of the magnitude, the number of new EU investigations into Chinese trade distortions has reached 22 so far this year, versus an average of 20 investigations a year against all countries around the world over the previous decade.

What you need to know:

- EU tariffs on Chinese EVs well in place: In what has become the flagship case for trade tensions, the EU has erected tariffs of 7.8 to 35.3 percent on EVs imported from China since October 30. This has not stopped negotiations over solution that involving commitments by producers in China to sell at a subsidy-adjusted price on the EU market. However, the last round of discussions made clear that Beijing’s desire for its business association to negotiate for its entire industry runs counter to Europe’s WTO-abiding condition for a manufacturer-specific approach.

- Beijing’s retaliation, notched up: On top of the expected retaliatory tariffs on French brandy and a WTO case, media has reported informal guidance by Beijing for its domestic players to refrain from investing in the EU EV value chain, especially in countries that have not opposed the tariffs. Given the current drop in European EV sales, it is hard for now to isolate those political calls from genuine business practices. Time will tell if Beijing has used this uniquely interventionistic response. State-owned SAIC has in the meantime claimed to have taken the Commission to the Court of Justice for not taking account of some information it shared during the investigation procedure.

- Brussels unrolling redressing measures has been unphased: Brussels has opened three new investigations on imports from China since the end of the summer, targeting plywood, chemicals, and screws. Emanating from a different policy silo, Europeans are also ramping up their regulatory efforts against Chinese digital wrongdoings. After the two proceedings against TikTok earlier this year for breaching EU digital platform regulations, Temu saw the opening of a similar case in October, followed by a distinctive one by consumer protection associations of three member states in November.

Quick take: Recent EU Parliament hearings of Commission officials highlighted that European industry demands for protection from competition with China are still on the rise, while those of incoming commissioners made clear such demands have political wind in their sails. Yet Beijing seems undeterred from retaliating aggressively, even resorting to unofficial bans on outward investments – grossly infringing international rules and practices – against legitimate European regulations. Unless one of the two economic giants decides to review its approach, something the election of Donald Trump could spark, trade tensions will likely continue.

Read more:

- European Commission: Definitive countervailing duty on imports of EVs designed for the transport of persons originating in the PRC

- Reuters: China tells carmakers to pause investment in EU countries backing EV tariffs, sources say

- European Commission: Readout of video call between EVP Dombrovskis and Chinese Commerce Minister Wang

- European Commission: Commission urges Temu to respect EU consumer protection laws

- MERICS: The new European Commission and China + EU trade with China and the US + EV tariffs

- SAIC: 针对欧委会反补贴终裁,上汽拟起诉至欧盟法院

Short takes

Europeans suspect China is supplying military drones to Russian military

On their way to a Foreign Affairs Council meeting on November 18, European ministers acknowledged they had received information pointing at some direct supply of military drones from China to aid Russia’s war against Ukraine. So far, there has been no sign of any clear decisions from European discussion, as some uncertainties remain regarding Beijing’s role in those supplies.

- South China Morning Post: EU has ‘conclusive’ proof of armed drones for Russia being made in China: sources

- South China Morning Post: EU warns China of ‘consequences’ if it’s found to be making armed drones for Russia

European Central Bank warns of Chinese overcapacities

On its website blog, the European Central Bank underlined the euro area’s loss of competitiveness to China over the Covid period, explained by falling demand that slashed prices for some commodities in China due to the real estate downturn, productivity gains, subsidies, and excess capacity on the Chinese side. With EU and Chinese comparative advantages overlapping due to the upgrading of Chinese production, the ECB made an unusual call for European policymakers to “develop a fair and level playing field for the trade links with China.”

Two French politicians in spotlight for undue connections with Huawei

Jean-Louis Borloo, a former French environment minister, is being investigated for failing to declare a donation from Chinese telecom Huawei to his Africa-oriented NGO while he was a board member of the French subsidiary of Huawei. Another case regards similar unreported transactions to an advisory firm belonging to a local politician in the region where Huawei has its sole factory in France.

- Challenges: A former local politician investigated for connections with Huawei (in French)

- Challenges: Investigations are ongoing into the Borloo-Huawei connections (in French)

Chinese lawyer couple sentenced to years in jail for meeting European diplomats

On October 29, the Suzhou court of justice condemned Xu Yan to a nearly two-year jail sentence, while her husband Yu Wensheng received three years. The two human-rights lawyers were arrested on their way to meet the EU ambassador to China in April 2023 and were later charged with “inciting subversion of state power.” The EU expressed its “dismay” following the sentencing, as did France and Germany jointly.