Green technology

Over the past two decades, China has become the global leader in manufacturing green technologies. It occupies dominant positions in the supply chains for solar, wind, batteries, and new energy vehicles. As the largest investor in related manufacturing capacity, China accounted for three-quarters of investment in clean technology production in 2023.

In the eyes of Chinese policymakers, green technologies serve the twin purposes of stimulating economic growth and facilitating the country’s decarbonization. Products such as solar panels and batteries drive growth in exports, and China is investing heavily in its own renewable energy capacity.

Estimates suggest China will account for almost 60 percent of new renewable capacity installed globally between 2023-2028.

Robust market competition and state support have bolstered China’s green tech industries. Private firms such as LONGi, Mingyang, CATL and BYD demonstrate the important role of entrepreneurs in the sector’s success. However, the Chinese government has also provided significant financial support and a home market advantage to local players.

Foreign countries benefit from cheap imports of green technologies, but China's dominance also poses strategic risks. Overdependencies increase the likelihood of China exerting economic coercion and the potential for costly supply chain disruptions. Competition from China also undermines Europe’s industrial ambitions in green technologies.

Graphics dashboard

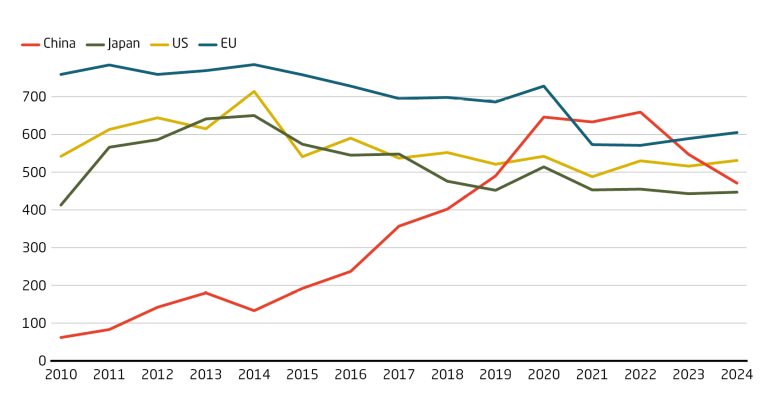

China’s internationally registered invention patents in environmental technologies rose sharply between 2010 to 2020, mirroring its rise in the sector. The number of patents has dipped since 2022, but remains on par with the EU, the US, and Japan. At the same time, China became the largest manufacturer and exporter of renewable energy equipment globally. This suggests that innovation in China is slowing down as the sector matures.

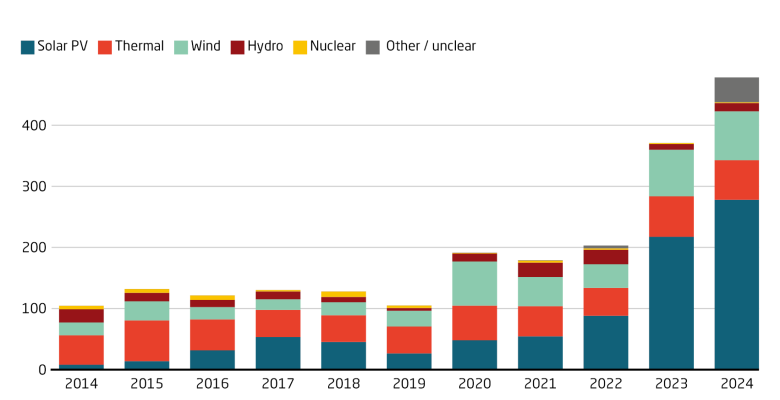

China’s solar PV installations grew at breakneck speed in 2022 and 2023 due to a drop in prices and increases in government backing. While growth has slowed, reflecting a large established base, the country more than tripled its annual new installations of wind and solar capacity in 2024 compared to 2021 and reached its target of installing 1,200 GW of wind and solar capacity by the end of 2024.

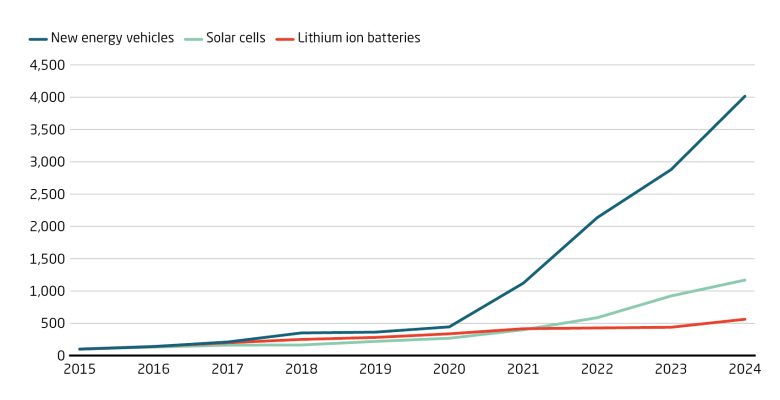

Green technology output, in particular new energy vehicles (NEVs), has grown considerably thanks to growing demand, partly driven by government support for low carbon industries. Between 2020 and 2024, the number of NEVs made in China grew from 1.5 million to 13 million, accounting for 40.9 percent of all cars produced in the country.

Green technology in China: Timeline of crucial events

China Society of Automotive Engineers releases the Energy Saving and NEV Tech Roadmap 2.0, aiming for new energy vehicles (NEVs) to comprise 50 percent of new car sales by 2035.

China implements a nationwide carbon trading market, starting with the power sector. Initially covering 4.5 billion tons of CO2, it is now the biggest carbon market worldwide.

China’s renewable energy capacity exceeds 1,000 gigawatts – an energy transition milestone. Renewables make up 44.8 percent of capacity, with hydropower the largest at 37 percent of all renewables.

The NDRC releases the 14th Five Year Plan for renewable energy. Renewables will make up at least half of electricity generation capacity added in 2021-2025. The plan aims to double solar and wind.

Sinopec completes China's largest green hydrogen plant in Kuqa, Xinjiang, using photovoltaic power. It will reduce CO2 emissions by 485,000 tons annually by replacing hydrogen from natural gas.

China’s largest electric vehicle maker BYD says it will build a car factory in Szeged, Hungary. Its first in Europe, the plant is expected to create thousands of local jobs.

Wind and solar energy capacity surpasses coal for the first time. Non-fossil sources now make up over half of total capacity. But coal still comprised 60 percent of power generated in 2023.

Firms led by state-owned China Energy Investment Corp. Ltd create a CNY 10 billion (EUR 1.3 billion) fund for new energy technologies &projects, encompassing solar, wind &hydrogen-based technologies.

Xi Jinping says China aims to reach peak carbon emissions by 2030 & carbon neutrality by 2060. The 2060 target is ten years later than the G7, EU, South Korea & Brazil and 10 years earlier than India.

The National Development and Reform Commission (NDRC) releases a strategy to develop the hydrogen sector by 2035, focusing on the transport, energy storage, power and industrial sectors.

The government extends its 2014 tax exemption policy to promote EVs. EV sales are exempt from the vehicle purchase tax until the end of 2025, and must only pay half until the end of 2027.

Ningbo Shanshan, the world's largest supplier of electric car battery materials says it will build a new plant in Finland. The plant will serve Western and Central Europe.

People’s Daily reports: In 2023 Chinese shipbuilders received over half of all global orders for low carbon &pollution ships. An official says China will pursue policies to support green shipbuilding.

The Ministry of Industry and Information Technology issues draft rules that raise the capital ratio for solar PV manufacturing projects and need plants to operate at least 50% of annual capacity.

Tech progress

- China Huaneng Group and Dongfang Electric Corp., both state-owned, have announced a prototype for a floating offshore wind turbine capable of generating 17 MW of electricity, highlighting Chinese-made key components. China already operates the world’s most powerful offshore wind turbine with its OceanX project. (Sources (CN, EN): 163, July 11, 2025, Bloomberg, August 29, 2025)

Domestic dynamics

- China’s largest green hydrogen ammonia integration project has launched its first phase in Chifeng, Inner Mongolia. With an annual output of 320,000 tons of green synthetic ammonia, the project plans to scale up to 1.5 million tons per year by 2028. (Source (CN): STDaily, July 9, 2025)

- 490 million tons of lithium ore were discovered in Hunan, said to contain 1.31 million tons of lithium oxide. The province hopes that the reserves will provide a foundation for the development of a battery supply chain. (Source (CN): EET, July 10, 2025)

- Shipments from Tesla’s Shanghai factory slipped back into decline, with an 8.4 percent decrease from a year earlier. Meanwhile in July, overall sales of EVs and hybrids in China grew 25 percent to 1.18 million units. (Source (EN): Bloomberg, August 4, 2025)

Foreign involvement

- UAE-based company Autocraft signed a USD 1 billion purchase agreement with China's Shi Technology for 350 E20 electric vertical takeoff and landing (eVTOL) aircraft. This marks China's largest single eVTOL order to date. (Source (CN): EET, July 18, 2025)

- German company Lucara announced intentions to stop sourcing wind turbines from Chinese company Ming Yang Smart Energy, choosing instead to use Siemens turbines. The Chinese deal had been controversial, after the European Commission launched investigations into Chinese suppliers under the Foreign Subsidies Regulation (FSR). (Source (EN): Reuters, August 25, 2025)

Publications