UK-China relations +EU-China economic dialogue +Tech-competition

ANALYSIS

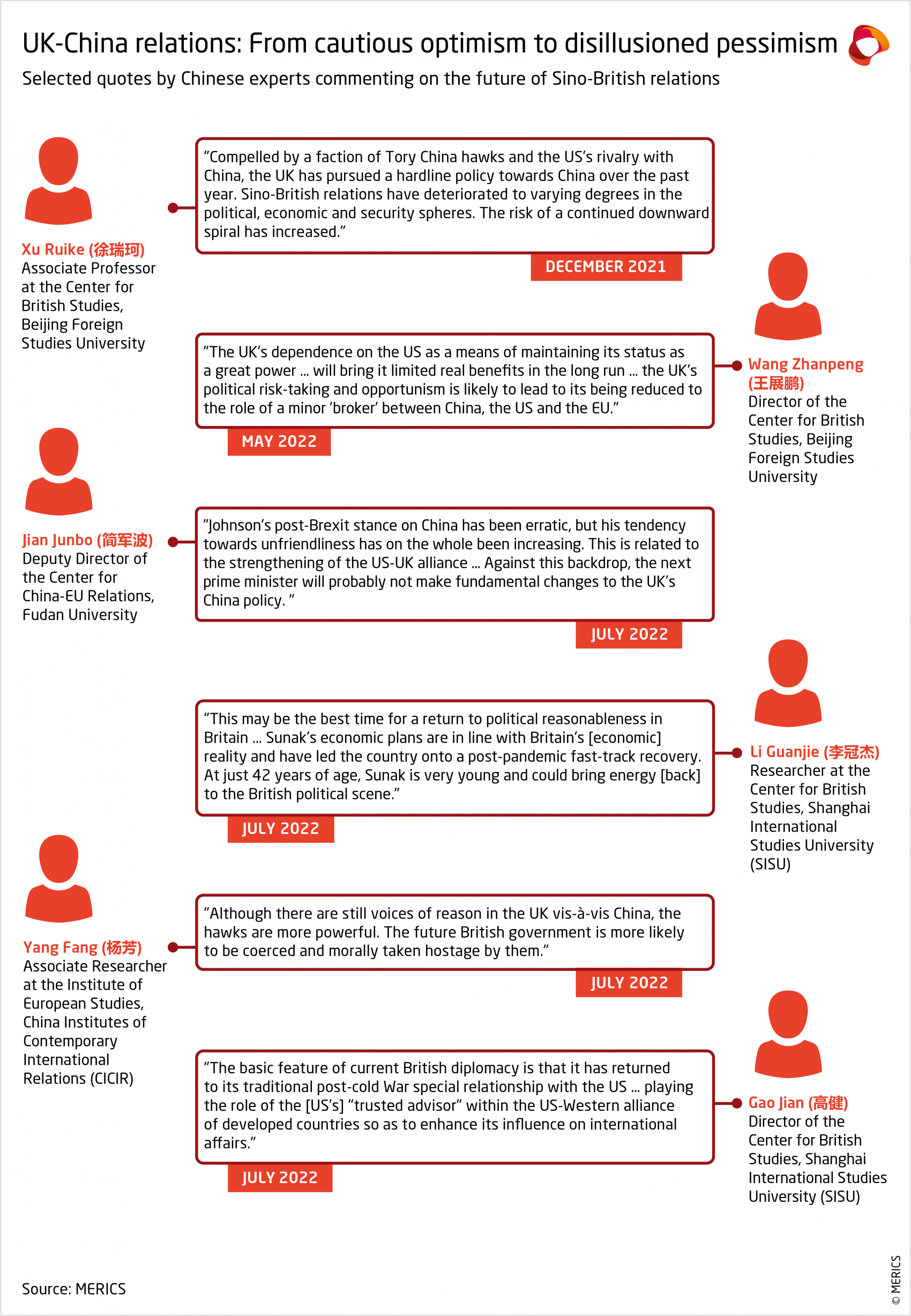

UK-China relations: From cautious optimism to disillusioned pessimism

By Thomas des Garets Geddes

Britain is set to welcome a new prime minister in September following Boris Johnson’s reluctant decision to step down as leader of the Conservative Party on July 7. But regardless of who replaces him, Chinese scholars expect no significant breakthrough with Number 10.

The change of mood is striking compared with just eighteen months ago. Until then, and despite a sharp souring of relations throughout 2020, most Chinese experts had remained cautiously optimistic about the future of their country’s ties with the UK. Many believed that Britain’s rapprochement with the US was set to be short-lived and expressed faith in what they perceived to be British diplomacy’s immutable characteristic — its interest-based pragmatism. This was sure to lead Britain back to a rebalancing of its political and economic interests in favor of Beijing.

In the past year, however, pessimism among Chinese scholars seems to have become the new norm. “In the short term, the chances of a warming of relations between China and the UK are slim … the long-standing ‘cold politics and hot business’ between China and the UK may worsen and enter a period of ‘cold politics and cold business’”, writes Li Guanjie, a researcher at Shanghai International Studies University (SISU).

Two years ago, Chinese experts such as Liu Jin, an analyst at the China Institute of International Studies (CIIS), would often see the “efforts made by the UK to resist US pressure” on issues such as Huawei or the South China Sea as evidence that Britain would avoid “taking sides” in the context of US-China rivalry. Occasional pro-engagement signaling by Downing Street was also highlighted as potential signs that Downing Street would sooner or later return to a more “pragmatic” and “independent” approach towards China.

But disillusionment has clearly replaced such reserved optimism. “The special relationship between the UK and the US has warmed up more than expected”, stresses Xu Ruike, a professor at Beijing Foreign Studies University. Britain and China “no longer emphasize seeking common ground while preserving differences, but rather confrontation”, regrets Li.

Britain’s alleged attempts to become a “leader” and “convener” of a US-backed coalition of liberal countries are increasingly seen as posing a threat to China’s interests. In Ukraine, the UK “is attempting to drag the world into a bipolar setup by playing up the ‘Russia-China threat’, warns Kong Yuan, a researcher at the Chinese Academy of Social Sciences (CASS). Kong fears that Britain’s attempts at “shaping a new European security landscape” both through NATO and through specific “mini-multilateral mechanisms” (such as the recent British–Polish–Ukrainian trilateral agreement), might lead to the “dismantling of European strategic autonomy” and to an increasingly US-tilted Europe.

The UK’s growing involvement in the Indo-Pacific has also become an irritant. Whereas the recent forays of other European countries into the region tend to be somewhat downplayed, Britain’s efforts to actively engage with China-sceptic countries such as Japan, India or Vietnam and, more importantly, to take part in US-backed coalitions against China have been widely condemned. Chen Xiaochen and Chen Hong, two professors at East China Normal University, argue that last year’s trilateral security pact between Australia, the UK, and the US (AUKUS) effectively bolsters Britain’s future compliance with US goals in the region. Hu Jie, a professor from Wuhan University, worries that the UK's active involvement in the Indo-Pacific will “contribute to the internationalization of the South China Sea dispute and encourage other countries with serious concerns to take further action”.

Whoever succeeds Boris Johnson, current commentary in China expects British foreign policy to remain much as it is now — Atlanticist and adversarial. Nevertheless, with the Tory leadership race now down to just two candidates (Rishi Sunak and Liz Truss), a Chinese preference for a former chancellor of the Exchequer who has previously called for a “mature and balanced relationship” with the PRC over a Foreign Secretary who the Chinese have repeatedly criticized for her “anti-China” comments, seems conceivable. Hope is never lost.

Read more:

- Analysis by Xu Ruike [CN]: Britain's diplomatic relations (Quote 1)

- Analysis by Wang Zhanpeng [CN]: Adjustments to the UK's domestic and foreign policies in the post-Brexit era (Quote 2)

- Guancha interview with Jian Junbo [CN]: Why did British Prime Minister Johnson "suddenly" step down? (Quote 3)

- Analysis by Li Guanjie [CN]: Can British politics return from passion to reason after the resignation of Johnson – the one who "broke all the rules"? (Quote 4)

- Analysis by Yang Fang [CN]: Prospects for Britain's political scene and China policy after Johnson steps down (Quote 5)

- Analysis by Gao Jian [CN]: Will Johnson's departure resolve Britain's chaos and disorder? (Quote 6)

MERICS EU-CHINA OPINION POOL

With the European Parliament’s Vice-President Nicola Beer conducting a 3-day visit to Taiwan this week (the first visit by a European Parliament official of this rank), we would like to bring your attention to the latest MERICS EU-China Opinion Pool. In this round, we have asked a number of experts: What key objectives should the EU set itself in its policy towards Taiwan and how could it best realize them?

REVIEW

EU-China High-Level Economic Dialogue

At the EU-China summit held last April, the EU and China agreed to hold the High-Level Economic Dialogue (HLED) before the summer break, and it took place on July 19.

What you need to know:

- Who: European Commission Vice-President Valdis Dombrovskis and the PRC’s Vice-Premier Liu He chaired the meeting. Commissioner for financial stability Mairead McGuinness and Director-General for Trade Sabine Weyand also participated in the meeting.

- What: The dialogue touched upon three main topics: challenges facing the global economy, the disruption of supply chains caused by Covid-19 and the impact of the Russian invasion of Ukraine on food and energy security, and upon financial markets. The Russian invasion of Ukraine was mentioned in the EU press release but in the Chinese one, it only refers to the war indirectly through terms such as “the uncertainty of the global economic situation”.

- Why: Prior to 2021, the HLED was an annual meeting between the EU and China. It was not held in 2021 due to the exchange of sanctions between the two. Although less spontaneous than other outreach attempts presented in the “Buzzword of the Week”, the dialogue falls neatly in the broader re-engagement effort from China that Europeans are currently witnessing.

Quick take:

Expectations for significant outcomes of this HLED were not high. As the dialogue did not take place last year, not to mention the delayed response from the Chinese to confirm the date of the dialogue with the EU, the fact that the dialogue took place at all is in itself an achievement.

Admittedly, there are some notable points regarding financial services and on exchanging information on supply chains, specifically, raw materials and “other products”. But even on the most practical of the aforementioned points — financial cooperation, the biggest breakthrough was a commitment by China and an MoU between the People’s Bank of China and the European Security and Markets Authority. The remainder is a mixture of new general concerns such as the stability of global markets and food security, and old long-standing topics, such as the reform of the WTO.

Two elements, however, are striking. The first is the number of unilateral remarks from the EU side, which signals a lack of agreement between the parties on important topics, such as addressing industrial subsidies and overcapacity. The second is the mere two lines dedicated to economic coercion and Lithuania in the EU press release, which are likely to be representative of the level of prominence the issue had on the agenda that day as well as of the conciliatory tone of the meeting.

Read more:

- European Commission: EU-China: A stable global economy is a shared responsibility

- South China Morning Post: China and EU to hold high-level trade talks this week after months of delays

- Xinhua News Agency: 刘鹤同欧盟委员会执行副主席东布罗夫斯基斯共同主持第九次中欧经贸高层对话

BUZZWORD OF THE WEEK

Operation stabilization

Over the last weeks Beijing intensified its diplomatic outreach to European counterparts in an attempt to stabilize EU-China relations. During the G20 foreign ministers meeting in Bali between July 7–8, Wang Yi met with High Representative Josep Borrell and the foreign ministers of Germany, France, Spain and the Netherlands, signaling interest in boosting engagement with the EU.

Further signals come from Wang’s plans to visit Europe in September and, even more importantly, from the informal back-channeled invitation extended by Xi Jinping to the leaders of Germany, France, Italy and Spain to visit Beijing this November following the conclusion of the Party Congress.

Beijing is likely mindful of the increased transatlantic alignment on China, visible at the recent NATO summit, which has been facilitated by its own tacit support for Moscow. Equally, its domestic economic disturbance has further triggered a call for stable economic relations. While the EU should note a change in China’s rhetoric, it is vital to expect concrete proposals to accompany the conciliatory tone and to maintain a united position in communicating on with Beijing.

Read more:

- Ministry of the Foreign Affairs of the PRC: Wang Yi Meets with High Representative of the EU for Foreign Affairs and Security Policy Josep Borrell Fontelles

- SCMP: China GDP: second-quarter economic growth plunges to 0.4 per cent, lowest in 2 years after missing expectations

- SCMP: China denies inviting European leaders to meet Xi, but sources confirm approach has been made

Tech-competition: the Netherlands considers new export controls on ASML

Facing lobbying by the US, the Dutch government contemplates expanding export controls on ASML produced equipment used for the fabrication of semiconductors.

What you need to know:

- Context: The Dutch company ASML is the world’s leading supplier of lithography equipment used in production of semiconductors and the sole provider of extreme ultraviolet (EUV) equipment necessary for fabrication of cutting-edge 10 nanometer (nm) chips.

- Recap: Back in 2019, following pressure by the Trump administration, the Netherlands revoked ASML’s license to export EUV equipment to China. This temporarily capped China’s lead semiconductor manufacturer SMIC to produce chips at a capacity of 14 nm. Still, ASML has continued to sell less advanced, deep ultraviolet (DUV) technology manufacturing equipment to SMIC.

- New round: With EUV technology not available, SMIC has been planning to find workarounds using DUV lithography to develop 12 nm chips. To prevent such workarounds from being found the US administration is domestically mulling further export controls and is lobbying the Dutch to expand restrictions on ASML’s sales of DUV equipment.

- NL position: The Dutch government is yet to make its decision. ASML itself opposes the ban of DUV sales to China, as almost 15 percent of its 2021 revenue came from cooperation with China-based facilities and it views DUV as a mature technology.

Quick take:

The semiconductor sector remains at the heart of technological competition with China but is also increasingly dominant within the EU’s deliberations on its relations with Taiwan. Especially so, as in the implementation of the European Chips Act the bloc is exploring possibilities of cooperating with Taiwan and its leading semiconductors company TSMC. The discussions in relation to potential projects are ongoing, but the EU lags behind the US in this regard.

Read more:

SHORT TAKES

On July 8, the third EU-China High-Level Environmental and Climate Dialogue reunited the European Commission’s Vice-President Frans Timmermans and PRC Vice-Premier Han Zheng. Details of the discussions are limited, but the pair discussed carbon markets, the hydrogen industry, methane emissions and biodiversity loss.

- Twitter: Vice-President Timmermans’ thread on the dialogue

- State Council of the PRC: China, EU hold environment, climate dialogue

The incoming EU Ambassador to China Jorge Toledo Albiñana shared a glimpse of his position on China and Taiwan policies in an interview for Spanish newspaper LaVanguardia. The English version of the article circulating online, unfortunately, features several mistranslations.

- LaVanguardia [ES]: We need China for governing the world

- Twitter thread: Patrizia Cogo’s comparison of the original text with English translation

Pelješac Bridge, the EUR 550 million project constructed by the China Road and Bridge Corporation in Croatia, is set to open on July 26. The project, for which the EU provided 85 percent of financing, marks an unusual case of a Chinese company successfully winning an EU co-funded infrastructure tender.

- SCMP: Croatia’s China-built, EU-funded bridge to open over troubled waters

- Croatia Week: Pelješac Bridge to open on July 26

The Italian government released a 2021 report on the use of its “Golden Power”, a regulation that allows it to block acquisitions in strategic sectors over national security concerns. All three cases in 2021 pertained to actions by Chinese companies: Sygenta, Zhejiang Kesheng lntelligent Equipment, and Mars lnformation Technology.

Ireland's Data Protection Commission is making inquiries into TikTok, owned by Chinese company Bytedance, for potential breaches of EU data rules over an amendment to its privacy policy concerning personalized advertising.

On July 17, Foreign Minister Wang Yi had a telephone call with the Hungarian Minister of Foreign Affairs and Trade Péter Szijjártó. The Chinese readout focused on the economic challenges created by the “Ukraine crisis” (without mentioning Russia) and included a commitment to expanding Sino-Hungarian ties.

- Ministry of Foreign Affairs of the PRC: Wang Yi Speaks with Hungarian Minister of Foreign Affairs and Trade Peter Szijjarto on the Phone

Jeffrey Sachs, special advisor to the EU’s High-Representative Josep Borrell, stated in a public interview that he believes Covid-19 originated from an American bio-tech lab. Sachs’ points echo narratives spread during the pandemic by China’s state media outlets. The interview was also shared by Chinese diplomats on social media.

- Jeff Sachs: Covid possibly came out of a U.S. biotechnology lab, says Columbia professor

- Politico: Borrell’s adviser pushes China’s contested claim that COVID came from US

On July 16, Serbia and China launched a direct Belgrade-Beijing flight connection operated by Hainan Airlines. It is the latest in a series of moves including preparations for a free-trade agreement, signaling growing ties between the two countries.