Chinese restrictions threaten Europe’s hopes of absorbing battery tech

China has tightened the screws on green technology exports. In July, it added several battery-making methods to its export restriction catalogue, requiring licenses for overseas transfers, effective immediately. The move complicates European hopes of importing Chinese know-how to accelerate its own battery manufacturing ambitions.

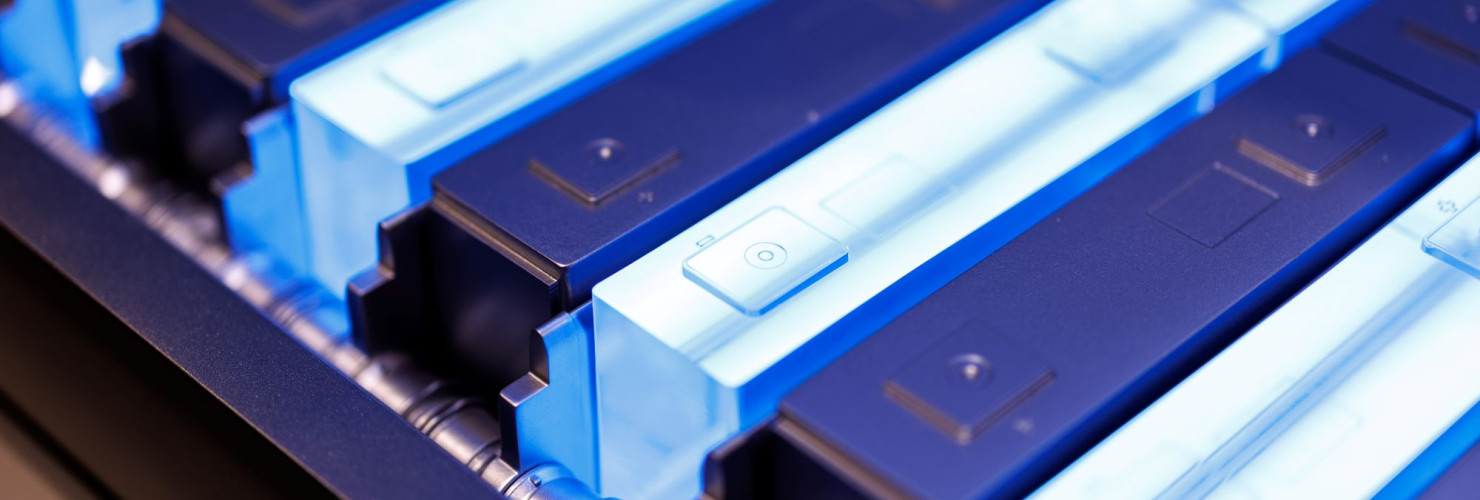

Three of the new restrictions cover the preparation of lithium iron phosphate (LFP) batteries. Another five concern lithium extraction and processing techniques used to make advanced batteries, including next-gen solid-state batteries. LFP batteries, pioneered by Chinese firms BYD and CATL, are made almost entirely in China. Safer and cheaper than traditional nickel-, cobalt- or manganese-based batteries, they now account for more than half of global electric-vehicle demand.

Having secured this lead, Beijing is in no hurry to share it. China’s technology controls are part of a broader strategy to secure value chains at home, reinforce economic resilience and exert leverage abroad. China has most recently used its dominance in the rare-earth supply chain to build pressure in negotiations with America and Europe.

For its part, Brussels wants to lure Chinese firms to build factories on the continent, bringing with them expertise and scale. It is already offering subsidies as an incentive – so long as local European partners are involved, skills and know-how are shared, and production creates value in Europe. Another option under discussion is tying access to the EU’s vast market to local content and tech transfer requirements. Beijing may be willing to compromise and accept this as a necessary cost for its firms to expand into Europe’s high-income market.

Any arrangement will need to be carefully crafted so that it works in Europe’s favor. Swedish battery maker Northvolt, which filed for bankruptcy in early 2025, offers a cautionary tale. The company relied heavily on Chinese equipment and struggled to keep production lines running. It is unclear whether Northvolt’s troubles were due to intentional sabotage, but it highlights the uncertainty regarding China’s willingness to contribute to the success of foreign firms. To avoid relying on Beijing’s goodwill, policymakers in Europe ought to promote independent capabilities and actively support for collaboration with other leaders in battery technology, such as South Korea.

Alexander Brown, Senior Analyst, MERICS: “The EU’s plan to partner with Chinese firms to boost battery manufacturing in Europe has its limits. The new restrictions on battery technology exports indicate that Chinese firms will be constrained in their ability to share skills and know-how. To achieve battery supply chain security, Europe will need to strengthen the innovation capabilities of local players and foster collaboration with other leading, non-Chinese partners.”