Digital connectivity

China’s government has long considered the internet essential infrastructure to upgrade its industry, boost competitiveness and for potential military uses. A combination of industrial policy, protectionism and entrepreneurship have led to the establishment of important telecommunications companies – chief among them, Huawei.

China was an early mover in 5G, currently the most modern mobile connection to the internet. Huawei and ZTE took part in early standardization meetings on 5G, and China deployed 5G in 2018, before most Western countries started their roll-out. Huawei’s technology rivals that of established equipment suppliers Nokia and Ericsson and is usually cheaper.

Now, the world is watching 6G, for which 2025 will be an important year. Huawei is already set to play an important role in this future key technology.

China’s strategy of building infrastructure first, assuming demand will follow, has worked very well especially in mobile and broadband internet. In disruptive internet technologies, this strategy is not possible. For instance, Chinese companies still trail the US satellite internet provider Starlink, which pioneered low Earth orbit (LEO), high-bandwidth satellite internet. China launched the first satellites in 2024 for Qianfan, an eventual globe-spanning internet network to rival Starlink, one of three networks intended to be operational in China by 2025.

Other technologies have seen less innovation in recent years but are still a focus of US-China tech competition. Submarine communications cables, for instance, have an average life cycle of 17 years, with recent innovation mostly focused on cost effectiveness. Since most traffic passes through submarine cables, both the US and China are wary about spying, and have thus competed for the location and control of many of these cables.

Graphics dashboard

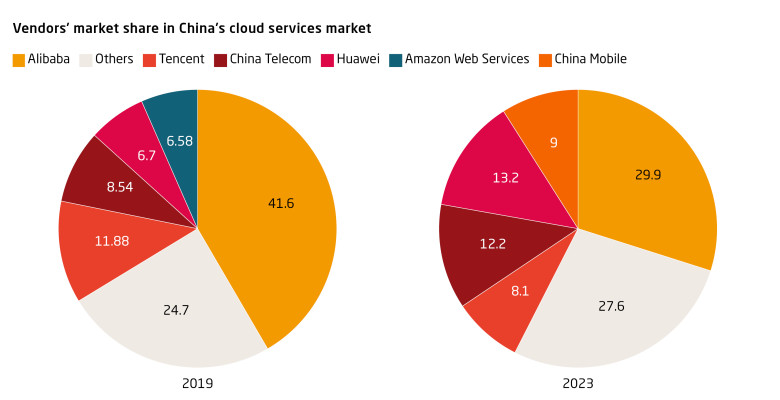

In 2016, various domestic units formed a committee with one mission: Systematically replacing foreign technology from China’s IT systems, starting with government and military infrastructure and later moving to state-owned enterprises. The campaign that unfolded, known as “xinchuang” (信创, loosely translated as IT innovation) has nurtured domestic champions not only in hardware sectors, but also in software segments like databases, cloud services and operating systems.

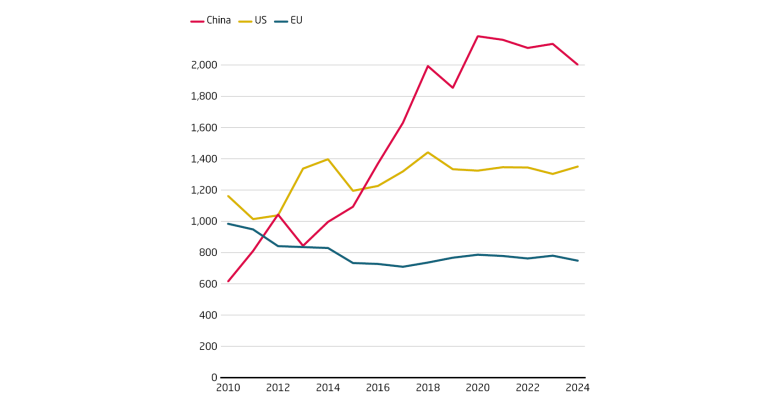

China’s globally registered invention patents grew sharply in telecommunications from 2010 to 2021. China surpassed the US in 2016 and has maintained its leading position, but its growth seems to have plateaued, suggesting that innovation in slowing down. Patent publications have fallen slightly in the EU, despite being home to two of the largest equipment vendors in the world, Nokia and Ericsson, after starting at a level close to China and the US in 2011.

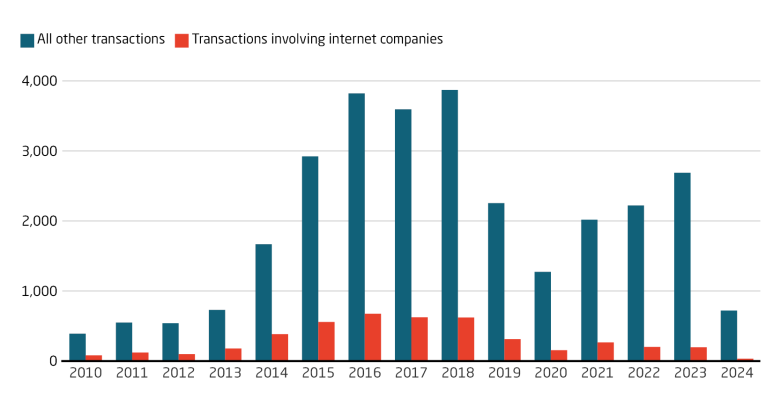

Between 2014 and 2018, many Chinese startups offered internet-based services, like the Internet of Things. With China’s tech crackdown of 2020-2021 and the reorientation of the economy toward the “real economy,” fewer startups focused on providing internet-enabled services.

Digital Connectivity in China: Timeline of crucial events

China's Big Three state-owned telecommunication operators (China Mobile, China Unicom and China Telecom) launch 5G networks in China, almost nine months before the launch of 5G in Europe.

China establishes the SOE China Satellite Network Group (SatNet) to drive the internet satellite megaconstellation GuoWang (China Satellite Network), China's state megaproject for satellite internet.

NDRC launches "Eastern data, Western computing" megaproject to make China’s computing power infrastructure more efficient &sustainable, moving data processing to inland provinces with cheaper land.

Huawei presents 5G-Advanced (also called 5.5G) at the Mobile Broadband Forum in Doha. 5G-A is an innovation between 5G and 6G. Huawei was the first to develop a complete product portfolio for 5.5G.

National Research Centre of Parallel Computer Engineering and Technology (Wuxi) discloses details on supercomputer Sunway OceanLight, built despite US sanctions, may be one of three exascale machines.

China Mobile conducts the world's first low earth orbit (LEO) satellite test using 6G technology, driving forward its plans for an integrated terrestrial-space network with high speed and low latency.

A team from Beijing University of Posts and Telecommunications says it has built the world's first 6G field test network, an important step toward commercialization which Beijing wants by 2030.

China submits two spectrum allocation filings to the UN’s International Telecommunication Union (ITU), revealing plans for a megaconstellation of ca. 13,000 internet satellites.

The powerful Central Commission for Cybersecurity and Informatization publishes Beijing’s most important strategic blueprint for the digital transformation, the 14th Five-Year Plan (2021-2025).

Second Institute of China Aerospace Science and Industry Corporation (CASIC) tests real-time wireless transmission using terahertz technology, important for 6G achieving 100Gbps on a 10GHz bandwith.

Details emerge about the supercomputer Tianhe Xingyi (Tianhe-3), developed by the National University of Defense Technology despite US export restrictions. May be it is the world's most powerful.

China has 3.2 million 5G base stations, 87 percent of the goal set in the 14th FYP. At the end of 2021, the EU-27 had only 256,000 base stations, according to the EU's 5G Observatory.

Shanghai Lanjian Hongqing Technology Company (link to private rocket maker Landsoft) files with ITU to launch Honghu-III, a network of 10,000 satellites, might be the third Chinese megaconstellation.

Tech progress

- China’s Taiyuan Satellite Launch Center conducted a sea launch off Rizhao in Shandong, sending Geespace’s fourth satellite of the Geely Constellation into orbit aboard Jielong-3 rockets, as part of a nationwide strategy to boost China’s “space-ground communication” network. (Source (CN): STDaily, August 9, 2025)

- China launched group 6 of its low-orbit satellites for space-based internet using the Long March 8A rocket from the Hainan commercial space launch site, increasing launch capacity by 55 percent through modular combination and new material application. This mission marked the third successful launch from Hainan. (Source (CN): STDaily, July 30, 2025)

Domestic dynamics

- In Q3 2025, the Cyberspace Administration issued new regulations on Administrative Penalties for all Internet Information Departments, taking effect on August 1, 2025. Key measures target improving network security, better protection of government data and the establishment of a nationally integrated data system with unified standards. (Source (CN): gov.cn, July 26, 2025)

Foreign involvement

- China is imposing tariffs of up to 78.2 percent on US fiber-optics firms to stop firms from evading existing anti-dumping or countervailing duties. Because of sustained investment in the sector, China has excess capacity, so these tariffs are unlikely to hurt China’s economy and could even help local producers. (Source (CN/EN): gov.cn, Reuters, September 3, 2025)

- European telecommunications giant Nokia has filed lawsuits against Geely Group, a Chinese automaker, covering four of its brands and 32 subsidiaries in 18 European countries. As cars become more digitized as “smartphones-on-wheels," they are relying more on telecommunications technology. The dispute involves standard patents for 4G/5G technologies, essential for the implementation of technical standards in mobile devices. (Source (CN): EET, August 15, 2025)

- Huawei announced that the company is marketing AI services and 5G infrastructure to Belt and Road countries, avoiding US sanctions. Already, four private Malaysian companies signed agreements to use Huawei’s AI solutions, and the government of Uzbekistan uses Huawei’s cloud. Uptake, however, has been more limited on the whole so far, partly due to US pressure. (Source (CN): 36kr, June 20, 2025)

Digital connectivity in China: Profiling the actors

Publications