EU-China calendar for the remainder of 2022 + Chinese LNG exports to Europe

Analysis

EU-China calendar: What to keep an eye on for the remainder of 2022?

By Grzegorz Stec

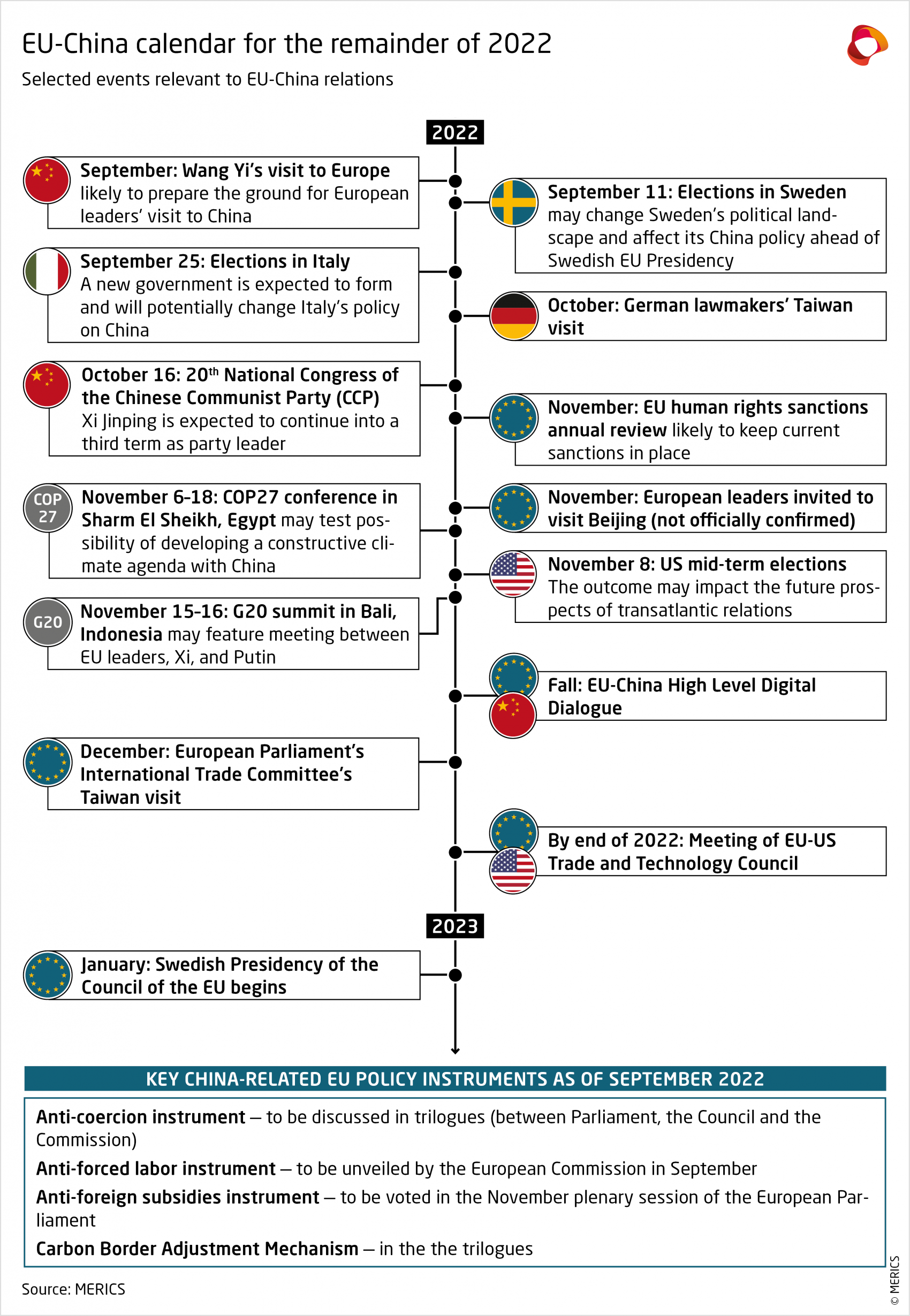

Several key events may signal adjustments in the trajectory of EU-China relations. Since the beginning of the year, relations have continued to decline. China-Lithuania tensions spilled over to the EU level prompting Brussels to launch a case against China at the WTO. Beijing’s sustained tacit support for Moscow since Russia’s invasion of Ukraine has further strained relations. The strained EU-China summit and characterization of China as a security challenge in NATO’s strategic concept exemplifies the situation. The crisis in the Taiwan strait over the summer ushered an additional dimension to the tensions.

Ahead of the 20th National Congress of the Chinese Communist Party (CCP) in October, Beijing is attempting to stabilize relations with the EU or at least avoid major fallouts. China’s government officials reached out to European counterparts at July's G20 foreign ministers meeting in Bali and reportedly invited selected European leaders to visit Beijing this fall. Then, Chinese state airlines moved to purchase almost 300 Airbus jets. In addition, Beijing agreed to conducting the EU-China High-level Economic and Trade Dialogue, despite initial unwillingness to set its date. However, these signals were primarily diplomatic and low-cost.

So, what events remain in 2022 that are significant for how EU-China relations evolve?

Party Congress and Beijing visit

The CCP’s upcoming party congress, China’s most important political event that occurs once every five years, will set the tone for Xi Jinping’s anticipated third term as party and state leader. Xi’s speech will signal the broad vision for the party while the new Politburo Standing Committee could signal where potential change lies. That includes foreign policy, with the party’s top diplomat Yang Jiechi set to retire.

Following the Congress, Beijing may also announce the new Chinese Ambassador to the EU, as per suggestions of China’s Ministry of Foreign Affairs (MFA). The position has been left vacant since Zhang Ming left in December 2021. The choice of the new Ambassador will signal whether Beijing wants to command a more confrontational or conciliatory voice in Brussels.

It is also in the context of the party congress that China extended an unofficial invitation to the leaders of France, Germany, Spain and Italy to visit Beijing, the first time since the pandemic began. The member states’ decision on how to navigate such a selective, likely a G20-membership-based invitation and what message to convey should the visit materialize, will be indicative of the level of European unity on China.

G20 summit and Russia tensions

The G20 summit in Bali will perhaps bring Xi Jinping and Vladimir Putin face-to-face with the leaders of EU member states. Tensions between the EU and China over different outlooks on Russia’s invasion of Ukraine will likely be on display — with both sides’ actions being indicative of how much of a roadblock it remains for their relations. The summit will also be significant in terms of political communication regarding the positioning of multiple developing countries amid tensions between G7 and Sino-Russian attitudes.

Taiwan visits and One China Policy

German lawmakers and the European Parliament’s International Trade committee are planning to visit Taiwan in October and December respectively, with similar visits possible by other European lawmakers. Following the heightened tensions stemming from Beijing’s reaction to Nancy Pelosi’s visit to Taiwan, the EU can expect pushback from such visits, as already exemplified by the sanctioning of the Lithuanian Deputy Transport and Communications Minister over her visit to Taipei.

Beijing may try to impose de-facto limitations on the EU’s One China policy, under which the EU and member states conducted working- and legislative-level contacts with Taiwan — ensuring that interactions did not amount to recognition of statehood. The EU needs to form a common position on how to address potential pressures from Beijing and jointly oppose moves to impose limitations on its own policy.

EU to remain firm with its agenda

Aside from paying attention to these events in the coming months, Brussels and member states should monitor China’s tone toward the EU in multilateral fora and "minilateral" organizations, like the BRICS country grouping (Brazil, Russia, India, China and South Africa). Beijing may also choose to play a more constructive role in addressing food security, energy or climate challenges, but possibly under the auspices of its own initiatives.

However, while the EU should keep its eyes open for such signals of change, it should not bet on them. China’s trajectory under Xi Jinping’s previous two terms has been clearly focused on assertively deploying China’s capabilities as well as challenging the international rules-based order. So, while remaining open to potential targeted cooperation with China on a specific issue, the EU should remain clear-eyed and continue to develop its policy tools that address the economic and systemic challenges stemming from Beijing’s ambitions.

Read more:

Review

China sells LNG to Europe

China is reselling unused liquified natural gas (LNG) to European states as Europe is facing shortages due to Russia’s decision to, at least temporarily, “close the tub” following the imposition of sanctions.

What you need to know:

- Why is China selling LNG to Europe? The lockdowns coupled with Beijing’s decision to boost energy production through fossil fuels has left China, the largest buyer of LNG in the world, with surplus gas. Plus, the growth in LNG demand made the potential profit attractive for Chinese companies.

- How much? 7 percent of Europe’s gas import for the first half of 2022 comes from China, which totals to “tens of million” USD profit for China.

- Where is China’s import of LNG from? China’s top six suppliers of LNG, covering 85 percent of the country’s supply, are: Australia, the United States, Qatar, Malaysia, Indonesia, and Russia.

- Is it Russian LNG? No. While Russia is among the top six exporters of LNG to China, others such as Australia and the US are larger exporters to China. For example, in 2021, China's Sinopec signed a 20-year contract with US Venture Global LNG to purchase 4 million tonnes of LNG per year. That is from where most of the re-sold LNG originates.

Quick take: While increasing dependence on Chinese supply of LNG may appear to be the wrong move for an EU that was attempting to decrease dependence, it is important to distinguish between long-term dependencies and temporary solutions. Europe buying LNG from China in such large quantities is, for time being, a temporary solution for two reasons. First, once China’s economy picks up, so too will its LNG demand, meaning there will be much less capacity to re-sell it. Second, despite China’s growing home extraction of gas, the country is unlikely to fulfill its own need for LNG, let alone become a large exporter. In that sense, alarm about increasing European dependence on China for LNG is at the very least premature.

Read more:

- Financial Times: China throws Europe an energy lifeline with LNG resales

- Asia Nikkei: Sinopec resells LNG to Europe despite China's sanctions snub

- Bloomberg: China Sells U.S. LNG to Europe at a Hefty Profit

Short Takes

China and Russia, together with India, Laos, Mongolia, Nicaragua, and Syria, launched the joint Vostok 2022 military exercises in Eastern Russia and the Sea of Japan. The exercises will run between September 1 and 7 and include more than 50,000 troops and 5,000 weapons units, including 140 aircraft and 60 warships, according to the Russian Ministry of Defense.

- FT: China and Russia join forces for Vostok military exercises

- Al Jazeera: Russia to launch major military drills with China and others

Despite the discussions on limiting dependence on China, German businesses continue to expand their engagement with the country. According to data gathered by the German Economic Institute, in the first half of 2022, German companies invested EUR 10 billion in China — outperforming results of any of the complete years since 2000.

Speaking at the Bled Strategic Forum on August 29, European Commission President Ursula von der Leyen highlighted that the European demand for lithium batteries is set to grow annually by 40 percent between 2020 and 2025. The president cautioned, however, against a potential increase in dependence on China. Out of 30 critical raw materials used in lithium batteries, 10 are predominantly sourced from China.

- European Council: Keynote speech by President von der Leyen at the Bled Strategic Forum

One of the few non-Chinese rare-earth processors, Canadian Neo Performance Materials, plans to excavate rare earths deposits available in Greenland and send it to a processing facility in Estonia. Only two such plants exist outside of China, which dominates the rare earths supply.

On August 29, German Chancellor Olaf Scholz spoke at Prague’s Charles University on the revision of European treaties, voicing support for majority voting in the Council of the EU. Within this context, Scholz mentioned issues relevant to China, including sanctions, human rights and foreign policy. Reaching a joint EU position on such issues pertaining to China has been oftentimes impossible due to vetoes by Hungary and other specific member states.

On August 23, Dutch Prime Minister Mark Rutte exchanged a videocall with Chinese Premier Li Keqiang. The exchange focused on taking stock of economic cooperation (the Netherlands is the second largest trade partner of China within the EU) and prospects for developing it further.