Digital connectivity

China’s government has long considered the internet essential infrastructure to upgrade its industry, boost competitiveness and for potential military uses. A combination of industrial policy, protectionism and entrepreneurship have led to the establishment of important telecommunications companies – chief among them, Huawei.

China was an early mover in 5G, currently the most modern mobile connection to the internet. Huawei and ZTE took part in early standardization meetings on 5G, and China deployed 5G in 2018, before most Western countries started their roll-out. Huawei’s technology rivals that of established equipment suppliers Nokia and Ericsson and is usually cheaper.

Now, the world is watching 6G, for which 2025 will be an important year. Huawei is already set to play an important role in this future key technology.

China’s strategy of building infrastructure first, assuming demand will follow, has worked very well especially in mobile and broadband internet. In disruptive internet technologies, this strategy is not possible. For instance, Chinese companies still trail the US satellite internet provider Starlink, which pioneered low Earth orbit (LEO), high-bandwidth satellite internet. China launched the first satellites in 2024 for Qianfan, an eventual globe-spanning internet network to rival Starlink, one of three networks intended to be operational in China by 2025.

Other technologies have seen less innovation in recent years but are still a focus of US-China tech competition. Submarine communications cables, for instance, have an average life cycle of 17 years, with recent innovation mostly focused on cost effectiveness. Since most traffic passes through submarine cables, both the US and China are wary about spying, and have thus competed for the location and control of many of these cables.

Graphics dashboard

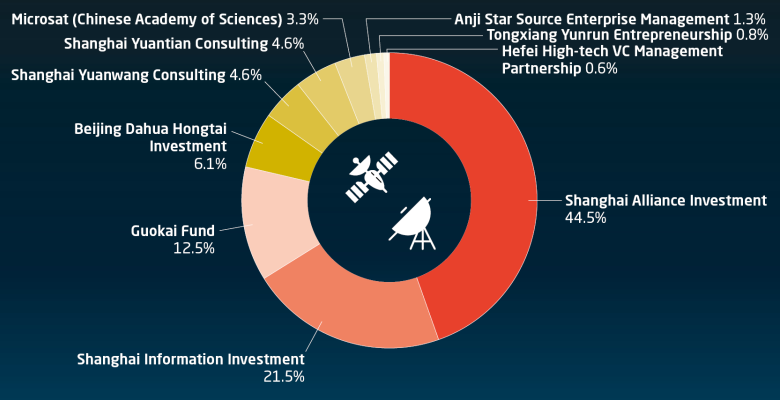

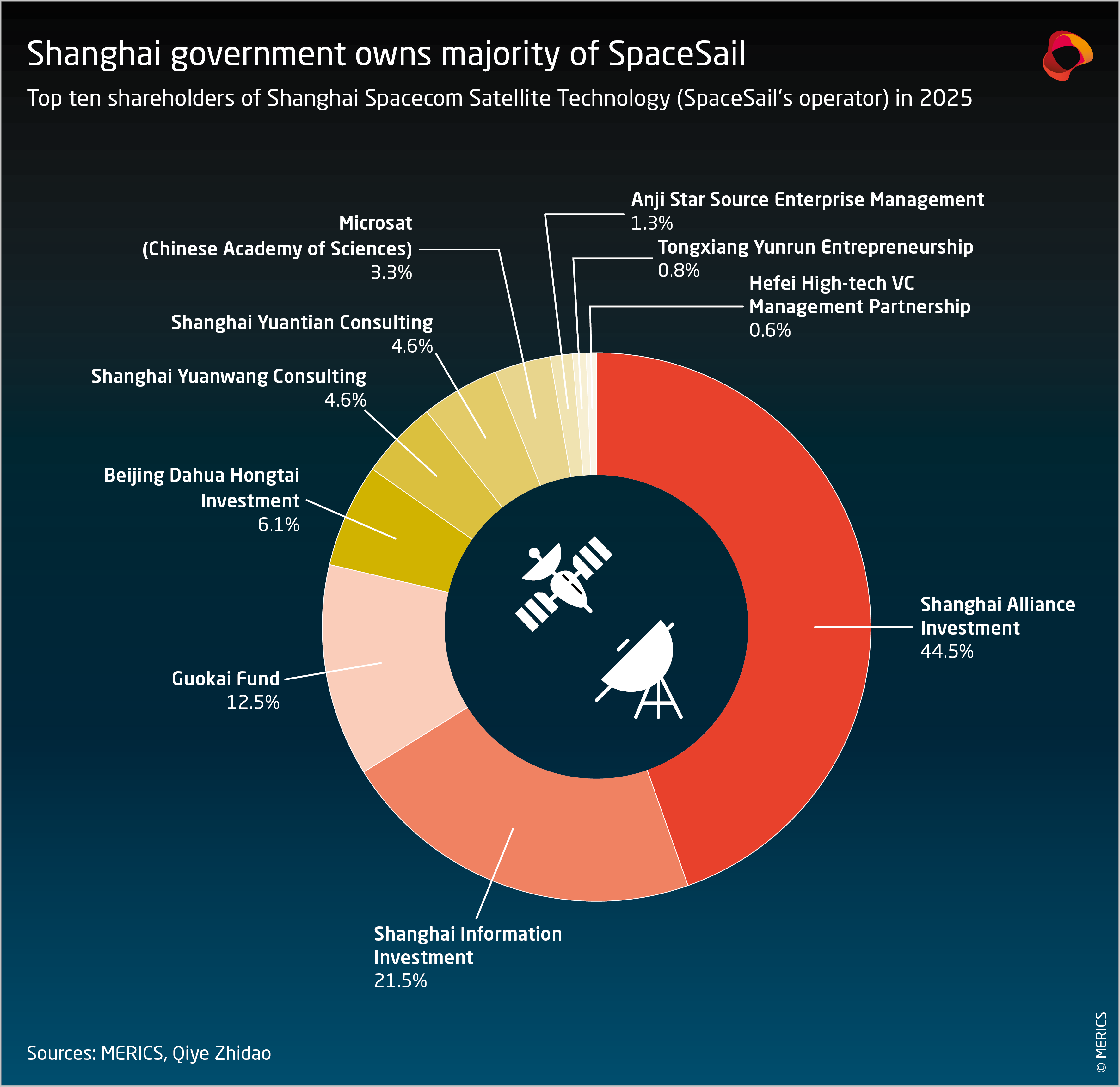

China’s commercial space sector is heavily funded by state capital, with private capital playing a supporting role. For example, about 82 percent of shares in the company that operates SpaceSail, one of China’s satellite internet megaconstellations in Low Earth Orbit, are held by state investors, with the rest belonging to private shareholders. Core segments such as satellite manufacturing and ground systems are largely state-funded. Rockets, component manufacturing, remote sensing, and navigation services increasingly rely on the private sector for funding.

Satellites depend on ground stations to manage and control satellites and facilitate communication. China has expanded this infrastructure in recent years. On the ground, it hosts five rocket launch centers, three sea-based launch sites, two aerospace and satellite control centers in Beijing and Xi’an, and at least ten tracking, telemetry, and control (TT&C) stations. The country is also trying to build ground stations beyond its borders.

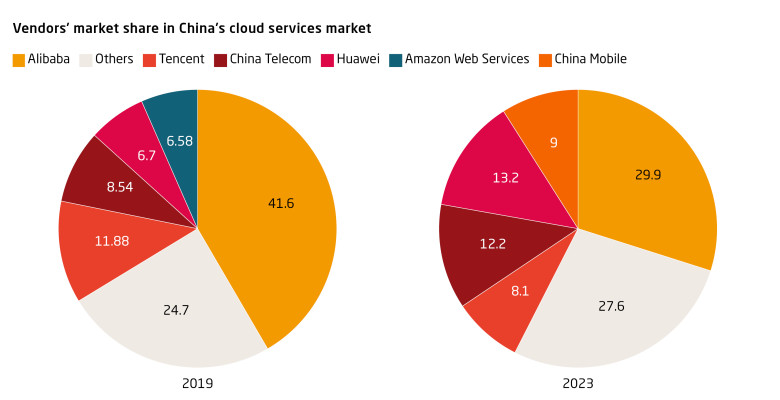

In 2016, various domestic units formed a committee with one mission: Systematically replacing foreign technology from China’s IT systems, starting with government and military infrastructure and later moving to state-owned enterprises. The campaign that unfolded, known as “xinchuang” (信创, loosely translated as IT innovation) has nurtured domestic champions not only in hardware sectors, but also in software segments like databases, cloud services and operating systems.

Digital Connectivity in China: Timeline of crucial events

China's Big Three state-owned telecommunication operators (China Mobile, China Unicom and China Telecom) launch 5G networks in China, almost nine months before the launch of 5G in Europe.

China establishes the SOE China Satellite Network Group (SatNet) to drive the internet satellite megaconstellation GuoWang (China Satellite Network), China's state megaproject for satellite internet.

NDRC launches "Eastern data, Western computing" megaproject to make China’s computing power infrastructure more efficient &sustainable, moving data processing to inland provinces with cheaper land.

Huawei presents 5G-Advanced (also called 5.5G) at the Mobile Broadband Forum in Doha. 5G-A is an innovation between 5G and 6G. Huawei was the first to develop a complete product portfolio for 5.5G.

National Research Centre of Parallel Computer Engineering and Technology (Wuxi) discloses details on supercomputer Sunway OceanLight, built despite US sanctions, may be one of three exascale machines.

China Mobile conducts the world's first low earth orbit (LEO) satellite test using 6G technology, driving forward its plans for an integrated terrestrial-space network with high speed and low latency.

A team from Beijing University of Posts and Telecommunications says it has built the world's first 6G field test network, an important step toward commercialization which Beijing wants by 2030.

China submits two spectrum allocation filings to the UN’s International Telecommunication Union (ITU), revealing plans for a megaconstellation of ca. 13,000 internet satellites.

The powerful Central Commission for Cybersecurity and Informatization publishes Beijing’s most important strategic blueprint for the digital transformation, the 14th Five-Year Plan (2021-2025).

Second Institute of China Aerospace Science and Industry Corporation (CASIC) tests real-time wireless transmission using terahertz technology, important for 6G achieving 100Gbps on a 10GHz bandwith.

Details emerge about the supercomputer Tianhe Xingyi (Tianhe-3), developed by the National University of Defense Technology despite US export restrictions. May be it is the world's most powerful.

China has 3.2 million 5G base stations, 87 percent of the goal set in the 14th FYP. At the end of 2021, the EU-27 had only 256,000 base stations, according to the EU's 5G Observatory.

Shanghai Lanjian Hongqing Technology Company (link to private rocket maker Landsoft) files with ITU to launch Honghu-III, a network of 10,000 satellites, might be the third Chinese megaconstellation.

- China filed an ITU application for 203,000 satellites to expand its space programs, mostly driven by state and commercial actors. The new Institute of Radio Spectrum Utilization and Technological Innovation (无线电创新院) holds 95 percent of the applications, with the rest coming from Shanghai Spacecom (SpaceSail), China StarNet (Guowang), and China Mobile. (Source (CN): STDaily, January 11, 2026)

- The NDRC, together with the National Data Administration (NDA) and other ministries, released a roadmap for smart cities. The plan targets over 50 cities for full digital transformation by 2027. It requires them to build AI models for disaster and infrastructure monitoring, integrate data across state agencies, and expand digital services. (Source (CN): NDRC, October 31, 2025)

- After a seven-month pause, the Shanghai-backed mega-constellation SpaceSail (千帆) launched 18 satellites in October 2025, bringing the total to 108 SpaceSail satellites in orbit. The project is behind schedule (aiming for 648 satellites in 2025 and over 10,000 by the 2030s) due to challenges in manufacturing and launch capacity. (Source (CN): Innovation Academy for Microsatellites (CAS), October 17, 2025). [See also our latest CTO report “Orbital geopolitics: China's dual-use space internet” by Altynay Junusova, Rebecca Arcesati, and Antonia Hmaidi]

Publications